WDAY Earnings, Extremely Bullish Seasonality Through Year End, To Short Or Not To Short

Note: To sign up to be alerted when the morning email is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe”.

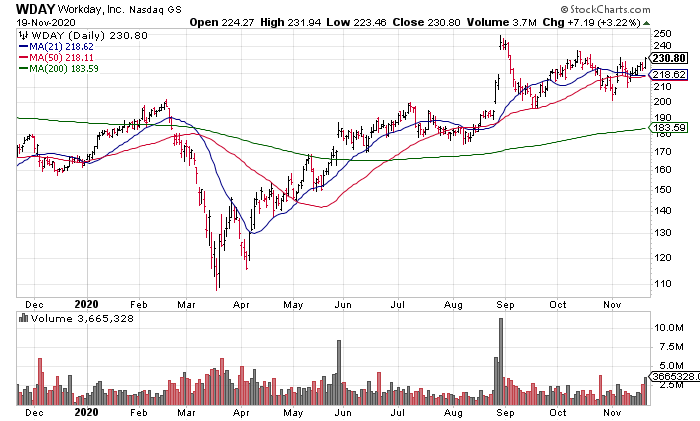

Yesterday afternoon, Workday (WDAY) reported a solid quarter (Revenue +18%, EPS +62% to 86 cents) but saw its shares sell off in the after hours. We’ll see how it does in today’s trading session but this is the fourth time we’ve seen this kind of action in a stock this week (WMT, HD & NVDA): A good or even great quarter that can’t move the stock higher or the stock even sells off on because it’s technically extended and overvalued and so the numbers are already #PricedIn

And these aren’t the only four stocks, as I’ve been documenting this phenomena throughout earnings season. The market is overbought and overvalued and is having a hard time moving higher from here as a result. For your reference, here are the valuations for WMT, HD, NVDA and WDAY (I use Price / Trailing Twelve Month (TTM) EPS or EV / TTM if the company has net cash to give it credit for that). Trailing P/Es:

WMT 28x

HD 23x

NVDA 61x

WDAY 86x

In general, you don’t make money long term buying stocks at these various stages in their growth cycles at these valuations. It doesn’t mean that you won’t this time, but the probabilities are against it.

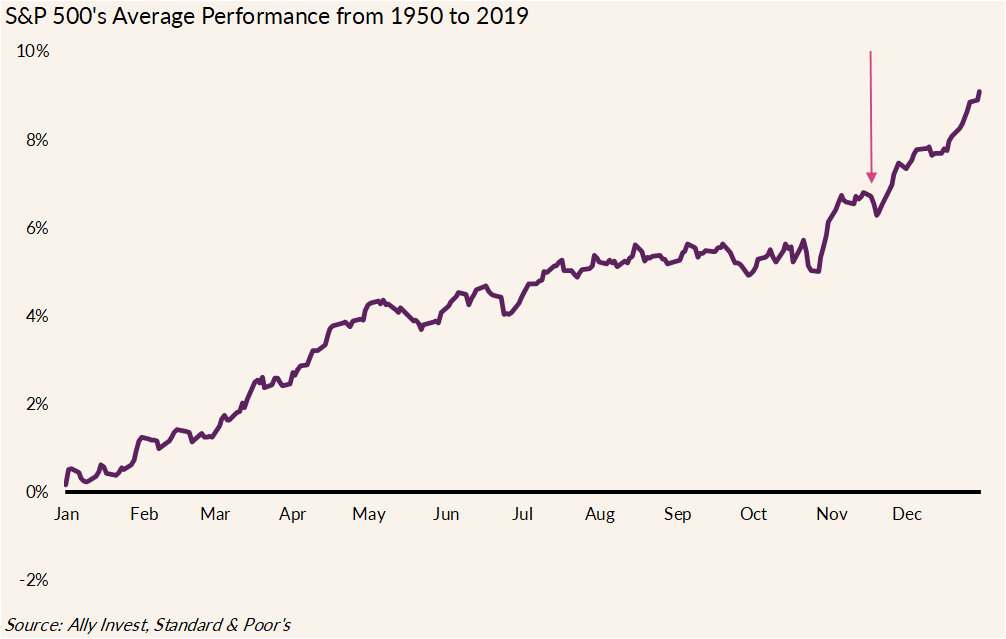

A secondary reason for wanting to make the IWM & EWJ trade, after a correction, is extremely bullish seasonality from now until year end. After today, we have 6 data light weeks, two holiday shortened. With investors so bullish and the #COVIDVaccine causing the rotation into #Value from #Growth as investors anticipate a #2021 #ReOpen, I expect that narrative to control the action as stocks drift higher into year end with seasonality acting as a tailwind.

