Why The S&P Will Drop 25% in 2025

It’s been a great time in the market with the S&P +31.46% over the last year. But – for a number of reasons – I suspect 2025 will surprise many in being a bad year with the S&P dropping 25%.

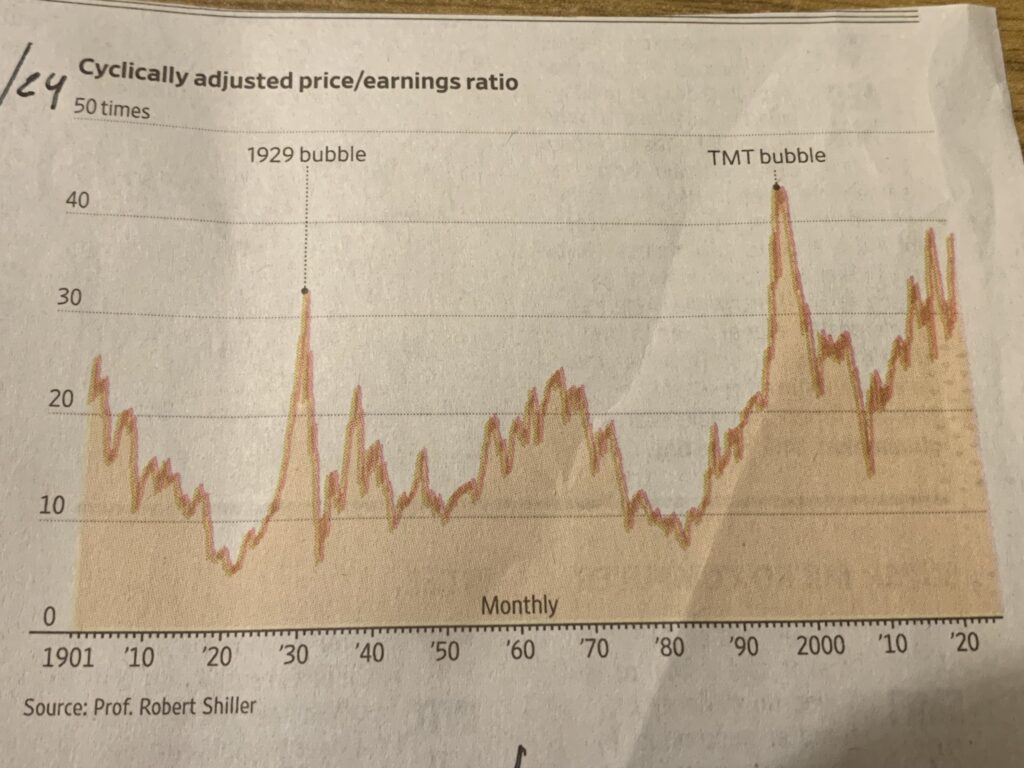

The first reason is extreme overvaluation. We are frequently told that the S&P is trading at 22x forward earnings estimates – expensive but not horribly so. But if you look at the CAPE which averages the last 10 years of earnings, it’s approaching 40. It’s only been higher at the top of the Dot Com Bubble. As I’ve noted a couple of recent posts, there’s just no value in stocks at the moment (“No Value In Stocks” 12/5, “No Value In The Mega Caps” 11/20). The WSJ’s James Mackintosh made the same point in an article in Monday’s paper (“Is This Wildly Overvalued Stock Market Doomed? Yes, But Maybe Not Yet” [SUBSCRIPTION REQUIRED]).

However, one of the things you learn with experience is that valuation is not a catalyst. Expensive stocks can get more expensive and cheap stocks can get cheaper. Things don’t turn around until they turn around. But on Monday we saw signs of profit taking in some of the best performing names. For instance, take a look at Monday’s candles on Palantir (PLTR), AppLovin (APP) and CAVA. Those were pretty nasty – though we’ll need to see follow through to conclude that a top is potentially in.

The market has rallied powerfully since the election of Donald Trump – and for some good reasons. First, Trump is unabashedly pro business. He’ll be deregulating and cutting back the government beaurocracy whose red tape places undue burdens on business. This is exemplified by the creation of the Department of Government Efficiency to be run by Elon Musk and Vivek Ramaswamy. He’ll also extend his 2017 Tax Cuts and generally keep taxes low. All of these are bullish for the economy and markets.

But some things are being overlooked. Extending the tax cuts will keep the deficit large. Investors are starting to focus on the deficit and federal debt which is putting some pressure on long term interest rates. Trump’s proposed crackdown on illegal immigrants is the right thing from a cultural perspective but it has economic costs. Reducing the supply of labor while holding demand constant increases the price. That will put upward pressure on prices and squeeze businesses. Trump’s proposed tariffs are also probably the right thing from a societal point of view by attempting to rebuild the US manufacturing base. But they will also increase prices. All of these things put upward pressure on inflation and interest rates which is a potential wildcard for the economy.

From a sentiment perspective, things could hardly be more euphoric. You can barely find a bear anymore with most capitulating. The latest is David Rosenberg who last Thursday wrote “Lament of a Bear”. In that piece, the longtime permabear tried to understand what he had gotten wrong over the last two years and wrote some surprising things like “there really is nothing to stand in the way of this bull market being extended” and “I do hate to ever use the term ‘new era’ or ‘it’s different this time'”.

For all these reasons I suspect 2025 will surprise the crowd with the S&P dropping 25% to 4500.