The Week Ahead: Omicron Uncertainty, CRM ZS SNOW CRWD OKTA DOCU Earnings, NASDAQ 50 DMA In Play

The Omicron variant that hit financial markets Friday has created an enormous amount of uncertainty and – as COVID reporter Kai Kupferschmidt writes – that uncertainty is likely to persist for the next few weeks as scientists gather and analyze data about the virus. In other words, we don’t know much about the virus right now and we won’t for a few weeks. That means that while Omicron will dominate the market narrative next week, it will be impossible to rationally price in its effects.

At the same time, we do have a number of significant earnings reports next week beginning with Salesforce (CRM) on Tuesday afternoon. CRM has held up pretty well thus far but at 65x ’21 EPS guidance the stock looks vulnerable to me in this environment.

Even more vulnerable are earlier stage tech companies Zscaler (ZS), Snowflake (SNOW), Crowdstrike (CRWD) and Okta (OKTA) which report Tuesday and Wednesday afternoon. These four stocks – which have market caps between $30 billion and $100 billion – trade at price to current sales ratios of between 30x and 100x. They are exactly the kind of stocks that have been taken to the woodshed in the current environment. It will be interesting to see if that pattern continues.

Finally, on Thursday cloud document software company Docusign (DOCU) reports. DOCU is more mature than the previous four as well as somewhat of a pandemic beneficiary but its valuation also makes it vulnerable IMO.

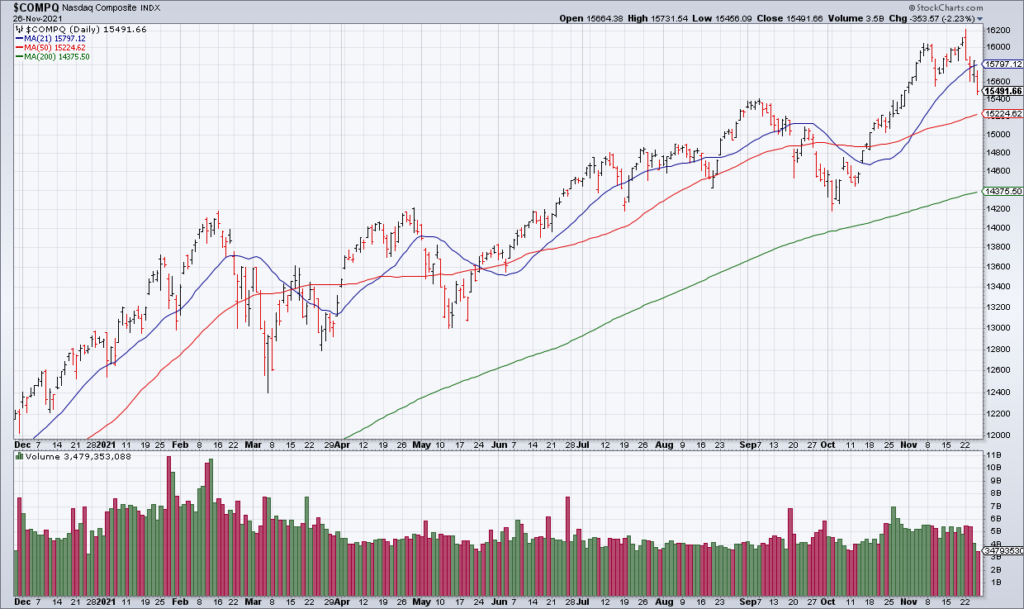

From a technical standpoint, I’m keeping my eye on the NASDAQ’s 50 DMA at 15,225 which is less than 2% below Friday’s close. Bulls are going to want to see that hold.