NOTE: Every week or two I wrote a Client Note for my clients. I post the notes to my blog but with a time delay usually between 1 day and 1 week. To receive the Client Notes at the same time as my clients, sign up in the box in the right hand corner of the website.

Originally sent to clients May 15.

*****

The market continues to be stuck in a rut and has given back about 50% of its YTD gains so far in the 2nd quarter. In

“The Long Awaited Correction” (April 17), I mentioned 1340 as a level many were watching. In his most recent weekend chart show, master trader Charles Kirk (

www.thekirkreport.com) showed that that level has taken on added importance as the neckline of a head and shoulders topping formation. A decisive break of the neckline would suggest a measured move down to the 1250-1260 area on the S&P.

The catalyst for most of this selling pressure is renewed concern about Europe. In the wake of elections, Greece has been unable to form a new government and the previous bailout package is in jeopardy. Alexis Tsipras, leader of the radical left Syriza party which finished second in the May 6 elections, rejects the austerity measures which are a condition of bailout payments (

“Contagion Fears Hit Markets – Worries Over Greek Exit From Euro Spur Slump; Specter of Collateral Damage”,

The Wall Street Journal, Tuesday, May 15, A1).

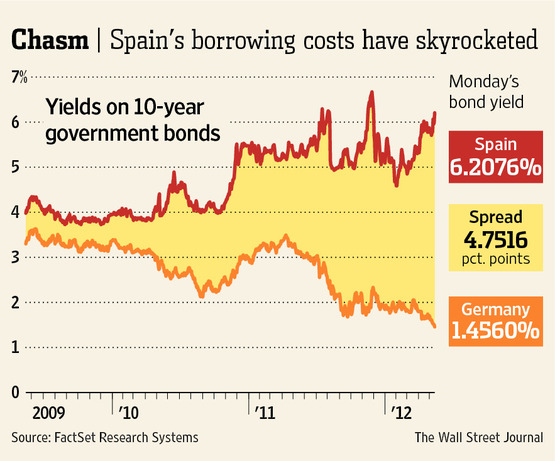

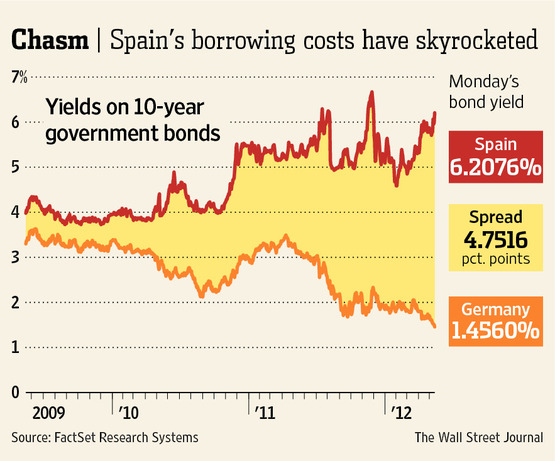

Fears about Greece leaving the euro have spilled over into worries about Spain and Italy whose stock and bond markets have been hit. Indeed, the spread between Spanish and German 10 year bond yields – a measure of financial stress and risk aversion – has widened considerably in the last couple months.

The one source of excitement in the market is the coming Facebook IPO scheduled for Friday. Facebook has registered to sell 337 million shares at a price between $34 and $38 a share. This is the biggest IPO since Google’s 8 years ago and it will be quite a spectacle.

Skeptics are pointing to the frenzy surrounding the IPO and sky high valuation as reasons to stay away. Facebook had revenues of $3.7 billion and $1 billion in profit in 2011. At the midpoint of the pricing range, the market capitalization is about $100 billion resulting in a trailing P/E of 100.

While this is a legitimate concern from a longer term investment standpoint, it won’t matter on Friday. Because Facebook is selling only a sliver of the company (about 12%), the limited supply of shares combined with the insatiable demand for them should result in a highly successful debut.

Greg Feirman

Founder & CEO

A Registered Investment Advisor

9700 Village Center Dr. #50H

Granite Bay, CA 95746

(916) 224-0113

CALL NOW FOR A FREE INITIAL CONSULTATION!