Tuesday Morning Rundown: Goldilocks, DHI UNP LMT Earnings

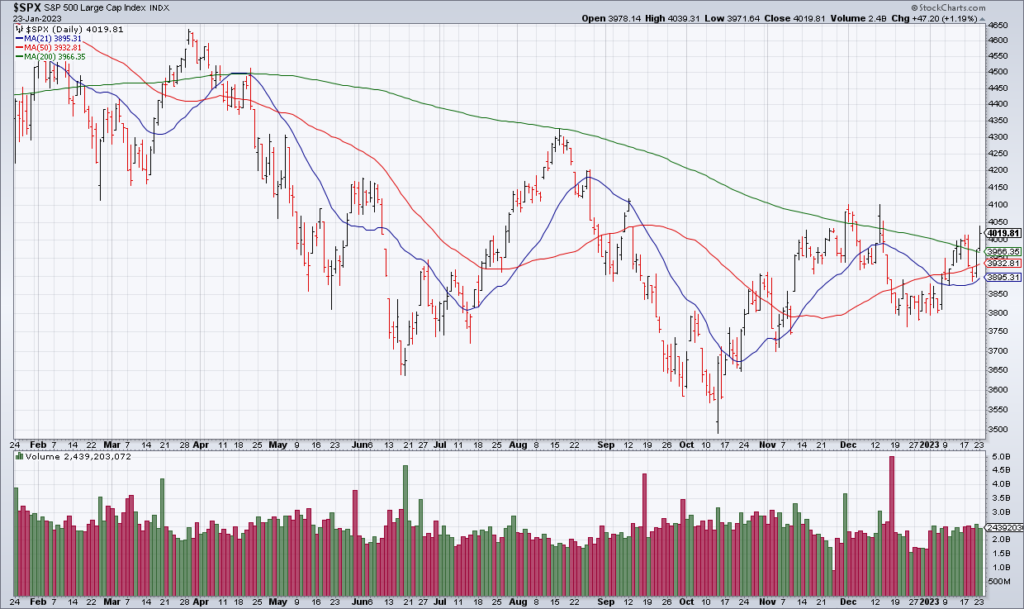

The S&P closed above its 200 DMA Monday on hope that the Fed is close to done in its fight against inflation and the economy will avoid a recession. Investors are pricing in a “Goldilocks scenario” according to Liz Ann Sonders in a front page article in today’s WSJ by Matt Grossman: “Pretty much everything would have to go right,” she said. Like I wrote yesterday in “Stocks Run Up Into Earnings Season As The Fed Considers Pausing”, I’m a seller of this narrative and rally.

Let’s turn now to a few earnings reports from this morning. Home builder DR Horton (DHI) – which has had a huge rally over the last three months – reported a 38% drop in new orders in the 4Q22. Chairman Donald Horton said there has been a “moderation in housing demand beginning in June 2022” due to rising mortgage rates and general economic uncertainty. This move in DHI and the other home builders is way overdone in my opinion and I have a small short position.

Railroad Union Pacific (UNP) also reported 4Q22 earnings this morning. Revenue carloads increased 0.8% – so it’s not really showing the signs of a decrease in economic activity I thought it might. Yet. I’d still stay away from such an economically sensitive stock.

Lastly, defense company Lockheed Martin (LMT) reported a strong 4Q22 and I continue to own it and Northrop Grumman (NOC) – which reports Thursday morning. In fact, I added to my positions yesterday due to the recent selloff. LMT guided to revenue of $65-$66 billion and EPS of $26.60-$26.90 in 2023 – which are both comparable to 2022 if you back out a $1.9 billion non-operational charge to earnings. At less than 17x forward earnings, LMT is a nice piece for your portfolio in a dangerous geopolitical world. If China ever goes after Taiwan, LMT will hit $600 – or higher.