The Peak Inflation Narrative

An interesting meme has taken hold of the crowd mind that is financial markets in recent weeks: The Peak Inflation Narrative. It started when Powell signaled a 50 basis point hike on Thursday April 21 and has gained momentum since. The idea is that since the Fed is pivoting hard to tackle inflation, the inflation trade is now over. This can be seen most clearly in the nasty retrenchment that has taken place in commodities and the precious metals.

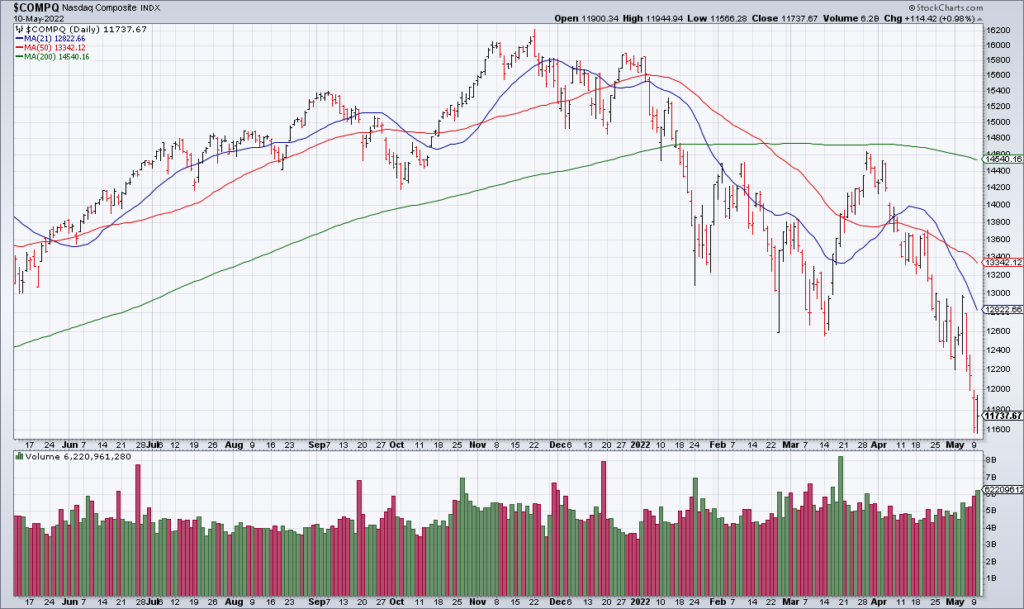

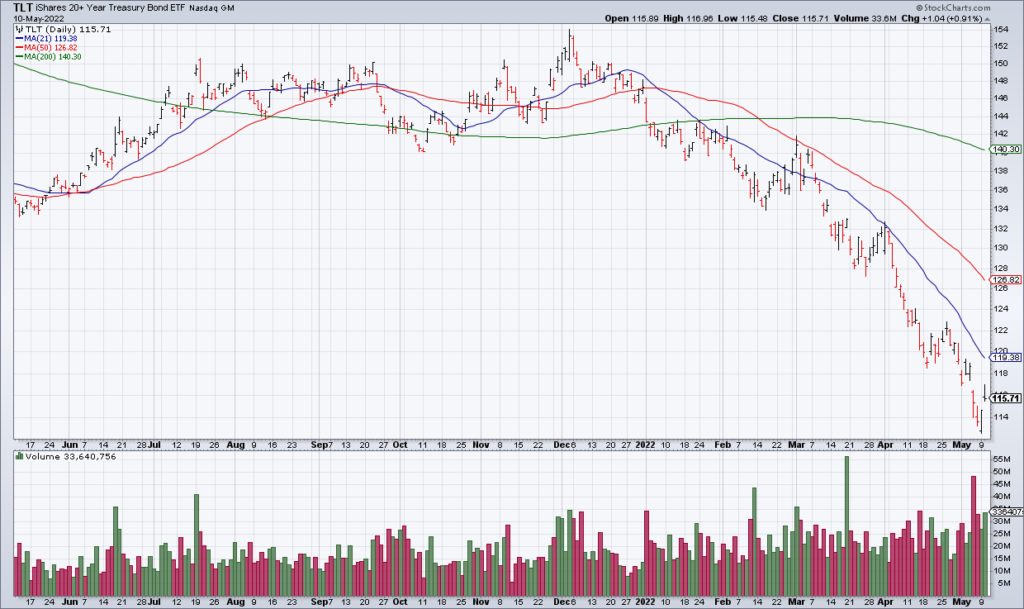

If the April CPI Report Wednesday morning comes in below March’s 8.5%, my guess is that the market will take it as confirmation of The Peak Inflation Narrative. And while commodities and the precious metals have likely priced this in already, stocks and bonds are now due for a relief rally after being crushed in recent weeks.

Is The Peak Inflation Narrative right?

This is where things get interesting. While the market has started to run with the idea that inflation has peaked, I have my doubts. With all the stimulus the Fed – and global central banks – have unleashed over the last decade plus, I find it hard to believe that a couple of 50 basis points hikes will be sufficient to reign it in. My guess is that the Fed will have to go full Volcker to do so – and I have my doubts that Powell is up to the task. If this is correct, the vicious sell off in commodities and the precious metals is a head fake – and the commodities bull market will resume shortly.