UNP & CSX Earnings, Inside Thursday

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

On Wednesday, I did a deep dive into BAC, GS and NFLX earnings and yesterday I did PG. Doing this type of valuation work is essential to understanding the psychology of the market, what exactly is being priced in. So today we’ll continue with the major railroads Union Pacific (UNP, market capitalization $140 billion) and CSX (CSX, $70 billion market cap).

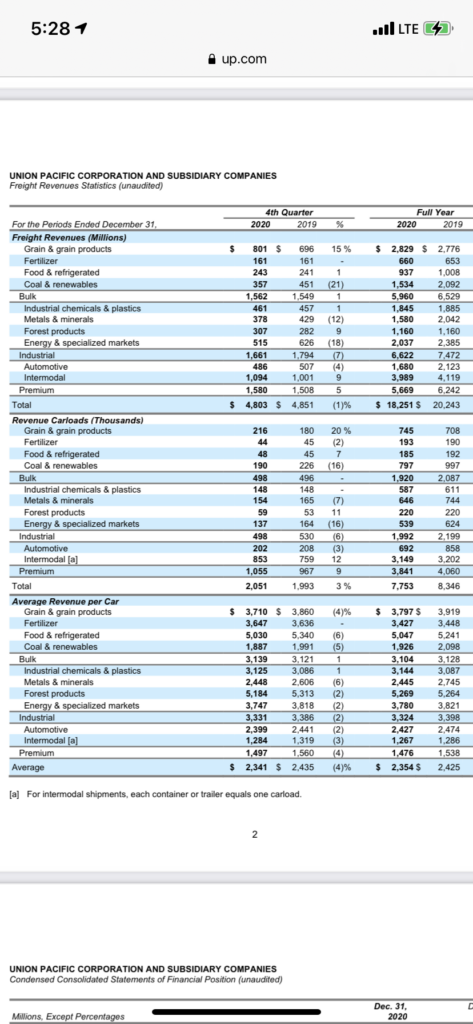

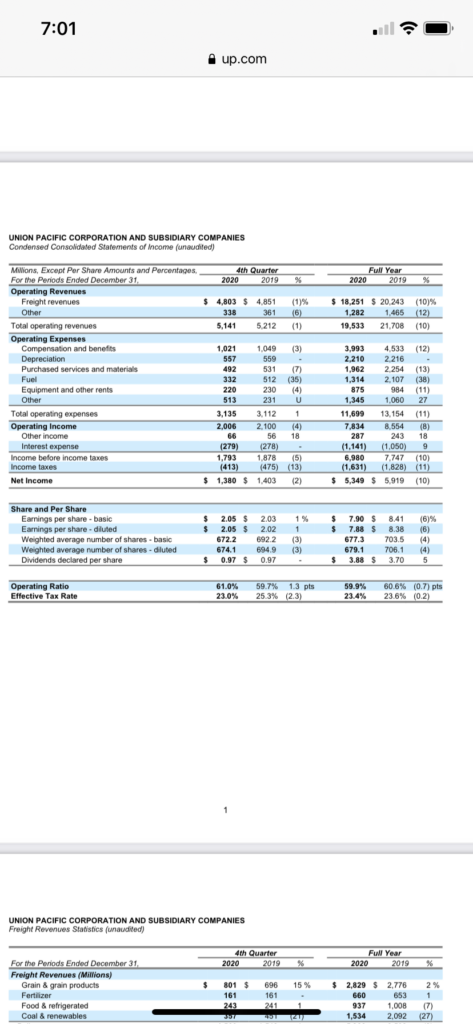

UNP reported 4Q20 earnings Thursday morning. Volume was +3% while Pricing was -4% resulting in a 1% decline in Revenue. Excluding a $278 million pretax impairment charge, EPS was $2.39 – up 17% from a year ago. So while they weren’t able to grow revenue, they were able to manage costs and increase profitability.

