The Worst Stock In The World, The Math Behind UBER $1 Trillion

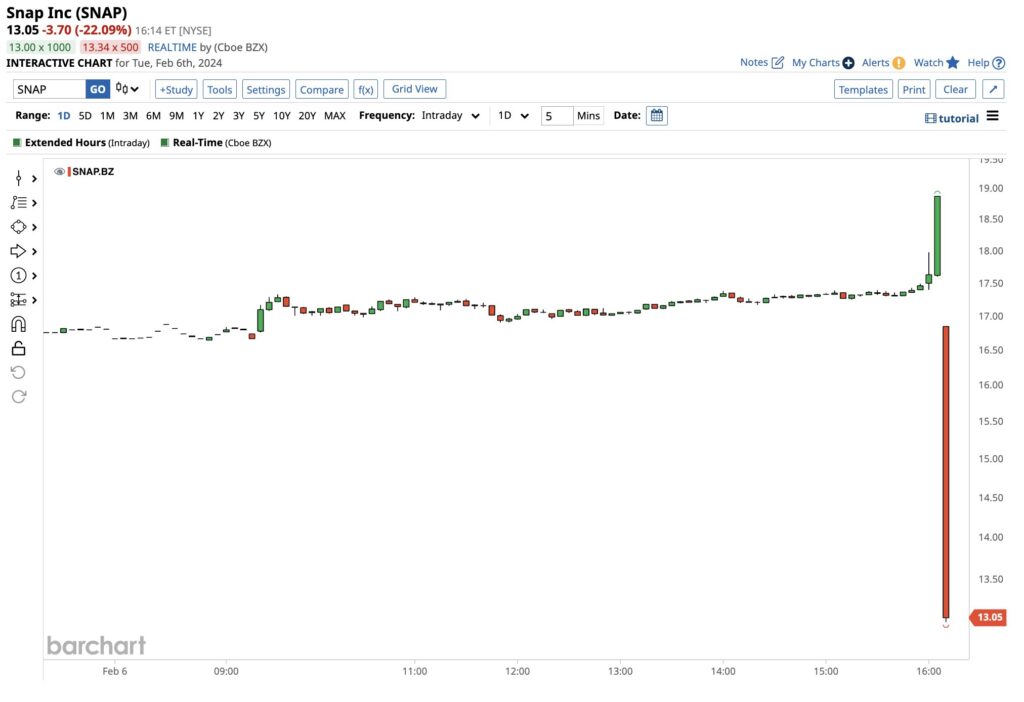

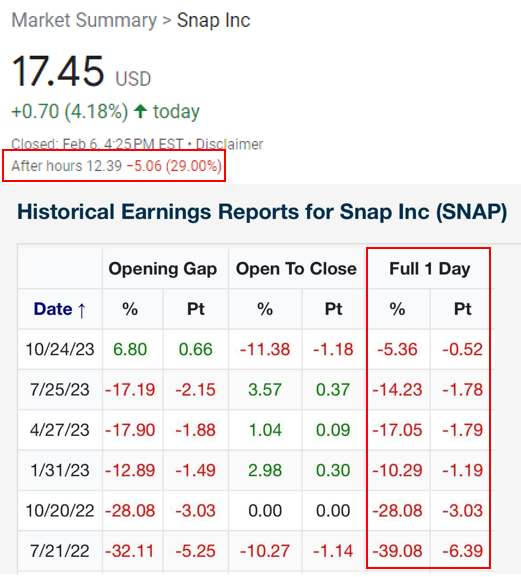

I can’t decide which stock is worse: Snapchat (SNAP) or Lyft (LYFT). SNAP is making a strong case this morning after reporting 4Q23 earnings Tuesday afternoon. The stock is currently -30% in the premarket and on pace for its 7th consecutive post earnings crash. The problem with SNAP continues to be their inability to monetize their 414 million daily active users (DAUs). Adjusted EBITDA is expected to be between -$55 million and -$95 million in 1Q24.

Yesterday I suggested that Uber (UBER) may be the next trillion dollar stock and this morning’s earnings report has further bolstered my conviction. Gross Bookings were +22%, Revenue +15% , Adjusted EBITDA of $1.3 billion (an all time high) and 1Q24 guidance suggests more of the same. CEO Dara Khosrowshahi called 2023 an “inflection point” for UBER.

For those of you wondering about my UBER $1 trillion call, I’m totally serious. At $471, UBER would have a $1 trillion market cap. To reach that price, UBER stock would have to compound at a 37% rate for the next 6 years. And that’s my expectation.

Lastly RIP Toby Keith. To all of you over the years who have questioned my choice of vocation, I concur: I should’ve been a cowboy.