Tue Feb 4 Earnings Rundown: GOOG/GOOGL, CMG, PYPL, SNAP, MTCH

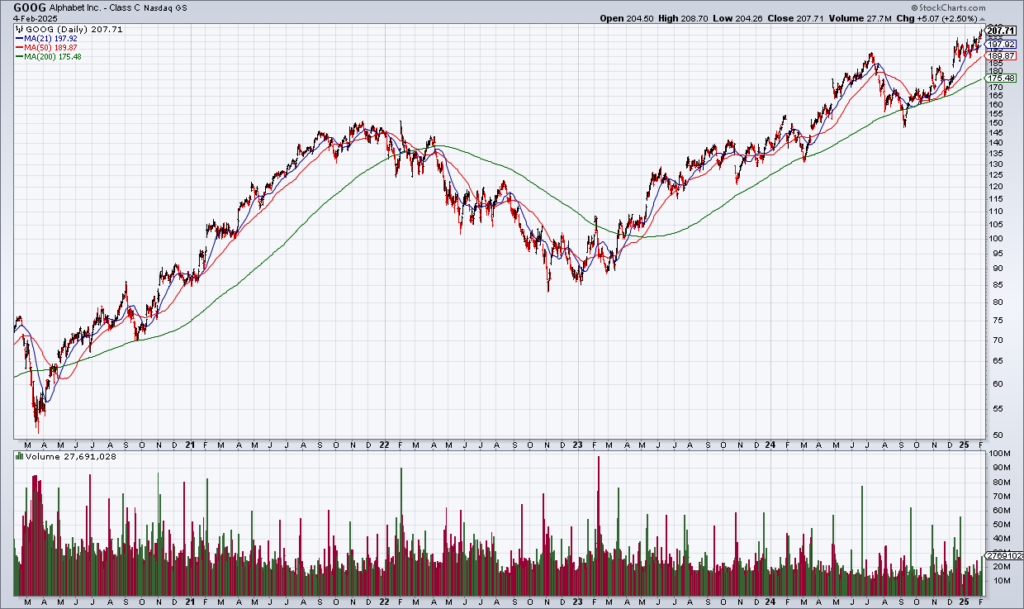

The big stock that reported earnings Tuesday afternoon was of course Google (GOOG/GOOGL). GOOG/GOOGL is of course one of the greatest companies in the history of capitalism. They own search on the internet through Google and that is not likely to change for the foreseeable future. The problem here – as with other Mag 7 companies – is that the business is maturing. I believe the main reason GOOG/GOOGL shares are -7% in the after hours is the 12% revenue growth they reported for 4Q24. That doesn’t support a 26x trailing EPS multiple or a $2.6 trillion market capitalization. GOOG/GOOGL is a stock that I would own at the right price – but that price is substantially below the market price.

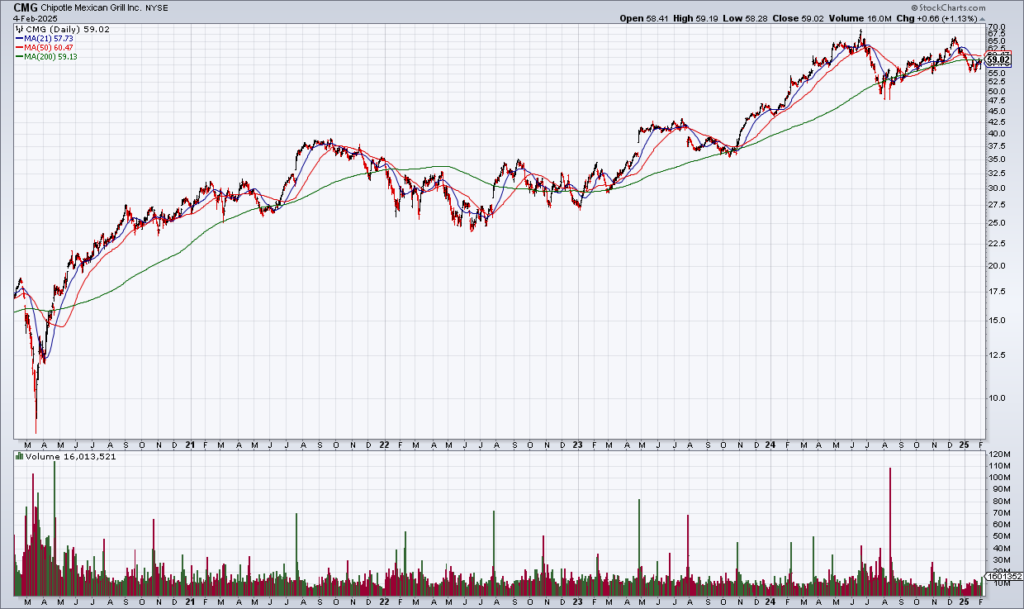

Chipotle (CMG) is another legendary company. It’s hard to believe there are many Americans who haven’t at least tried their food. But when you trade at a multiple around 50x earnings, quarters have to be almost flawless to move the stock even higher – and this one wasn’t. Comps of 5.4% would be good for most restaurant operators – but not CMG. Restaurant Level Operating Margin declined marginally for the 4Q24 and increased only marginally for full year 2024. As a result, CMG’s 2024 EPS increased only 24% to $1.12 from 90 cents in 2023. Once again, 24% would be a good number for most restaurants but not CMG. The stock is too expensive which is why it’s -5% in the after hours.

PayPal (PYPL) is a stock I’ve been watching closely for a couple years now after the big selloff it experienced in 2021-22. After a nice bounce over the last few months, the stock lost 13% on a mediocre 4Q24 earnings report Tuesday morning. 4% revenue growth raises concerns for investors that the good old days of real growth are past. On the other hand, Total Payment Volume (TPV) increased 7% to to $438 billion. And the stock is cheap at 15.5x ’25 EPS guidance. While the quarter was not what bulls were hoping for, I’m not ready to write PYPL off just yet.

The stock I’m most excited about of the five I’m covering in this blog is Snapchat (SNAP). SNAP has essentially been left for dead after a huge drawdown in 2021-22 and a number of disappointing quarters. But the numbers suggest to me that the story here is not over. The problem with SNAP has been its inability to monetize its substantial number of Daily Active Users (DAUs, 453 million). But that may be starting to change. Average Revenue Per User (ARPU) increased to $3.44 in 4Q24 resulting in Adjusted EBITDA of $276 billion and Non-GAAP EPS of 16 cents. As a result the stock is +5% in the after hours and I’m considering adding to my position tomorrow.

Last, let’s talk about Match (MTCH), owner of the dating apps Tinder and Hinge among others. The problem here is the maturation of Tinder. From a peak of over 11 million paying subscribers a couple year ago, that number has fallen to 9.5 million. Hinge is the growth story with Direct Revenue growing 39% and Paying Subscribers 23% in 2024. While the problems at Tinder are real, MTCH is extremely cheap. Adjusted Operating Income for 2025 was $1.252 billion for a stock with a market cap below $10 billion. These are good assets and a lot can go right at this price IMO. Top Gun has a small position.