Top Gun FP Client Note: Dow 15,000

NOTE: Every week or two I write a Client Note for my clients. For a limited time, I am allowing non-clients to sign up and receive it at the same time as my clients. You can sign up at the top right hand corner of the website. I will also be posting the notes on my blog with a time delay from time to time.

Originally sent to clients February 15.

*****

Based on cyclical patterns of market history, the odds are better than two chances in three that the Dow Jones Industrial Average will reach 15,000 or higher over the next two years. Based on the same cyclical patterns, there’s about a 50-50 chance that the Dow could hit 17,000 or more.

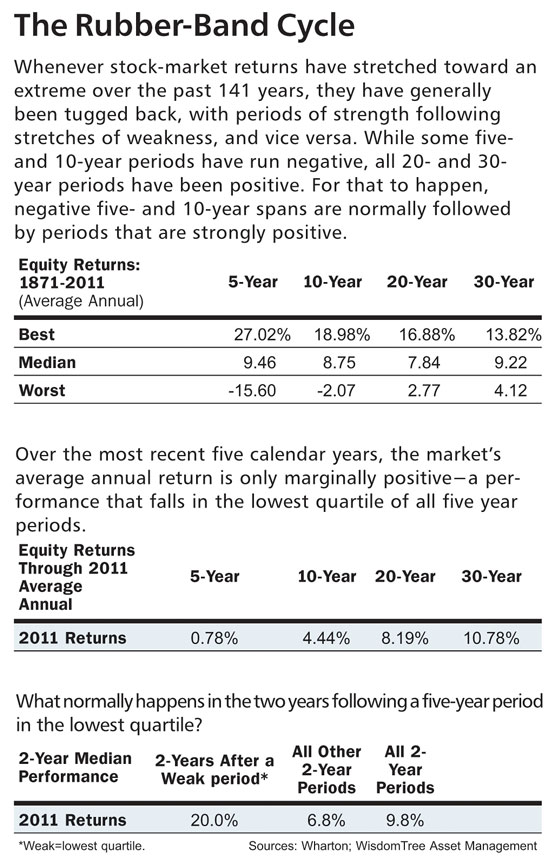

The market history draws on 141 years of equity performance, from which a fairly straightforward cyclical pattern can be discerned: a strong tendency for periods of worse-than-average returns to be followed by periods of better-than-average, and vice versa. Since the past five years have been squarely in the worse-than-average category, better-than-average returns in the two-year period just begun are now likely.

The cycles, then, are based on simple arithmetic: two-year intervals following intervals of five years. Also, five-year intervals that are worse-than-than average are objectively defined as belonging to the lowest quartile of all five-year periods in the 141 years tracked. Two-thirds of the time, after a five-year period like the one we’ve just seen, the market rises fast enough to lift the Dow to 15,000 or higher from present levels over the following two years. The same pattern applies to Dow 17,000 or higher, except that happens just half the time.

– “Enter The Bull”, Gene Epstein, Barron’s, February 11

The cover of Barron’s this weekend read “Dow 15,000” in large print. The article by Gene Epstein reviews the research of Wharton Professor Jeremy Siegel, author of Stocks For The Long Run, to make a historical case that there is a 70% chance that the Dow reaches 15,000 within two years.

The argument is straight forward and compelling. Siegel uses his stock market data going back to 1871 to break the market into 136 5-year periods. The 5-year period ending in 2011 falls into the bottom quartile of 5-year periods based on returns. For the 33 previous bottom quartile periods, the median return the following two years is 20%. Therefore, they argue, the Dow has a 50/50 chance of reaching 17,000 within two years. In 23 of the previous 33 bottom quartile periods, stocks returned 11.7% or greater the following two years. Therefore, the Dow has a 70% chance (23/33 = 70%) of reaching 15,000 within two years. In only 3 cases were the following two year returns negative.

I don’t care to go into detail refuting the argument. I will only point out that 30% of the time, the historical record would suggest we don’t reach Dow 15,000 and 10% of the time it suggests we will be lower two years hence. In addition, within the 5 years ending in 2011, we have already had an excellent 2-year period (2009-10).

More interesting to me is the light the cover sheds on sentiment. The magazine cover indicator is one of the most well known on Wall Street and says that we tend to see covers like this at points of extreme sentiment. The most famous example is Business Week’s “The Death of Equities” which appeared in August 1979 near the end of the nasty 1970s bear market.