The Week In Review, Declining Participation, GME As Microcosm and The Weekend Rule

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

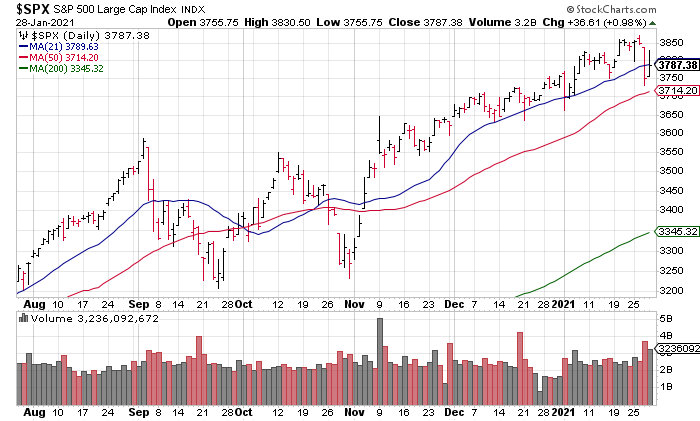

What a week it’s been! Early Monday morning we hit what the great short term trader Scott Redler characterized as an “air pocket” when the S&P dropped ~60 points in ~40 minutes before recovering almost all of those losses by the close.

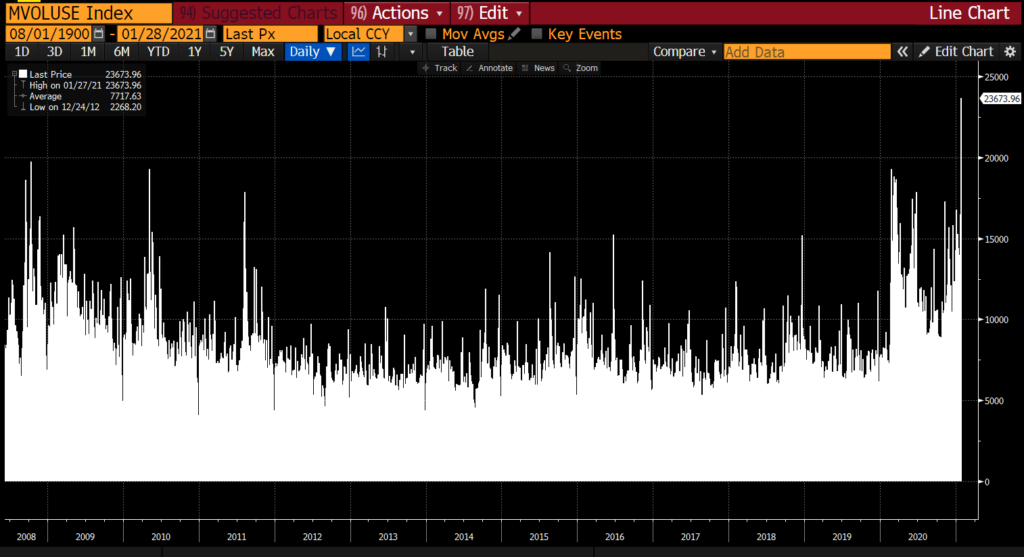

Tuesday was a non-event but Wednesday brought a crash and the first close below the 21 DMA since Tuesday November 3, 2020. In addition, volume was the highest it’s been since at least mid-2008 (Chart Source: Dani Burger Twitter, January 28, 5:38am PST).

Despite Japan and Europe selling off in the evening and over night Wednesday after poorly received earnings reports from AAPL TSLA & FB, the S&P surged higher to start the day Thursday only to give back most of its gains by the end of the day. Volume was once again huge with NYSE + NASDAQ of 16.6 billion – down 20% from Wednesday’s historic 20.8 billion.

And now here we are at 1am PST with Japan having sold off 1.89%, Europe off to another bad start (Germany -0.95% France -1.05% England -0.80%) and our Futures down in sympathy (S&P Futures -0.85% NASDAQ-100 Futures -1.16%).

One result of Wednesday’s crash is that the number of S&P components above their 50 DMAs took a dive to below 50% (Chart Source: David Keller Twitter, January 28, 10:29am PST).

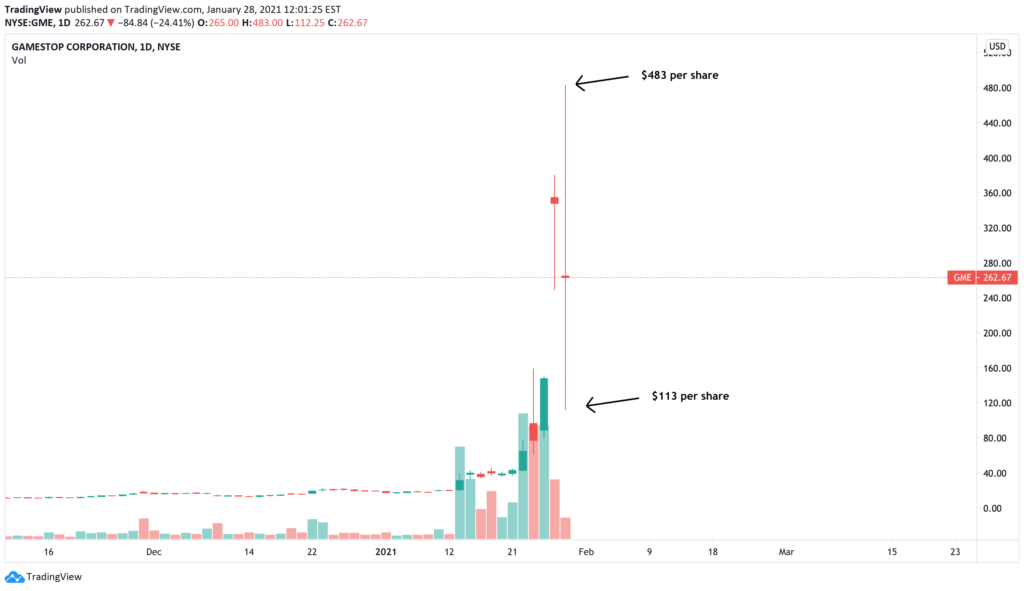

GameStop is the platonic ideal of a stock bubble – James Mackintosh, “GameStop Shows Epitome of Bubble”, WSJ A1, Thursday January 28 [SUBSCRIPTION REQUIRED]

Of course, we can’t finish our discussion of the week in review without mentioning GameStop (GME). James Mackintosh had a wonderful piece on the front page of yesterday’s WSJ about GME as microcosm: “It is tempting to see GameStop as merely clownish behavior in a chat room having some amusing effects on a stock few care about. That would be a mistake.” Later in the article, Mackintosh writes: “This month the stock moved into the pure speculative phase, producing several daily jumps of 50% or more, and fundamentals were abandoned.” This type of trading suggests “widespread disturbance to people’s judgment” and will end in tears (“When the stock is weighed, many will be found wanting, as they always are in bubbles”) Mackintosh concludes. Yesterday was the wildest day yet and today promises more of the same (Chart Source: TradingView Twitter, January 28, 9:02am PST).

The Friday close is the most critical price of the week because it is the price at which people commit to accepting the risk of holding a position over the weekend – Peter Brandt on The Weekend Rule, quoted in Jack Schwager, Unknown Market Wizards (2020), pg. 32

It will be interesting and important to see how the market closes today. I would pay close attention to the last hour as a window into investor psychology: Are they buying up perceived bargains ahead of an expected rally as they have over the previous 10 months or are they getting out in fear that this could be the top? It may or may not come into play but I’m interested to see if the 50 DMA at 3,714 holds.