The Market Is Poised For A Bounce

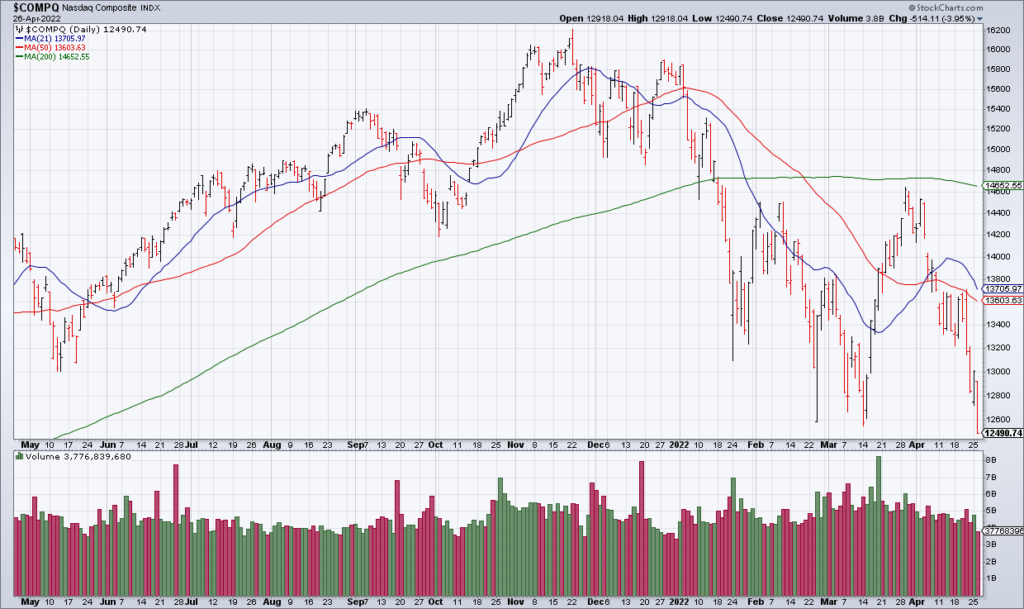

The market has been thrashed in the four days since Powell essentially assured a 50 basis point hike next Wednesday. The NASDAQ is down 8% over that time span (-20% YTD) and closed Tuesday at a 52-week low. The dollar has rallied hard and now looks extremely overbought. The VIX is up about 60% to 33.52. The Gold Miners ETF (GDX) is -12%. These are extreme moves and they have at least priced in the first 50 basis point rate hike at this point.

Google (GOOG/GOOGL) reported earnings after the close and its stock is down 5% after hours but the stock has already taken a massive beatdown since its last earnings report and I didn’t think the report was that bad. GAAP EPS was -6% – and that will get headlines – but that was due to non-core operations. Revenue was probably a bit lighter than bulls were hoping for at +23% while operating income in the core operations was +22%. This is hardly a “Faceplant”. In fact, I’m interested in buying shares for a trade if the stock is down 5% or more at the open Wednesday.