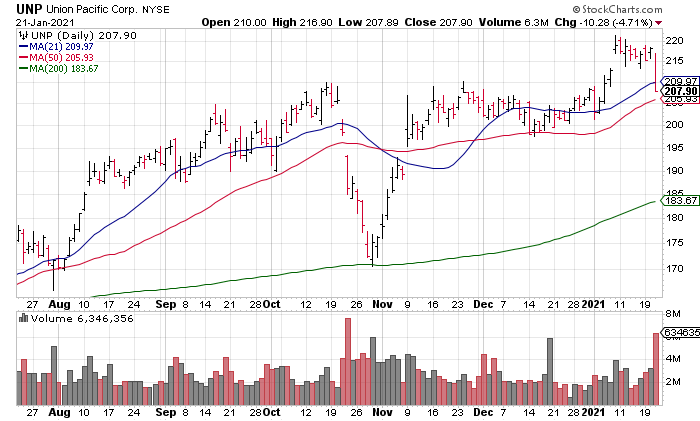

Excluding the impairment charge, UNP earned $8.19 in 2020 and $8.38 in 2019. Dividing yesterday’s closing price of $207.90 by peak 2019 earnings of $8.38 gives a multiple of 25x peak earnings. In other words, UNP is being valued as if we are on the verge of a mega bull market though the fundamentals do not yet support such an assumption. There’s not much of a margin for safety being priced in here.

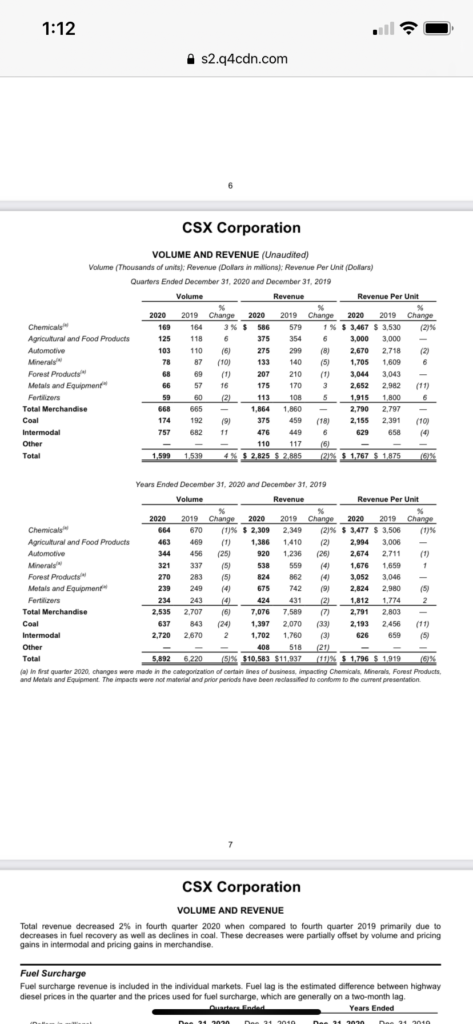

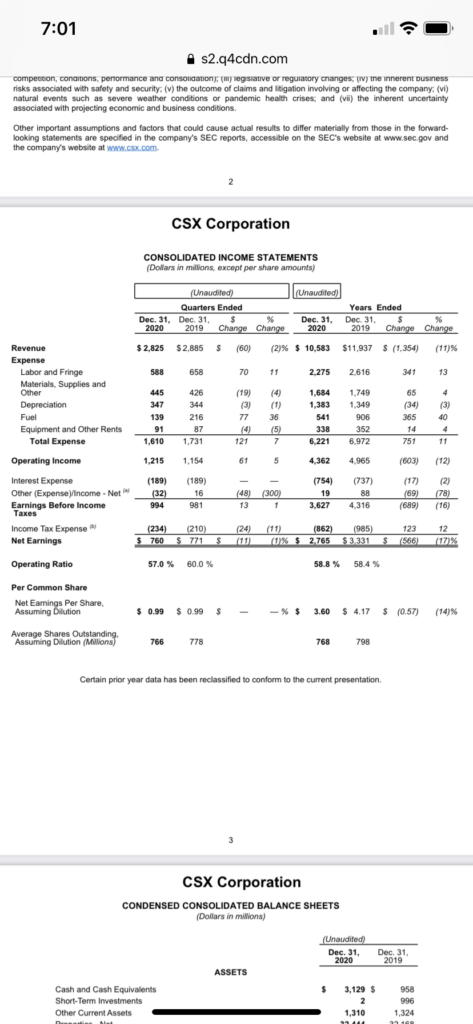

Unsurprisingly, CSX is being valued in much the same way. While 4Q Volume was up 4%, Pricing was -6% resulting in a 2% decline in Revenue. EPS was flat at 99 cents/share.

