The Messiahs of Momentum, SHOP WMT Earnings Preview

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Jason Zweig had a fun and excellent article in yesterday’s WSJ titled “How The Stock Market Works Now: Elon Musk Tweets, Millions Buy” (WSJ, Saturday February 13 [SUBSCRIPTION REQUIRED]). It’s a story about how business celebrities like Musk, Mark Cuban and Chamath Palihapitiya are egging on their millions of Twitter followers to buy highly speculative investments like GameStop (GME) and Doge Coin (DOGE.X).

Zweig concludes:

My own take is straightforward. The new messiahs of momentum, with their charisma and huge followings, can unite the buying power of scattered investors better than anyone who came before them. For a crowd of followers to be wise rather than foolish, though, those who lead it must have an unusual information edge.

And I’m not sure why the predictions of today’s powerful outsiders should be any more accurate than those of the insiders who came before them. Fame and fortune in other fields are no assurance of success in the financial markets.

Let me translate: This will likely end badly for the millions who follow Elon, Chamath and Cuban’s recommendations. This is another illustration of what has become the craziest market in history.

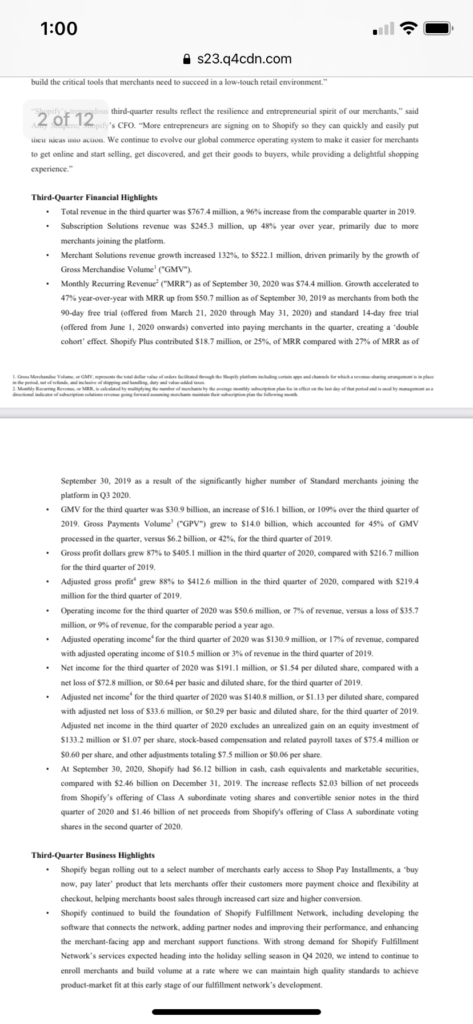

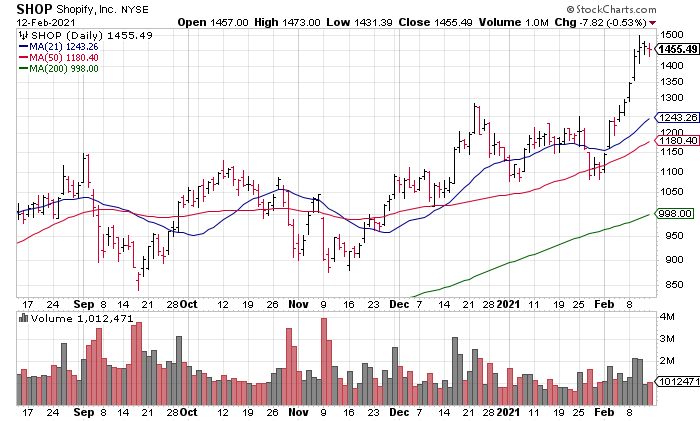

Now let’s put in a little legwork to get ready for the week ahead by previewing Shopify (SHOP, market cap $182 billion) and Walmart (WMT, market cap $412 billion) earnings. SHOP reports on Wednesday afternoon and it is almost certain to be another blowout quarter with businesses moving online where their customers are during the pandemic via Shopify’s online business platform. In 3Q20, SHOP reported 96% revenue growth and Adjusted EPS of $1.13 – compared to a 29 cent loss a year ago. However, the stock is up an incredible 33% in the last two weeks and trades for 84x Trailing Twelve Month (TTM) sales. Buying SHOP at these levels is not an investment; it’s pure speculation.

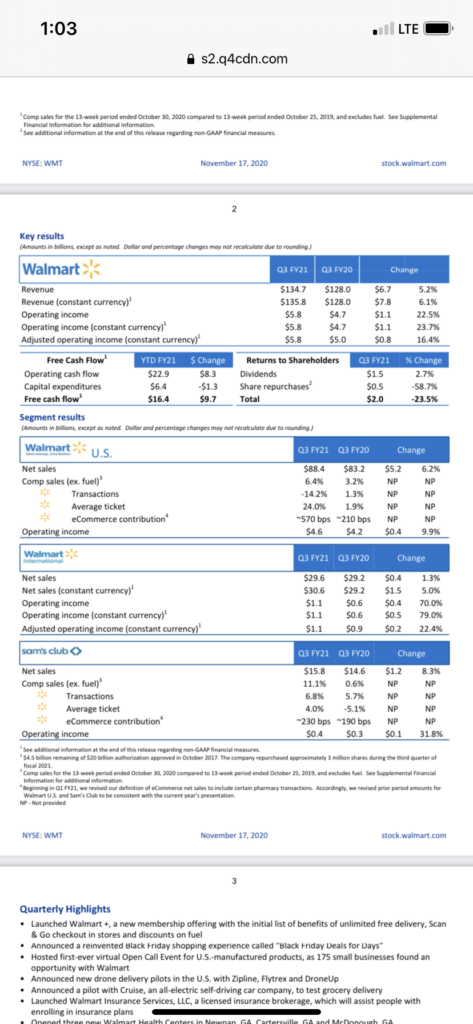

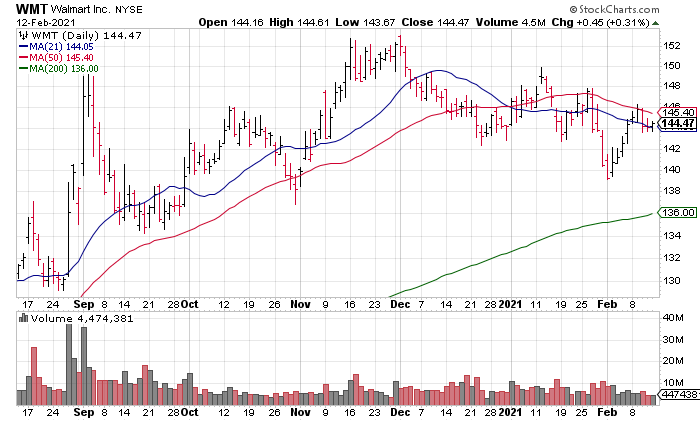

WMT is also likely to report another excellent quarter Thursday afternoon. In the previous quarter ended October 31, 2020, Walmart US Comps excluding fuel were +6.4% resulting in a 16% increase in Diluted EPS. While WMT has lost some favor the last couple months as investors sell consumer stapes to buy higher beta, tech names, the valuation is still expensive at 26x TTM Diluted EPS. Obviously, WMT is much cheaper than SHOP and I’d buy it if I had to choose one but it’s not by any means cheap on an absolute basis.