The Crowd And The Contrarian

When I was in college my best friend had a serious interest in economics. The only child of Indian immigrants, he had a deep need to become wealthy. Perhaps he felt that wealth would cause him to be accepted and esteemed thereby assuaging his feelings of insecurity about not fitting in. Having been influenced by Ayn Rand and Atlas Shrugged like myself, he spent a lot of time studying the subject independently. He would go on to earn a Master’s Degree in Economics and enter a Phd Program – though he dropped out of the latter due to a distaste for the complex math and jargon now in vogue in the field.

As college kids are prone to do, he would regularly get in political and economic debates with other college students. And he was frequently frustrated by his inability to persuade anybody of anything despite all of the effort he had expended in educating himself about the subject matter. Other people didn’t seem reachable by his rational arguments. And they weren’t because most people’s beliefs are founded on prejudice not reason. As we learn when we get older, you can rarely change anyone’s mind about anything.

In addition, most people find it extremely difficult, if not impossible, to think differently from the crowd. They find comfort in thinking like everyone else. Some people like my friend – and myself – are the opposite. We are born contrarians who feel a drive to understand things for ourselves even if that leads us to think differently from the crowd. These are archetypes; in reality, there is a continuum between the two types of temperament.

The crowd is right during the trend but wrong at both ends – Humphrey O’Neill, The Art of Contrary Thinking

In the short term, the market is a voting machine. In the long term, a weighing machine – Ben Graham, The Intelligent Investor

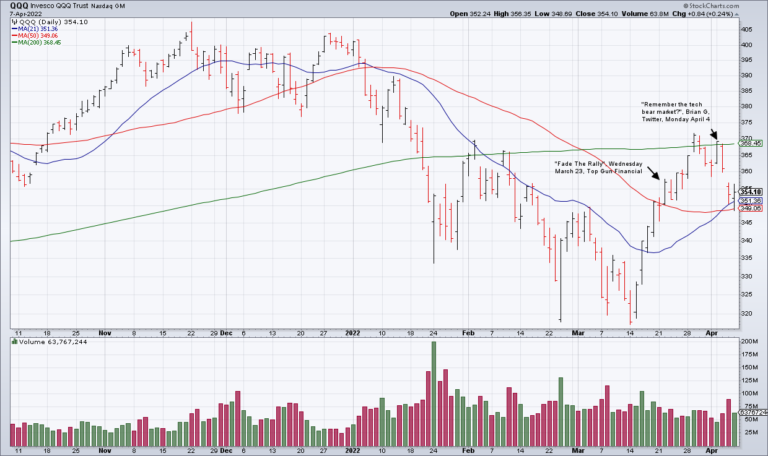

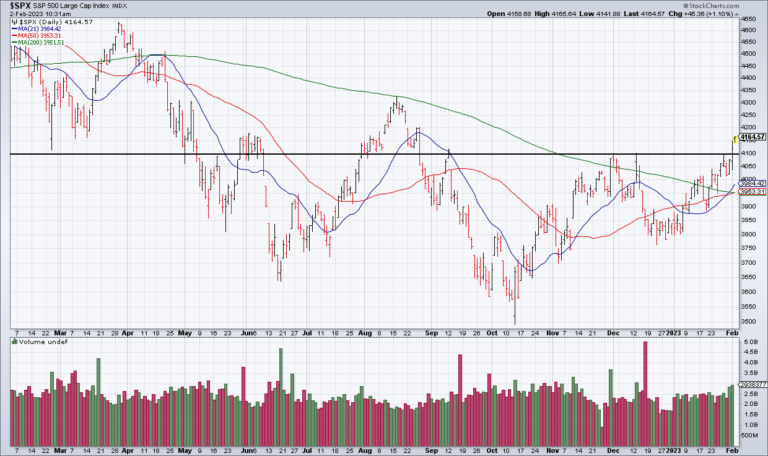

These insights prove useful when trying to understand markets. The crowd thinks one way and controls the market in the short term. But there are always contrarians who think differently. Take the present moment, for instance. Almost everybody is bullish. So much so that bears are summarily dismissed. And yet there are bears – like myself. Clearly these bears are built differently than the average person temperamentally. Unlike most, they can withstand the emotional tension of being at odds with the crowd.

Some contrarians are like children. Whatever position you take, they take the opposite. Their nature is oppositional and combative. But some contrarians are truly independent thinkers. Having studied the situation intensively, they find themselves with a view at odds with the crowd. Because markets are auctions and not objective barometers of economic reality, the crowd controls it in the short term. As a result the market frequently overshoots as everybody assumes the same positioning. Eventually it reaches a tipping point and reverses. It is at these moments that the crowd is caught wrong footed and the contrarian vindicated. But it can take a long time. “The market can stay irrational longer than you can stay solvent”, John Maynard Keynes famously quipped.

The crowd makes money during the trend but gives a lot of it back when the market reverses. It’s hard for them to understand that things have changed, that the tide has turned. Contrarians, on the other hand, underperform during the trend, especially towards the end when things are getting overdone. But they outperform when the market reverses.

It helps immensely to know what kind of investor you are and the strengths and pitfalls that go along with each type of temperament. People who are comfortable investing with the crowd need to be on guard against things going too far. For instance, it makes sense to sell incrementally into the kind of strength we’ve seen over the last few months. Nobody can pick the top exactly. On the other hand, contrarians run the risk of getting run over when the market is moving against them. They must learn to manage risk in order to survive the manic swings that are inherent to markets. They can’t pick turning points exactly either – though some are quite skilled in reading the tape.

The poker player Paul Wasicka, who finished second in the 2006 World Series of Poker Main Event, said that he became a winning player when he learned to be himself. That is, when he stopped trying to play like everyone else and learned to be comfortable playing the style that was most suitable to his temperament. Similarly, investors must find the investment style that suits their temperament, while adjusting for the pitfalls that go along with each style. There is more than one way to make money in markets. Know yourself said the Delphic oracle. Self knowledge will set you free – in markets and in life.