The Dumb Money Is Going All In While The Smart Money Gets Out, Who Is John Galt?

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

We’re seeing precisely the same types of of headlines about regime change due to the rush of individual investors that we saw in 1999. Rarely does history rhyme so well – Jason Goepfort, “Options mania lifts market to the level of satire”, Sentimentrader, February 1 [SUSBSCRIPTION REQUIRED]

I don’t think day traders are speculating because traditional speculation requires some market knowledge. They are instead gambling, which doesn’t – Arthur Levitt in 1999 when he was SEC Chair (quoted in James Mackintosh, “Gambling? In the Stock Market? I’m Shocked”, The Wall Street Journal, February 1 [SUBSCRIPTION REQUIRED])

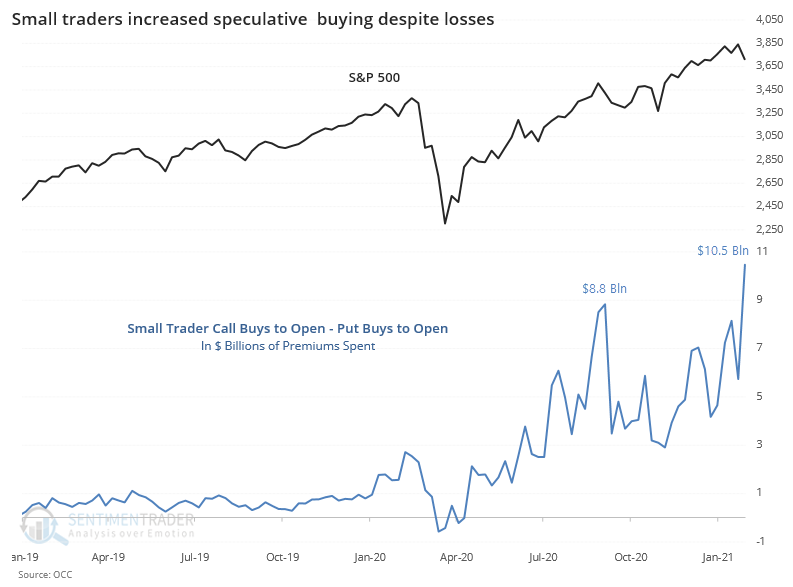

Last week, as markets crashed on Wednesday and Friday, small traders (“the dumb money”) bought the dip buying a net $10.5 billion in calls – by far the most in a week in at least the last 2 years (Chart Source: “Options mania lifts market to the level of satire”, Sentimentrader, February 1 [SUBSCRIPTION REQUIRED]).

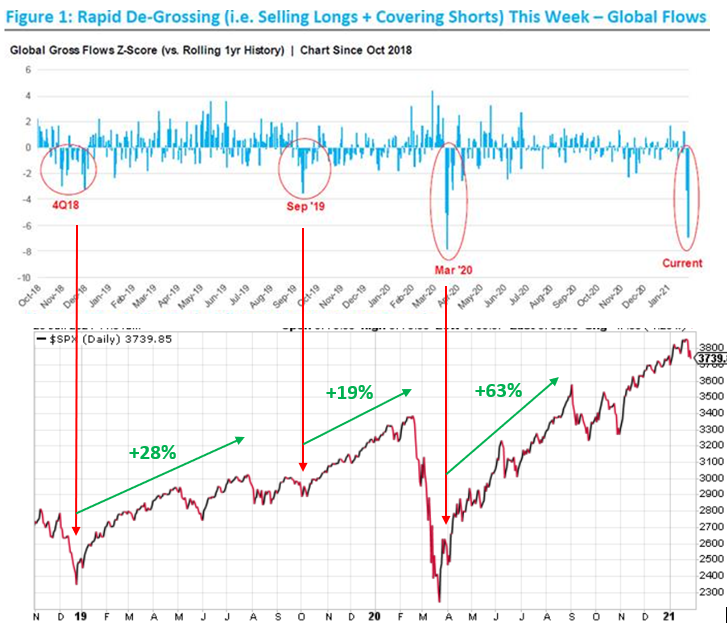

Meanwhile, hedge funds (“the smart money”) de-risked by the most since March 2020 (Chart Source: Moritz Twitter, January 29, 8:54am).