The best reason for staying away from shorting stocks is the overriding 10% annual return for the past 200 years. One way of seeing this is to dig up a long term chart of the stock market averages…. The overall impression is a continuous rise of some 100-fold over the past 100 years, with pauses in the 1930s and 1970s, and small downward blips in 1907, 1929, and 1987 – Niederhoffer, The Education of a Speculator (1997), pg. 268

Soros once told me that he lost more money selling short than any other speculative activity. My experience is similar. The advice that comes down the pike from authors of stock market doom books – that individual investors should sell short – is a ticket to the poorhouse – Niederhoffer, pg. 46

Now, I’m going to step back and look at the broader issue of shorting stocks and how it applies to my trading.

I made my first trade in February 2000 after I read an article by the Austrian/Objectivist economist George Reisman that we were in a stock market bubble. My parents had given me $1500 in EMC stock as a high school graduation present in June 1995 and that had appreciated to ~$20,000. I decided to sell and put it in the Vanguard Wilshire 5000 Index Fund as the investments course I had taken in the fall of my final year at UC – San Diego recommended. Sure enough, Reisman was right, the Dot Com Bubble peaked in March, and EMC stock dropped 90% in the ensuing years (unfortunately the Vanguard Wilshire 5000 Index Fund dropped 50%).

In 2005, I was a Philosophy Phd student at UC – Davis when the housing bubble came on my radar. Having been exposed to the ideas of Ludwig von Mises and the Austrian School of Economics and their theory of the business cycle in college, I understood exactly what was going on: overly low rates from the Fed had stimulated a national housing frenzy which was going to pop. I decided to wrap up my MA and started Top Gun in 2006 to profit from the implosion of the housing market and its ripple effects into the rest of the economy. I went live on January 1, 2007, shorted housing stocks and the investment banks holding mortgage backed securities on their books, the market peaked in October, I returned 15% in 2018 compared to -38% for the S&P, and I was managing $4 million by early 2009. I thought I was on my way.

Unfortunately, I thought that March 2009 was simply a countertrend rally in an ongoing bear market, not the bottom of The Great Recession and I remained bearish and short after trading the oversold bounce. After being right to bet against the market in 2000 and 2007, this was the beginning of a long period of being wrong. My performance deteriorated and my AUM shrunk to its current $2 million.

I thought COVID marked the end of the 2009-2020 cyclical bull market and became bearish and started shorting the stock market in May, not throwing in the towel until October (5 months). I was caught off guard by the massive and overdone rally we’ve seen since March 23 and my short campaign cost me and my clients a significant amount of money.

I’m in a very self reflective period right now, as those of you who read Monday’s morning email know (“The Return of Value?, Breaking My Value Trap Habit / Mark Minervini on Leaders Vs Laggards, Integrating Not Imitating Minervini”, Monday November 16, 2020: https://www.topgunfp.com/the-return-of-value-breaking-my-value-trap-habit-mark-minervini-on-leaders-vs-laggards-integrating-not-imitating-minervini/), and I had an epiphany yesterday afternoon about my shorting. I realized that I was placing being right above making money. It was about being right when everyone else was wrong. I was trying to be a hero and that is not the right way to invest.

I picked Victor Niederhoffer’s magnificent The Education of a Speculator (1997) off my shelf because it had a couple great passages on shorting that I had written about in a Client Note from 2012 entitled “The Loser’s Strategy”, which has unfortunately been lost from my website, and which I quoted from above. I think I’m done shorting. I’d rather profit more safely from the popping of the current bubble by being long gold which will benefit when the Fed steps in to prop up a collapsing securities market than being short in a situation in which the institution that controls the money supply is pumping tens of billions monthly (trillions total) into financial markets. I got burned May through September, have watched as one of my investing heroes, David Einhorn, has continued to lose money on his “Bubble Basket” of shorts for years now, and have concluded that I am done shorting. In conjunction with the self analysis on my penchant for Value Traps and lack of Risk Management in Monday’s morning email, it has been an incredible week of self analysis and self development as an investor. I’ve never felt even close to as good about my stock game as I do now, having patched up three major leaks, going forward. The best is yet to come.