The Fed Is Buying Stocks Again, DIS Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

I’ll never forget it. It was 11:50am Friday March 26, 2021. I was short stocks, mainly tech stocks, and doing quite well when, all of a sudden and out of nowhere, stocks started to rip higher. From breaking down they went to exploding higher without rhyme or reason. I believe the NASDAQ ripped higher by ~2% in that time period into the close. It went from being a great week to a miserable weekend but I had a suspicion: The Fed was buying stocks. I resolved to cover all my shorts at the open on Monday.

Something similar happened on Friday April 9 and it happened again today (Thursday May 13). I remember texting with my buddy as the market was breaking down that today would be a good test of my theory. If I was right that the Fed was buying stocks, they’d come in as the markets went from up big to red. And that’s exactly what happened. Now I’m more sure than ever: Beware shorts because The Fed is buying stocks. As big as this Bubble is, it’s probably unshortable because the Fed is surreptitiously intervening directly in the stock market to prop it up.

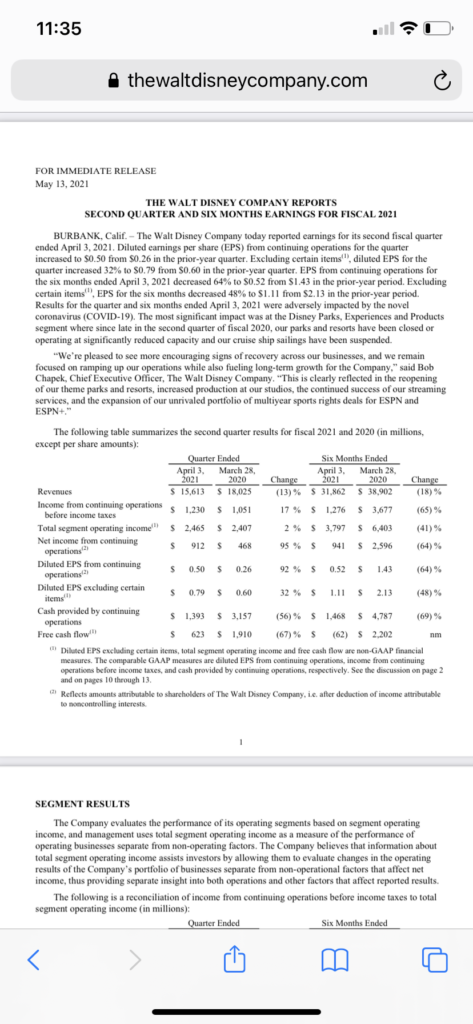

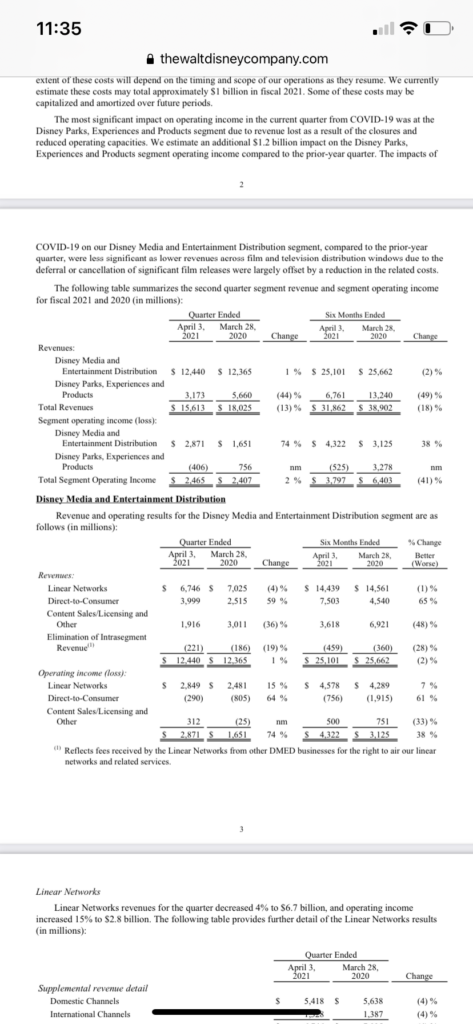

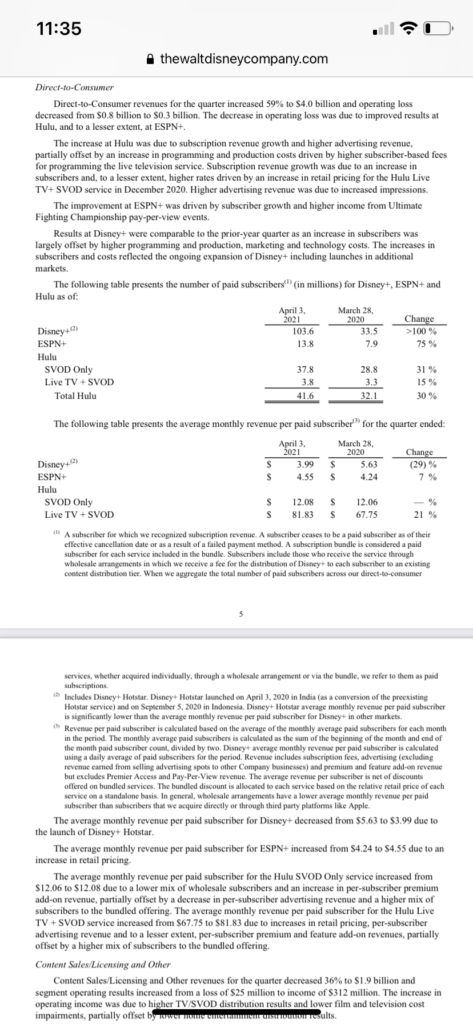

Let’s move on to Disney (DIS, Market Cap $326 Billion) 1Q21 Earnings. On an overall basis, DIS reported a 13% decline in Revenue but a 32% increase in Adjusted Diluted EPS to 79 cents/share. Digging down, Media and Entertainment Revenue was +1% while Parks, still impacted by COVID, was -44%. Disney+ added 8.7 million subscribers in the quarter to 103.6 million. Segment Operating Income for Media – Direct to Consumer, which includes Disney+, ESPN+ and Hulu, was -$290 million as the company is focused on growth not profitability for now. DIS stock closed the after hours session -3.89% to $171.40 which is about 15% below its All Time Closing High of $201.91 on March 8.