This Will End In Tears

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

(Table Source: Jeroen Blokland Twitter, January 7, 11:20pm

Emotionally, it was a bruising week. Rioters stormed the Capitol Building and disrupted the certification of the US presidential results. The Democrats won the two Senate seats up for grabs in Georgia. Friday’s payrolls report showed that the US shed 140,000 jobs in December…. All three could have – should have – caused the stock market to drop – Ben Levisohn, “The Stock Market Had a Fantastic Week. Now It Needs to Drop”, Barron’s, The Trader Column, Saturday January 9 [SUBCRIPTION REQUIRED]

Despite Democrats taking control of the Senate giving them complete control of Washington, a riot at the Capitol egged on by the current President and a bad jobs report, the stock market had a terrific first week of 2021 (S&P +1.8%, Nasdaq +2.4% and Russell +5.9%).

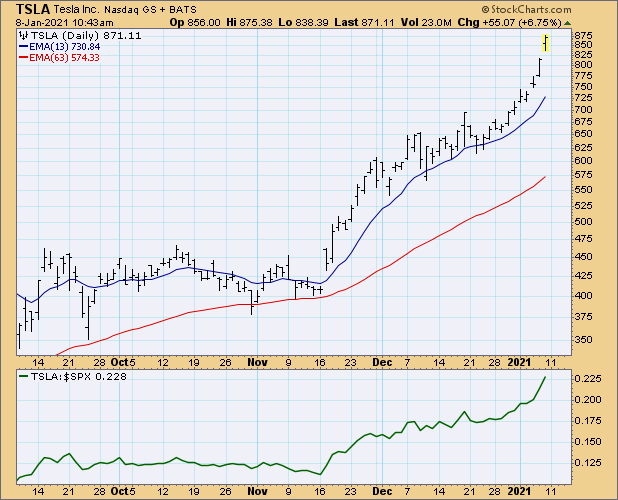

TSLA surged 25% on the week adding almost $200 billion in market cap and brining it to within spitting distance of a $1 trillion valuation. Blokland’s chart above was as of Thursday and so doesn’t take account of TSLA’s +7.84% on almost 2x average volume Friday which likely pushed Elon Musk’s net worth over $200 billion.

In a tweet accompanying the TSLA chart below, Walter Deemer quoted Bob Farrell: “Parabolic advances usually carry further than you think, but they do not correct by going sideways”. (Chart Source: Walter Deemer Twitter, January 8, 7:44am PST).

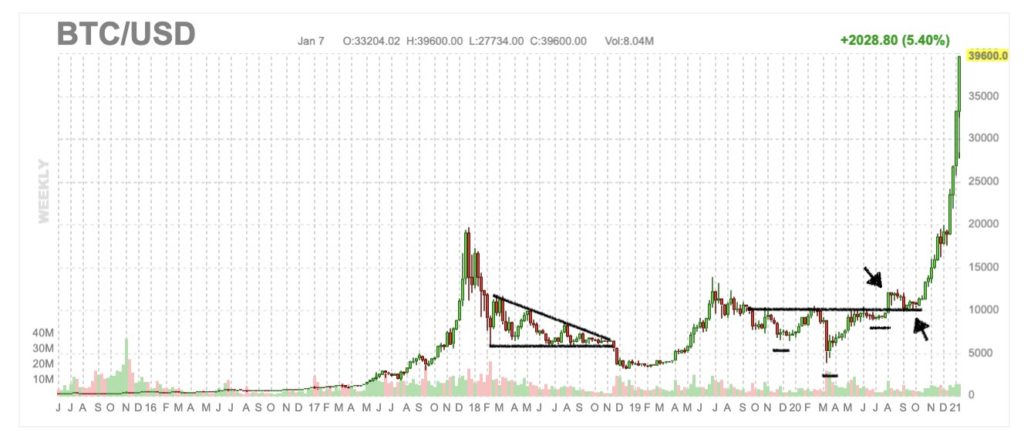

The other leading poster boy for the mania currently raging through financial markets is Bitcoin which surged through $40k last week (Chart Source: Arun Chopra Twitter, January 7, 8:31am PST).

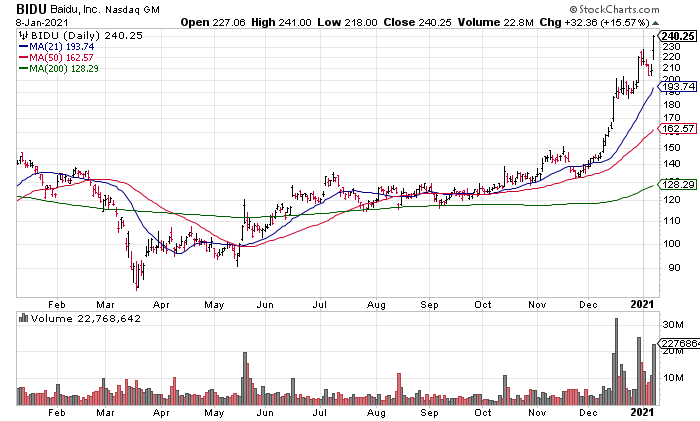

But the speculation is not limited to these two assets. In fact, it’s almost anywhere you look. For example, shares of Baidu (BIDU) are up 81% in 7 weeks, including a +15.57% move Friday on almost 4x average volume. Why? Speculation that they will enter the electric vehicle (EV) market (“EV Dreams Power Baidu but May Not Last”, Jacky Wong, WSJ, January 8 [SUBSCRIPTION REQUIRED]).

Meanwhile, in the real world, it was a bad week for America. The Democratic wins in the Georgia Senate runoff races give them total control of Washington. That means an increased likelihood of higher capital gains and corporate income taxes, increased spending on things like clean energy, a push towards socialized medicine and increased regulation of business.

If that wasn’t bad enough, our current President egged on a mob who subsequently rioted at the Capitol, likely destroying his legacy and political future in the process (see Kim Strassel, “Trump Erases His Legacy”, WSJ, January 8).

Caught in its own manic reverie, Wall Street ignored both of these political developments in addition to a bad Jobs Report Friday that showed a loss of 140,000 jobs in December as COVID surged throughout the country.

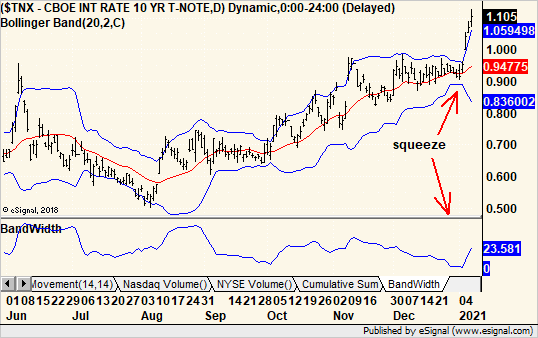

Lastly, interest rates exploded higher in the wake of the Georgia Senate runoff elections with the 10 Year Treasury Yield closing the week at 1.105%. This is because investors expect bigger deficits from a Democrat controlled government. Yields are still very low but moving higher quickly. This is not a bullish development for our highly indebted economy as increasing debt service costs will squeeze governments, businesses and households (Chart Source: Michael Kahn Twitter, January 8, 1:03pm PST).

Accompanying Instagram Market Commentary

Note: This will likely serve as Monday’s morning market blog.