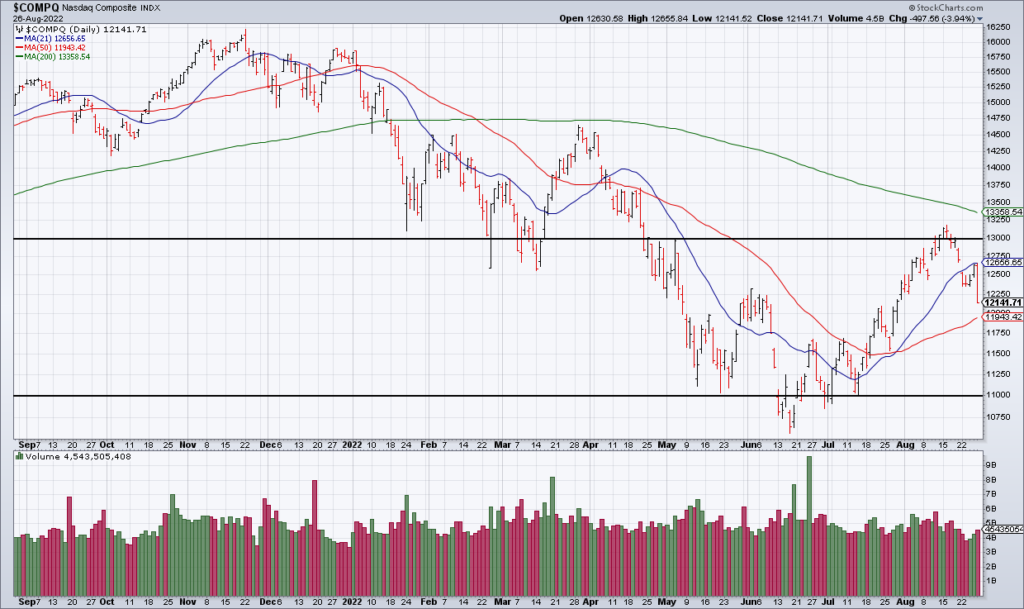

The Market Will Trade In A Range For The Rest Of The Year; Recession Coming In 2023

Two weeks ago people were talking about the end of the bear market and a new bull market. Now – after Powell’s speech – the narrative has completely reversed course and most seem to be expecting new lows imminently. In all likelihood – however – the market will trade in a relatively tight range for the rest of the year as investors digest all the crosscurrents in play.

Just as the technicians overreacted to the price action two weeks ago investors are overreacting to Powell’s words from Friday morning. Powell’s speech was straight out of The Fed Playbook: Talk hawkish, act dovish. What the Fed would like more than anything is to be able to tighten financial conditions by talking tough rather than actually having to raise interest rates and run off their balance sheet because that runs the risk of seriously derailing the economy. As I wrote on Saturday morning just because Powell sounded like they’re going to raise 75 points in September doesn’t mean 50 is off the table – or even less likely.

As inflation peaks in the near term and the Fed slows down to take stock of the consequences of its tightening the focus will shift to the slowing economy and earnings weakness. While bulls will take comfort in the Fed Pivot and assume conditions are in place for a new bull market reality will slowly set in as the economy slips into recession next year. At the end of last year I said that inflation would be the theme in 2022; in 2023 it will be recession.