When The Chart Goes Parabolic It’s Time To Sell

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

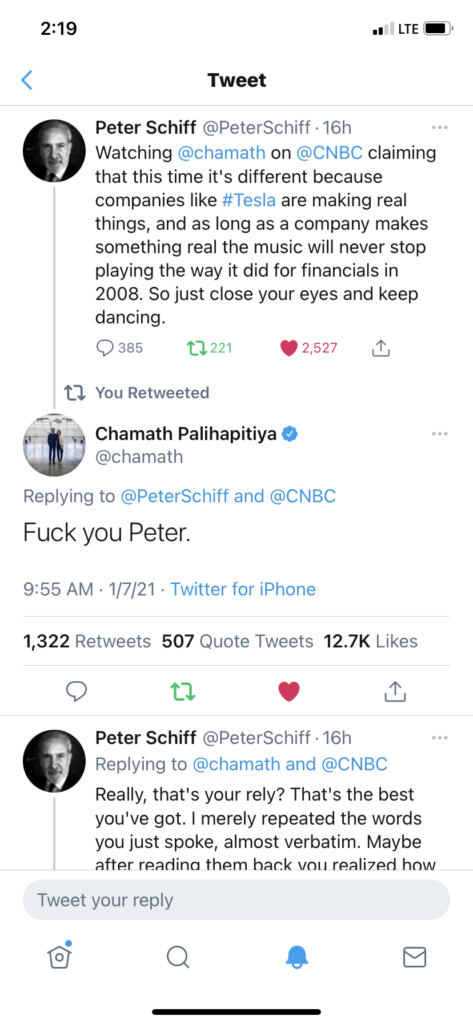

Sometimes luck plays such a big role in an individual’s success that the average person can’t help but mistake it for skill. Chamath Palihapitiya is that guy for the bull market starting in 2009. Starting as one of the first Facebook employees to investing in TSLA and Bitcoin, Chamath understands nothing, has been rewarded for his ignorance with billions and sees himself as a financial genius whose self image has been embraced by the media. In reality, he is the perfect prototype for an Ayn Rand villian, a complete second hander who sees himself as a brilliant financial mind, Peter Keating with the self image of Francisco D’anconia.

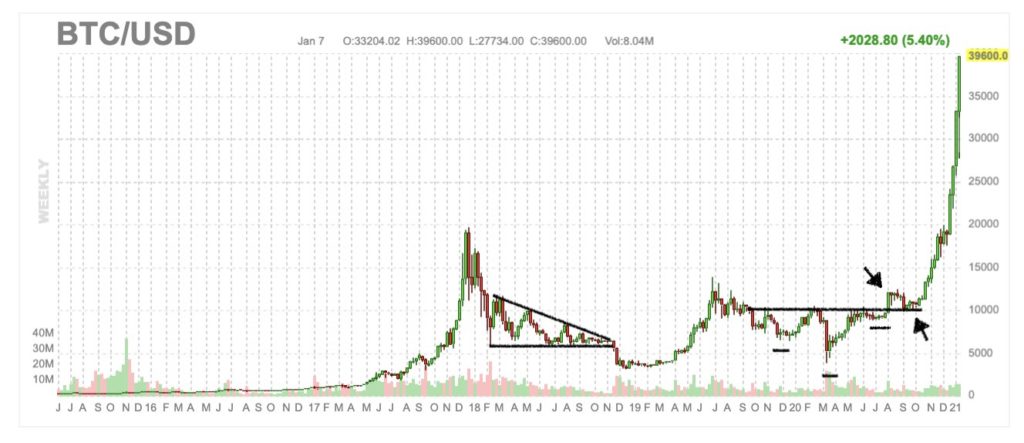

When $BTC gets to $150k, I will buy the Hanptons and convert it to sleepaway camps for kids, working farms and low cost housing – Chamath Palihapitiya Twitter, December 30, 2020, 7:38am PST

