The Bull Market Is Over

IMO a decisive break below and failure to reclaim $390 would mean that the bull market is likely over. I wouldn’t be surprised to see it happen this week – Top Gun Financial, November 30

Tuesday night I wrote that a “decisive break below and failure to reclaim $390” would likely mean the end of the bull market and that “I wouldn’t be surprised to see it happen this week”. It looked nearly impossible Wednesday morning as the QQQ traded above $400 but an historic intraday reversal resulted in it closing at $387.12.

On Monday I asked “QQQ vs IWM: Which One Is Telling The Truth?” In that blog, it was clear that I thought IWM was and IMO today’s action in QQQ confirmed IWM’s failed breakout as the “true move”. Unless bulls can reclaim $390 in short order, it is my belief that the historic 13 year bull market that began on March 9, 2009 is over.

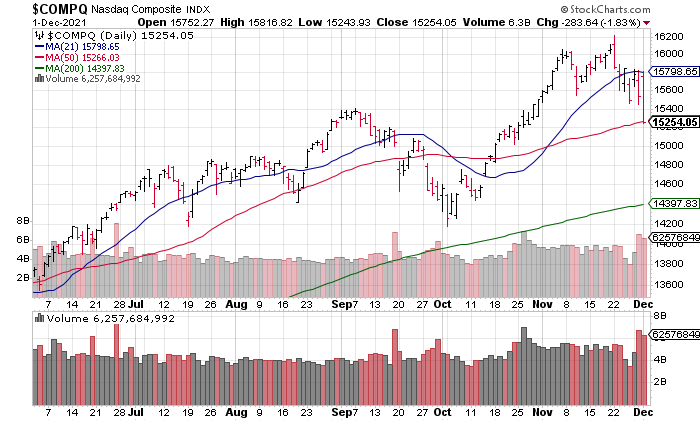

Panning out to the overall market, the S&P was -1.18%, the NASDAQ -1.83% and the Russell -2.34%. NYSE + NASDAQ Advancers to Decliners was 2,177 / 5,924. Volume of 11.6 billion was strong. Looking at the major ETFs (QQQ SPY IWM ARKK), volume was very high as well. (I have noted the strong volume in QQQ the last two sessions in the chart above).

I was relaxing Wednesday afternoon after the market close and caught the opening to CNBC’s Fast Money. What struck me was that Dan Nathan and Karen Finerman saw the current selloff as a clear buying opportunity. Former Morgan Stanley strategist Adam Parker was of the same opinion. Guy Adami was the only one that suggested it might not be. (I didn’t catch Tim Seymour’s opinion). This is likely representative of overall crowd sentiment at this point.

Therefore, we are likely to see a bounce fairly soon but it will only be a Dead Cat Bounce in a new bear market. Indeed, based off the futures it looks like bulls are going to buy the open this morning. The NASDAQ essentially closed at its 50 DMA so this is a natural spot.