The Week Ahead: Nov CPI & The Fed, COST Earnings: A Membership Fee Increase?

While the Fed is done hiking rates for this cycle, my concern last weekend was that Powell may still try to talk “higher for longer” in his press conference on Wednesday due to the strong recent moves in financial markets. But that may depend on the November CPI report due out Tuesday at 8:30am EST. The CPI is a statistical construct – not some perfect measure of inflation – so I have no idea what the number will be or the short term market reaction.

But inflation is dead: rents are rolling over as are gas prices along with just about everything else. Therefore, the top is in for yields and the real wager now is whether you think all the previous hiking will cause the economy to roll over into recession in 2024 or there will be a soft landing. If you believe the former like me, I think long term yields can go much lower and the Long Term Treasury ETF (TLT) will continue to rip.

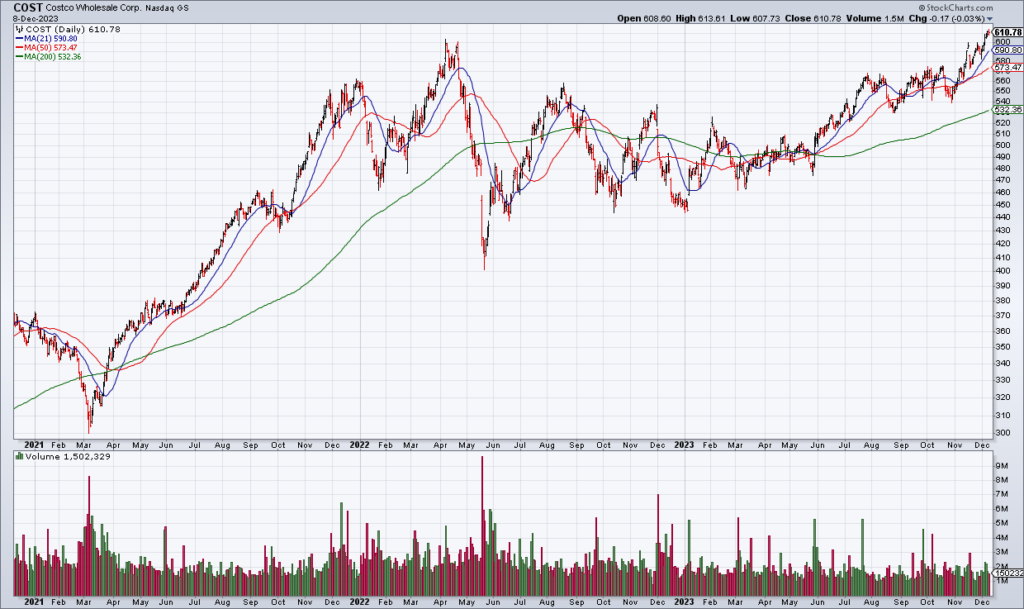

The other thing on my radar this week is a possible membership fee increase when Costco (COST) reports earnings Thursday afternoon. I have been speculating on this since March but I see no reason not to do it after solid September and October sales – unless they started rolling over in November. COST is quite expensive (~40x my FY24 EPS estimate) but I like its high quality and defensive characteristics and will likely continue to hold until they do inevitably raise the membership fee which may result in a short term blow off top.

Disclosure: Top Gun is long TLT and COST.