The Inflation Question

I went to one who had the reputation of wisdom, and observed to him – his name I need not mention; he was a politician whom I selected for examination – and the result was as follows: When I began to talk with him, I could not help thinking that he was not really wise, although he was thought wise by many, and wiser still by himself; and I went and tried to explain to him that he thought himself wise, but was not really wise; and the consequence was that he hated me, and his enmity was shared by several who were present and heard me. So I left him, saying to myself, as I went away: Well, although I do not suppose that either of us knows anything really beautiful and good, I am better off than he is – for he knows nothing, and thinks that he knows. I neither know nor think that I know. In this latter particular, then, I seem to have slightly the advantage of him. Then I went to another, who had still higher philosophical pretensions, and my conclusion was exactly the same – Plato, “The Apology”

Having been in a Philosophy Phd program people sometimes ask me what to read first and I always recommend “The Apology”. After a lifetime pursuing wisdom Socrates knew that he knew nothing – and that made him the wisest man in Athens. That’s because all the other reputable men also knew nothing but were deluded.

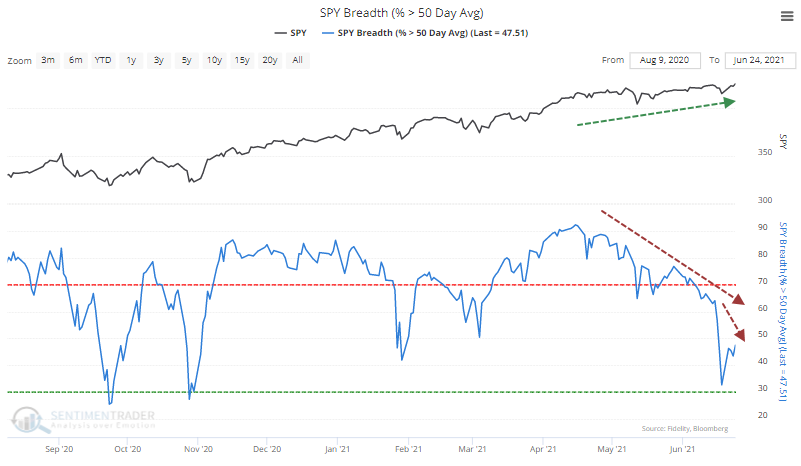

At the moment, the technicians are tripping over themselves pointing out that we have almost never seen a market at all time highs with so few components above their 50 day moving average. Some think this is a reason to get short. As Walter Deemer tweeted earlier today, one of these days one these indicators will be right but I don’t know which indicator or which day.

Which brings me to The Question: Will anything derail this bull market? It’s certainly possible that the market will roll over for technical reasons – but it hasn’t so far. To me, the real risk is inflation. So we can refine The Question: Will inflation derail the bull market? Because despite the Feds insistence that inflation is transitory, company after company is reporting significant inflation.

To begin with, General Mills (GIS) yesterday morning forecast that their cost of goods sold would increase 7% in their current fiscal year. In June, Campbell Soup (CPB) reported that their Adjusted Gross Margin had decreased from 34.7% a year ago to 31.8% in their quarter ended May 2, 2021. Last week, Federal Express (FDX) reported that composite yield in their Express division increased 10.2% in their quarter ended May 31, 2021 compared with the pre-pandemic quarter two years ago.

