The Bounce Is Here

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

This is something healthy in steep uptrends – Katie Stockton, Founder of Fairlead Strategies (quoted in “The Reflation Trade Is Stirring Growing Pains in Growth Stocks. Here’s Why.” Ben Levisohn, Barron’s, The Trader Column, Saturday March 6 [SUBSCRIPTION REQUIRED]).

On Thursday morning, one of the sections of my blog was “There Will Be A Powerful Bounce” and I reiterated and linked to it yesterday (Friday) morning. Well: It’s here!

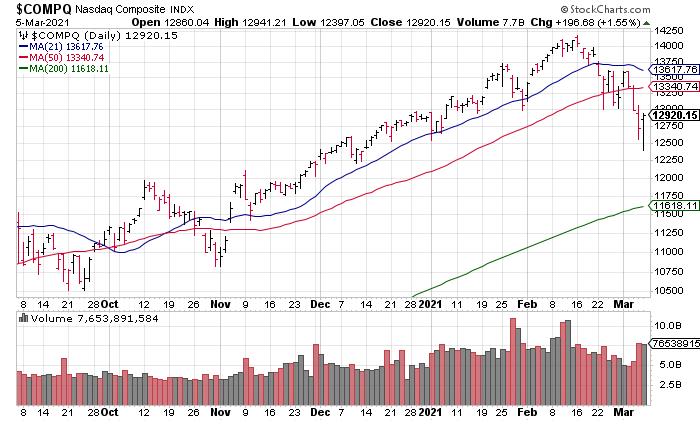

After selling off for the first two hours of Friday’s session, stocks found a bottom and rallied powerfully for the remaining 4 1/2 hours into the close. The NASDAQ, for example, hit a low around 12,400 before rallying more than 500 points to close above 12,900.

The move was broad based and on heavy volume so a short term bottom (at least) has almost certainly been put in. None of this should be any surpise to you if you’ve been reading my morning blogs.

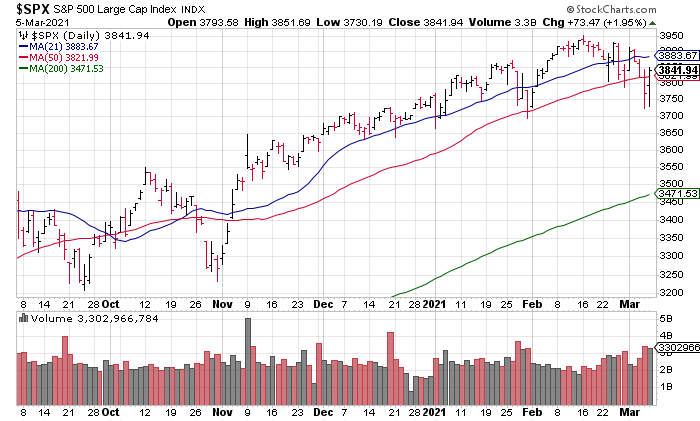

The S&P finished the day +1.94%, the NASDAQ +1.55% and the Russell +2.11%. Turning to technicals, the S&P reclaimed its 50 DMA though the NASDAQ did not.

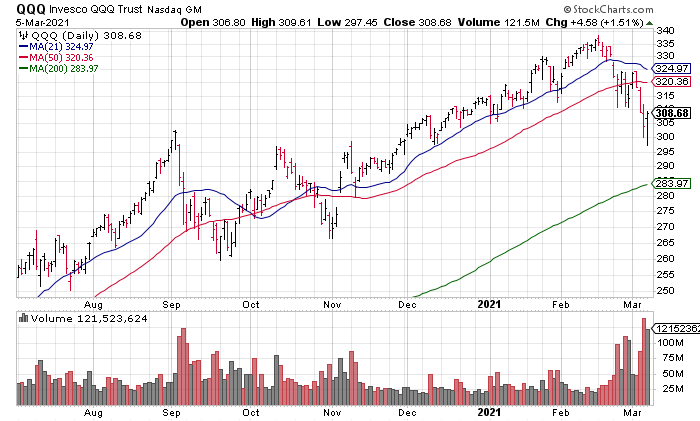

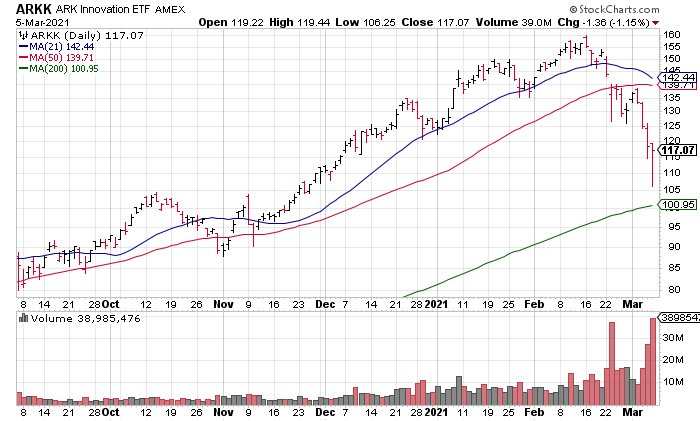

The QQQ, the bull market’s leading ETF, bounced nicely off its September 2020 highs but did not reclaim its 50 DMA. Neither did the second most important ETF in the market, Ark Innovation (ARKK). Both ETFs have significant work to do to repair the technical damage that was done the last three weeks.

Now the question arises: Was this just a correction in a bull market as the crowd believes? Or was this the the first salvo of a new bear market as I’ve been arguing?

We won’t know conclusively, of course, until we see what the market does but all of the catalysts for the selloff (rising interest rates, extreme valuations, euphoric sentiment) are sill in play and real technical damage was done. That’s why I argued previously and continue to believe that this bounce is to be sold and even shorted.

However, because the crowd is almost unanimous in its belief that this is just a “healthy” correction in an ongoing bull market (see the section “Sentiment: Just A Correction”, Top Gun Financial, Friday March 5), I don’t think you have to be in any hurry to unload positions or put on shorts because they will push this market higher for at least a few more days next week.

Believe it or not, this is exactly what two way investors and bears like me want: a bear market rally to take profits in longs and get short. Let the bulls push the market higher and become more and more convinced that this was just a correction. That only gives those of us who understand that a primary trend change is underway plenty of time and better prices to reposition.