The Year End Rally Consensus, CRM & KR Earnings

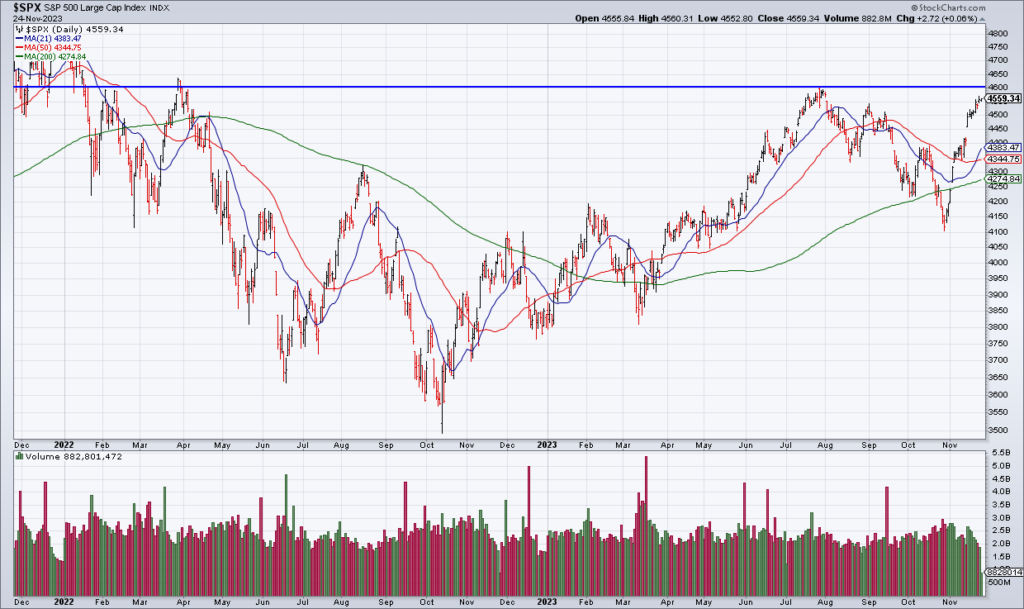

Everybody knows that December is one of the best months of the year from a seasonality perspective. And with the Federal Reserve on pause, the consensus for a year end rally is almost universal. The S&P is only 40 points below its YTD high around 4600 and my best guess is that the market will gravitate toward that level through year end.

Personally I’m more interested in earnings reports out next week from Salesforce (CRM) and Kroger (KR). CRM stock got some life 9 months ago when they reported a huge increase in operating margin and forecast more to come. The stock has leveled out of late as revenue growth is tracking at only 10% and the stock now trades for 28x current year EPS guidance. CRM reports Wednesday afternoon.

Up next is KR on Thursday morning. Those of you who have followed me for a while know that I’m a big KR bull. While the stock has flatlined for the better part of two years now, KR has continued to make business progress. KR is guiding current year underlying comps to +2.5% to +3.5% and EPS to $4.45-$4.60. It’s hard for me to see how you can go wrong with KR – which sells the ultimate necessity (groceries) – at 10x earnings.