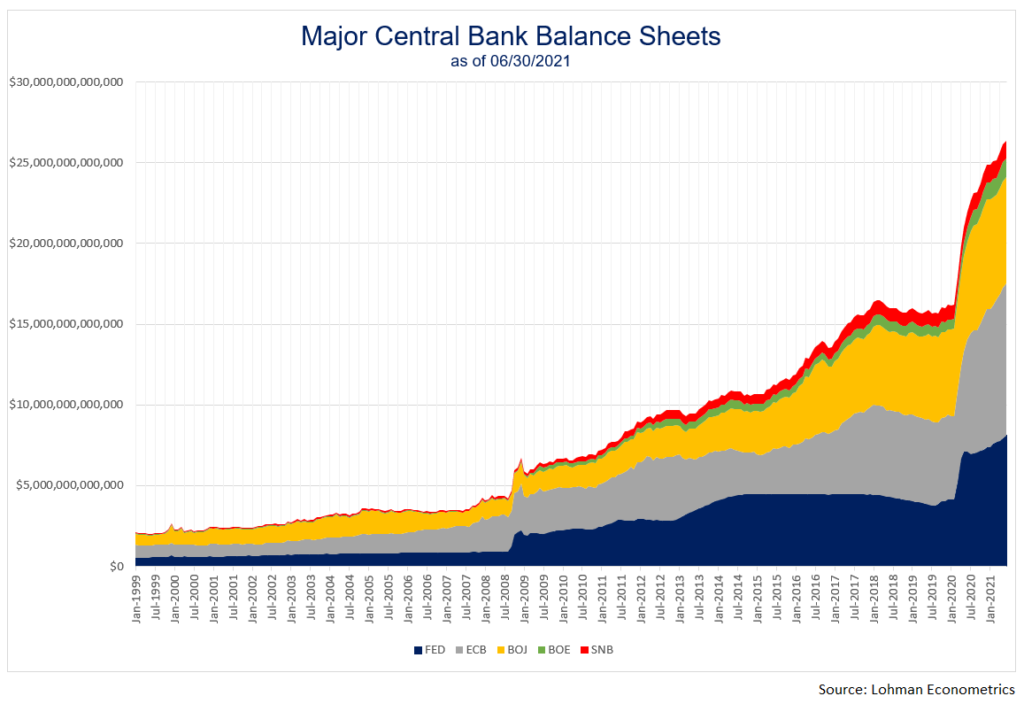

Inflation is a complicated thing. The earliest analysis of inflation goes back to at least the philosopher David Hume’s Quantity Theory of Money. The idea is that price is a function of the quantity of money. If you double the amount of money, you double the price level. Many still subscribe to the Quantity Theory of Money. But recent history has proven it false. We all know that the Fed and other central banks have been pumping money into financial markets like crazy. But we haven’t seen much in the way of consumer price inflation. I believe that’s because this money has mostly stayed within financial markets. As a result, we’ve had asset price inflation but not consumer price inflation.

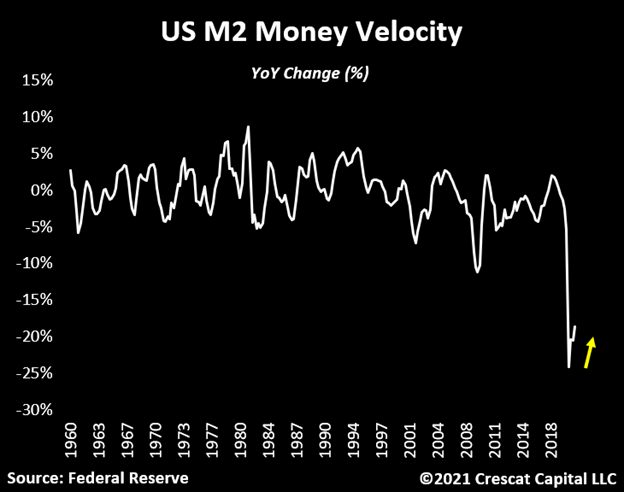

Another aspect of inflation is money velocity. I believe the economist Irving Fisher was the first to discuss money velocity. The idea here is that it doesn’t matter how much money there is if it’s not circulating. Conversely, the faster money is circulating, the more prices will rise. Intuitively this seems right to me and it provides an explanation for why the vast increase in the global money supply since the pandemic has not resulted in increasing prices. Economic reopening seems likely to greatly increase money velocity.

Another aspect of inflation is psychology or inflation expectations. Transactions in financial markets and the real economy are between people. What they believe about inflation, therefore, influences the price they are willing to transact at. Since we haven’t had real consumer price inflation in this country in 40 years, it’s no surprise that it isn’t really on people’s radar. But that’s starting to change. More and more people are starting to notice that prices are going up. If we hit an inflection point in inflation expectations that would cause inflation itself to increase.

If I’m right, then, the answer to The Question is Yes. Inflation will derail the bull market. If only I knew when.