Tech Shows Life, Gold > $1700

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

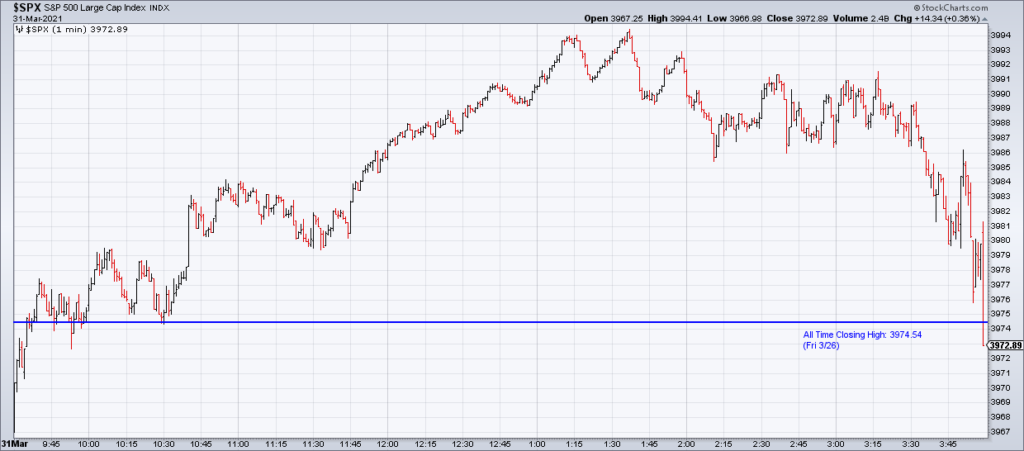

The market showed some strength yesterday, led by tech. The NASDAQ was +1.54%, the S&P +0.36% (S&P Tech (XLK) was +1.59%) and the Russell +1.13%. The S&P 500 looked almost certain to make a new All Time Closing High yesterday before collapsing in the final minute of the session.

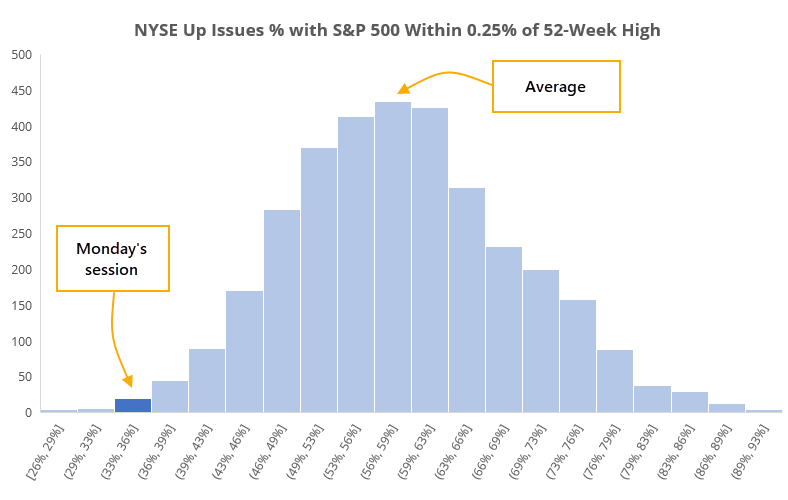

That’s a pretty bizarre last minute on top of the market’s strange behavior on Monday when something extremely rare happened: Advancers on the NYSE were less than 35% when the S&P was within 0.25% of its All Time High. That’s only happened a handful of times with negative near term implications for stocks every time it’s happened in the last 30 years:

In terms of what those weak days meant for forward returns, the S&P had some trouble holding near its highs when so many stocks had been declining under the surface. Every signal in the past 30 years showed a negative 1-month return (“Why Monday was so unusual”, Sentimentrader, Wednesday March 31).

Mega Cap Tech as represented by the QQQ has shown some strength relative to Reopen Value as represented by the IWM in recent days. The first chart below from Ian McMillan, with each bar representing one month I believe, shows the bounce in the QQQ vs the IWM. Scott Redler is also constructive on the QQQ.

This is being led by the biggest of the big stocks: Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), Google (GOOG, GOOGL) and Facebook (FB). The first and second charts below by Scott Redler are of GOOGL and FB. The third chart from Ian McMillan represents a bullish take on the NASDAQ breaking out above the wedge defined by it trendlines from the February All Time Highs and the March Correction Lows.

In yesterday morning’s blog on Crescat Capital’s March Letter “A Collision of Macro Narratives”, I had a chance to review the state of the precious metals miners and it was not looking good from a technical standpoint. Happily for us bulls, they bounced hard yesterday and are hanging in there technically – if barely. In yesterday morning’s blog, I posted a chart from Crescat showing the disconnect between the miners strong fundamentals and current price action. The macro environment is, of course, very supportive of the miners as well with inflation rearing its ugly head.