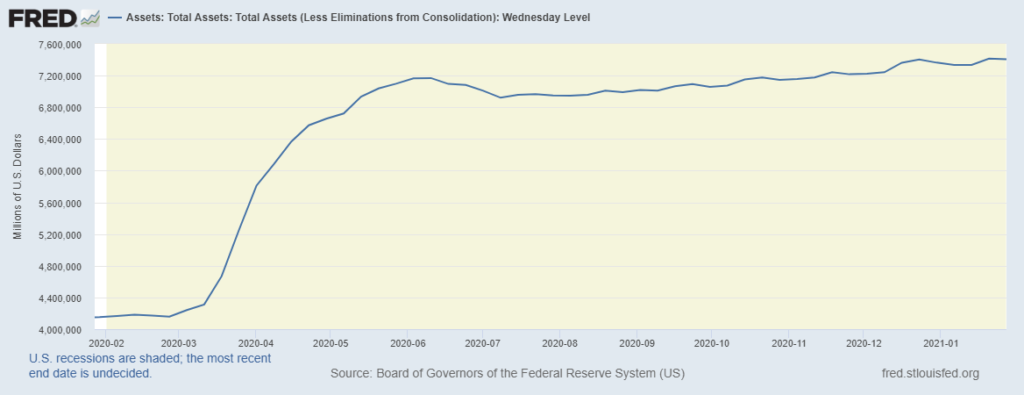

Now, you might say: “But look at the chart: hedge funds were wrong in March 2020!” – and you’d be right. The difference is that the Fed injected $3 trillion into financial markets over a 2 1/2 month period from mid-March through early June 2020 and many professional investors, including myself, underestimated the impact this would have on financial markets.

Unless you expect a repeat – and I don’t think a repeat is possible without side effects that are worse than the cure at this point – things are likely to turn out differently this time and the smart money to be right.

Today is the 116th anniversary of the birth of the great, and dishonestly maligned, Ayn Rand, author of the greatest book on economics ever written, the dystopian novel Atlas Shrugged (1957). Rand, whose novel was focused on bad regulatory policies that drove the productive underground, also understood Austrian Economics and the deleterious long term effects of loose monetary policy. She would have abhorred Quantitative Easing, the policy began by then Fed Chair Ben Bernanke in 2008 and taken to a new level by current Fed Chair Jerome Powell in the wake of the coronavirus pandemic.

It’s Quantitative Easing that has juiced the 12 year bull market that began in March 2009 and sent it into a manic crack high over the last 10 months. Loose monetary policy led to bubbles and crashes in 2000 (Dot Com Bubble), 2007 (Housing Bubble) and now the biggest of them all, called by many who understand the macroeconomics The Everything Bubble. The former two ended in horrific crashes and this one, being magnitudes of order larger, will lead to a Second Great Depression at best (“S&P Closes Below 50 DMA, AAPL: False Breakout?, CAT Earnings: No V-Shaped Recovery, The Fed and the Bull Market Since 2009, The Crowd’s View: Just A Correction”, Top Gun Financial, January 30).

I believe that today’s trading session will serve as confirmation that The Everything Bubble is popping. When it does, it will lead to a Second Great Depression at best, Civilizational Breakdown at worst (“The Possibility of Civilizational Breakdown”, Top Gun Financial, March 19, 2020). It’s the latter that Rand depicted in Atlas. How fitting then that, on the anniversary of her birthday, today’s trading session may well be remembered by those who truly understand finance and economics as the day her fiction began to be reality. She may have been more than 60 years early but the great ones always see what’s coming early while the average man never sees it coming until it’s too late. Who is John Galt?