There Will Be No Soft Landing

There is an important front page story in today’s Wall Street Journal by Jon Hilsenrath and Nick Timiraos entitled “Fed’s Chance Of Soft Landing Narrows” [SUBSCRIPTION REQUIRED]. It’s important because the market is priced for a soft landing – but it’s not going to happen. Why?

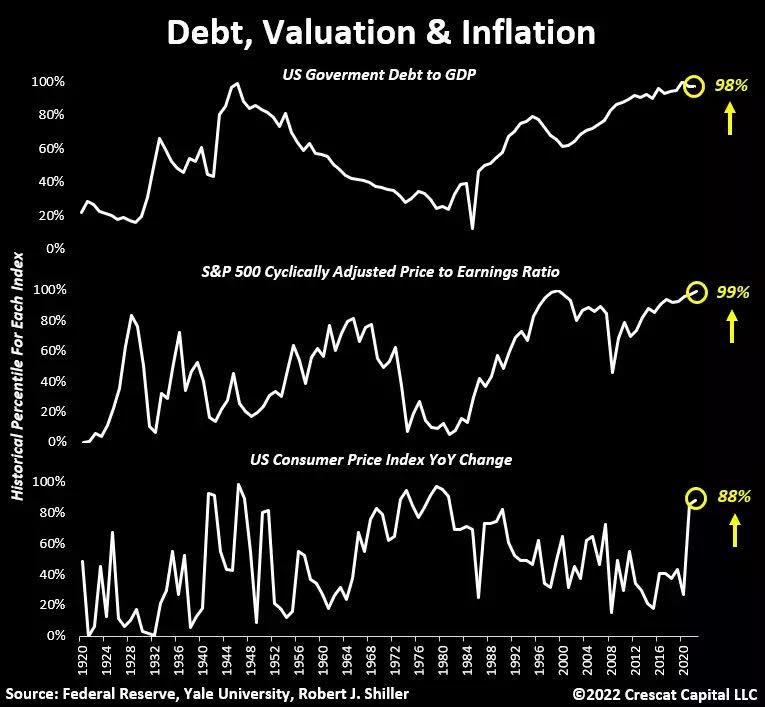

A nasty recession or worse is virtually guaranteed because the Fed is dealing with two extreme macro imbalances. The first imbalance is a 1929-style asset bubble that is the result of former Fed chair Ben Bernanke’s efforts to rescue the economy from the financial crisis – namely Zero Interest Rate Policy (ZIRP) and Quantitative Easing (QE). Bernanke was successful in staving off a Depression in 2008 but only by reinflating an even bigger asset bubble. As you can see in the chart above from Crescat Capital, the cyclically adjusted price to earnings ratio or CAPE is in the 99th historical percentile going back to 1920.

The asset bubble is starting to deflate because of the second extreme macro imbalance: 1970s-style inflation. The Fed has started to pivot hawkish because they are way behind the curve – and they know it. “This is not the only time in history that they’ve been behind, but they are strikingly behind”, Stanford Economics Professor John Taylor told Hilsenrath and Timiraos.

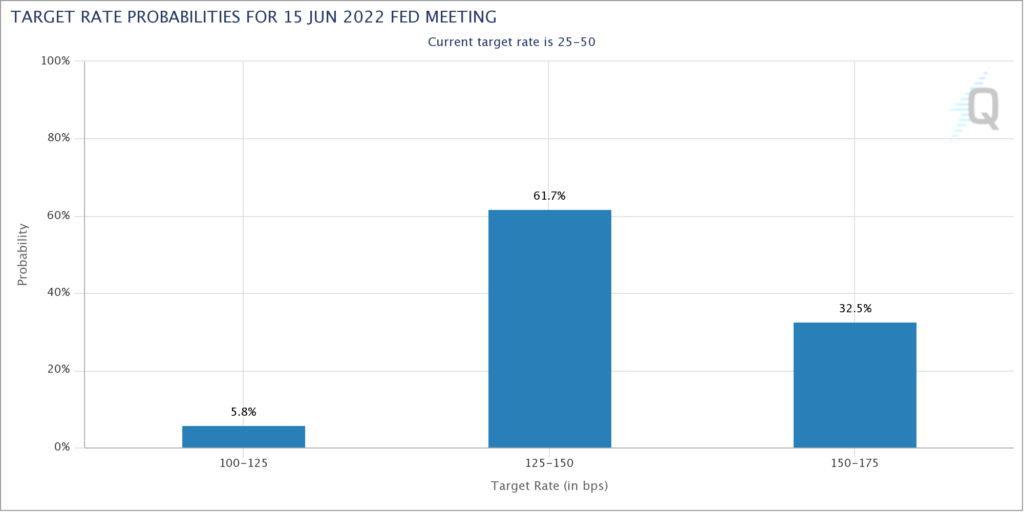

The market is complacent but it’s only two weeks until the Fed’s May 4th meeting at which they are expected to do the first 50 basis point rate hike since 2000. In fact – as you can see in the chart above – Fed Futures are currently pricing in a 62% chance of two 50 basis point hikes and a 32% chance of a 50 basis point hike and a 75 basis point hike at the May and June meetings! Reality is about to hit home.

It’d be nice to think that we didn’t have to pay a price for the extremely loose monetary policy of the last decade but a 1929-style asset bubble and 1970s-style inflation form a macro backdrop from which the Fed is not going to be able to engineer a soft landing.