Will The Fed Overshoot?

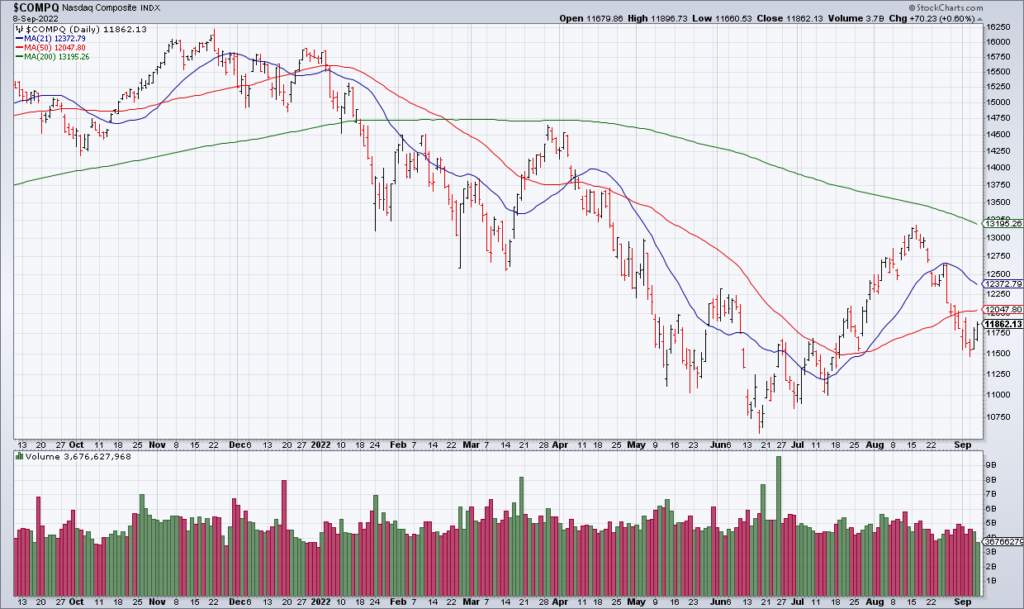

The stock market has suffered a nasty correction in the wake of Fed Chair Powell’s hawkish remarks at Jackson Hole two weeks ago. While the Fed is right that letting inflation linger would be a grave mistake they could also kill the patient with too high a dosage of medication. They have already raised the Fed Funds Rate 225 basis points over the last four meetings and are strongly suggesting they will raise another 75 on September 21 (“Fed On Path For Another 75 Point Interest Rate Lift” [SUBSCRIPTION REQUIRED], Nick Timiraos, WSJ A1, Thursday 9/8). That would be a mistake.

As you can see in the tweet above from Pinecone Macro commodity prices have plummeted since May. Inflation is clearly being reigned in. This is a direct result of the Fed’s aggressive tightening. I applaud the Fed for doing the right thing by reversing course on the idea that inflation was “transitory” and acting decisively. But they could go too far. It has become a cliche but monetary policy acts with a lag. The Fed should raise 50 on September 21 and then take stock. If they raise 75 I believe they will have overshot and risk a severe rolling over of the financial markets and the economy. Then they will have to reverse course again.