The Market Is Correctly Starting To Price In A Recession And The Magnificent 7 Are Played Out

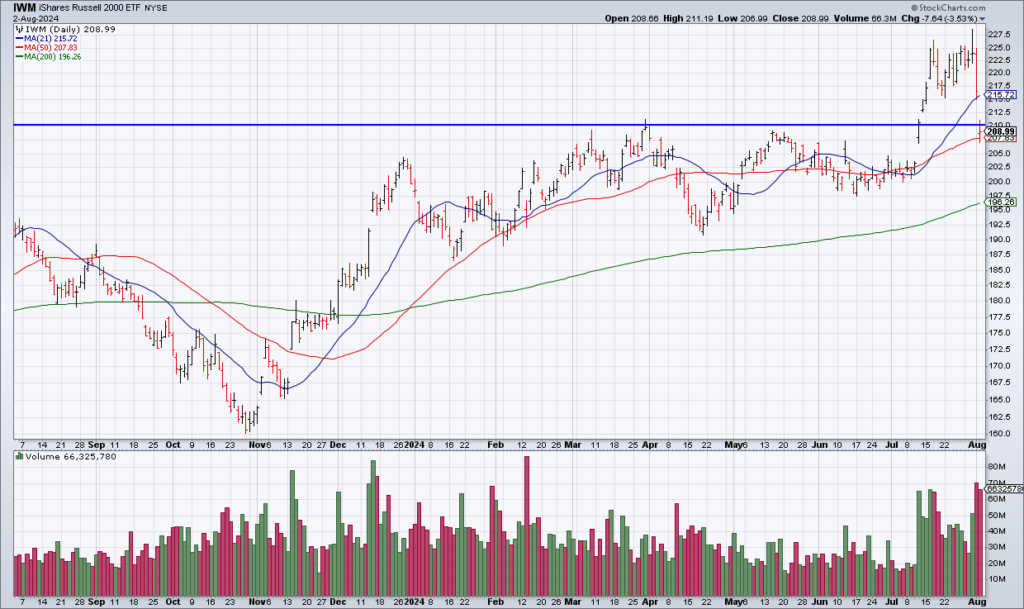

The narrative over the last few weeks has been that the defeat of inflation will allow The Fed to cut rates in September has resulted in a rotation out of Mega-Cap Tech (QQQ) and into Small Caps (IWM) which will benefit more from lower rates resulting in a healthy broadening out of the rally. I have been skeptical of that narrative all along and the action the last two days suggests I’m right because both Mega-Cap Tech and Small Caps are being sold like crazy. What’s working is Treasuries (TLT) which is a sign that investors are seeking safety in the event of a recession. The catalysts were a weak ISM Manufacturing Report on Thursday morning and a weak July Jobs Report Friday morning.

Most investors – of course – will see this as a buying opportunity and a bounce will materialize as bulls buy the dip in the near future. The problem is that the Magnificent 7 – which account for ~30% of the market cap of the S&P 500 – are played out. What I mean by that is that they have almost fully exploited their respective markets and there aren’t many avenues of growth for them going forward. It’s been amazing run for QQQ over the last 15 years – but it’s coming to an end.

To start, consider Apple’s (AAPL) 2Q24 earnings report out Thursday afternoon. Overall revenue increased only 5% and iPhone revenue – the cornerstone of the entire company – actually declined slightly. As I’ve been saying for a long time now: Apple is not a growth stock anymore (for example, see my “An Open Letter To Warren Buffet Re; AAPL”, Top Gun Financial, August 3, 2023). But it’s still trading with a growth stock multiple of 30x.

The same kind of thing applies to Google (GOOG/GOOGL). Google’s Core Advertising business (Google & YouTube) grew only 11.5% in 2Q24 and overall revenue 14%. Amazon’s (AMZN) 2Q24 overall revenue grew only 10%. North America – the core of its retail operation – grew 9% while Amazon Web Services (AWS) was +19%. Microsoft’s 2Q24 revenue increased 15% – and yet it’s trading at a 30x multiple.

These are legendary companies – but they are now mature; their days of heady growth are behind them. And the market is starting to reprice them accordingly.