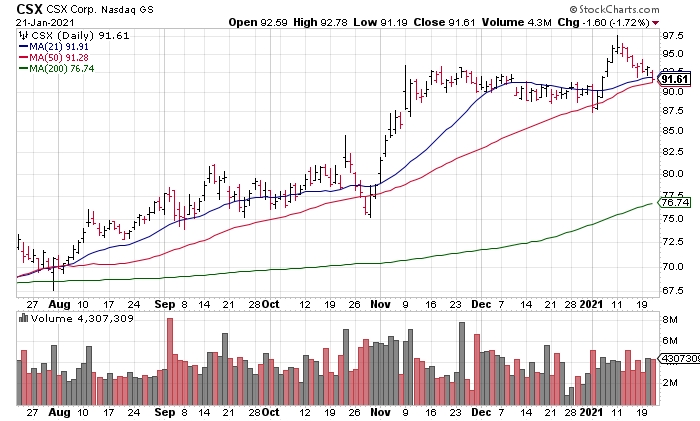

Moving on to valuation, CSX earned $3.60 in 2020 and $4.19 in 2019. Dividing yesterday’s closing price of $91.61 by peak 2019 earnings gives a multiple of 22x. Again, a mega bull market is being priced in before being supported by the fundamentals leaving little margin of safety.

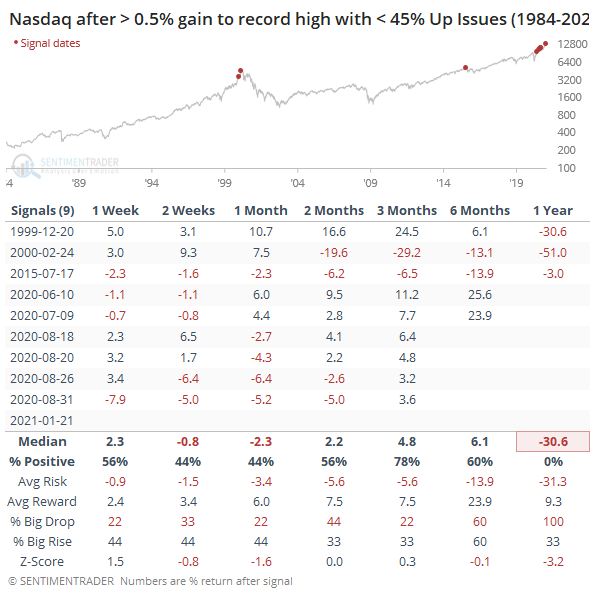

Before leaving, I want to note an oddity about yesterday’s trading pointed out by Sentimentrader (January 21 Blog Post). Thursday was only the 9th time since 1984 that the NASDAQ was up > 0.5% to a new ATH while Advancing Issues were < 45% (1668 of 3932 securities traded on the NASDAQ advanced yesterday or 42.4%, according to the WSJ Markets Diary). That’s because it was led by the biggest stocks (QQQ was +0.80%) while the Russell lagged (-0.89%).

The first instance of this was December 20, 1999 and the second February 24, 2000. We all know what happened in the ensuing months and years as the Dot Com Bubble burst. The third instance occurred on July 17, 2015 which also preceded a rough period for stocks, though the 2009 bull market did ultimately resume. The last six instances, including yesterday, have all occurred since June 10, 2020 so we don’t yet know how things will turn out and how reliable this indicator is. Nevertheless, it is disconcerting that the previous three instances have returns of -30.6%, -51% and -3% one year out.