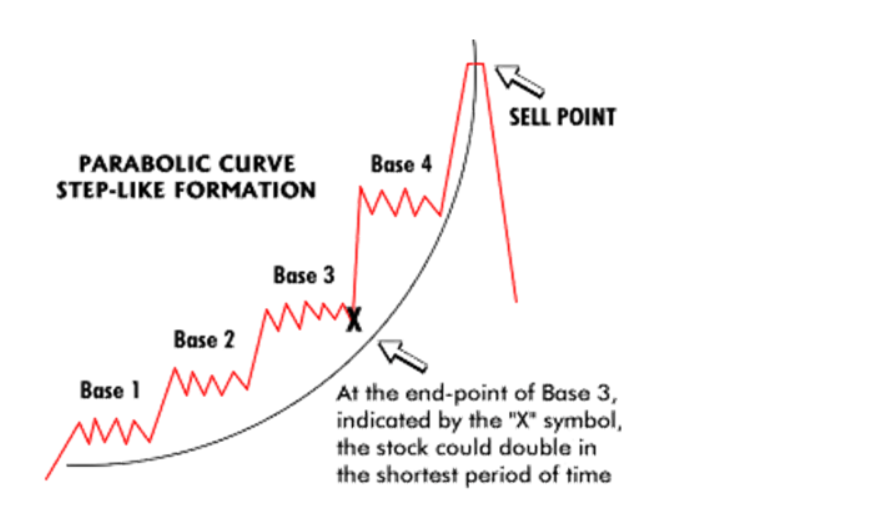

Bitcoin may well hit $150k in this insane market but, if it does, it will only go down in history as a contemporary example of Tulip Mania. Bitcoin has now gone from $10k to $40k in 90 days. What justifies that move? Nothing. What’s its cause? Pure speculation. When the chart goes parabolic it’s time to sell. I’m not calling a top. I’m saying we are close and when it does top, it will crash (Chart Source: Arun Chopra Twitter, January 7, 8:31am PST).

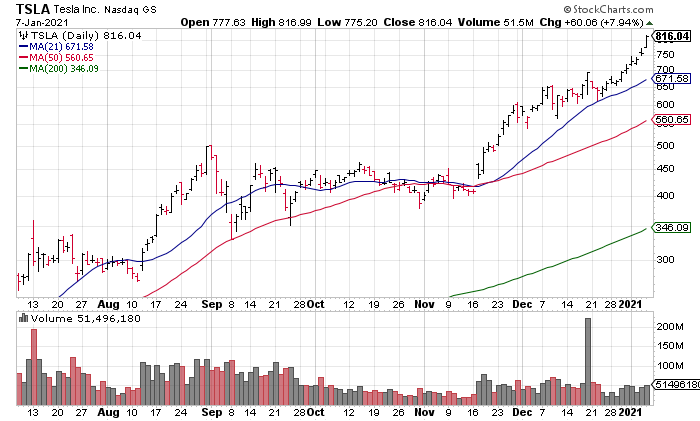

The big disruption that’s coming is to power utilities. There are trillions of dollars of bonds, of capex and of value sitting inside the energy generation infrastructure of the world that’s going to go upside down. And when that goes pear-shaped, Tesla will double and triple again – Chamath Palihapitiya, CNBC’s Fast Money Halftime, Thursday January 7 (quoted in “Chamath Palihapitiya says there’s a big disruption coming that will cause Tesla to double again”, CNBC.com, January 7, 2021 [SUBSCRIPTION REQUIRED]

While I have no idea what going “pear-shaped” means, if TSLA does double and triple again, like Bitcoin, it will have nothing to do with fundamentals and everything to do with pure speculation. I’ve made the case against TSLA many times so I won’t repeat myself here except briefly. TSLA closed yesterday at $816.04 giving it market cap of ~$900 billion. In 2020, they delivered ~500k cars. If you do the math, the market is now valuing TSLA at $1.8 million per delivered car in 2020.

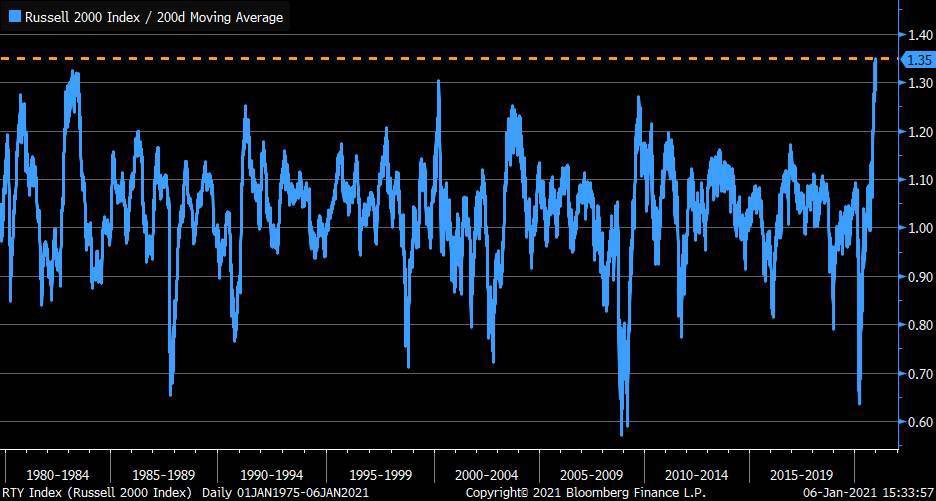

Bitcoin and TSLA are the best examples of the manic speculation currently taking place in financial markets but the Russell 2000 itself isn’t far behind. Now having more than doubled in less than 10 months, it is more than 35% above its 200 DMA – the most since at least 1980 (Chart Source: Liz Ann Sonders Twitter, January 7, 4:10am PST).

As they say folks: You can’t make this stuff up! Real life is indeed stranger than fiction.