The Bearish Case Has Rarely Been Stronger

While the S&P is near all time highs it might surprise you to know that the bearish case has rarely been stronger during my almost 20-year career in the business. In this blog I’m going to lay out a bunch of reasons for why this is so.

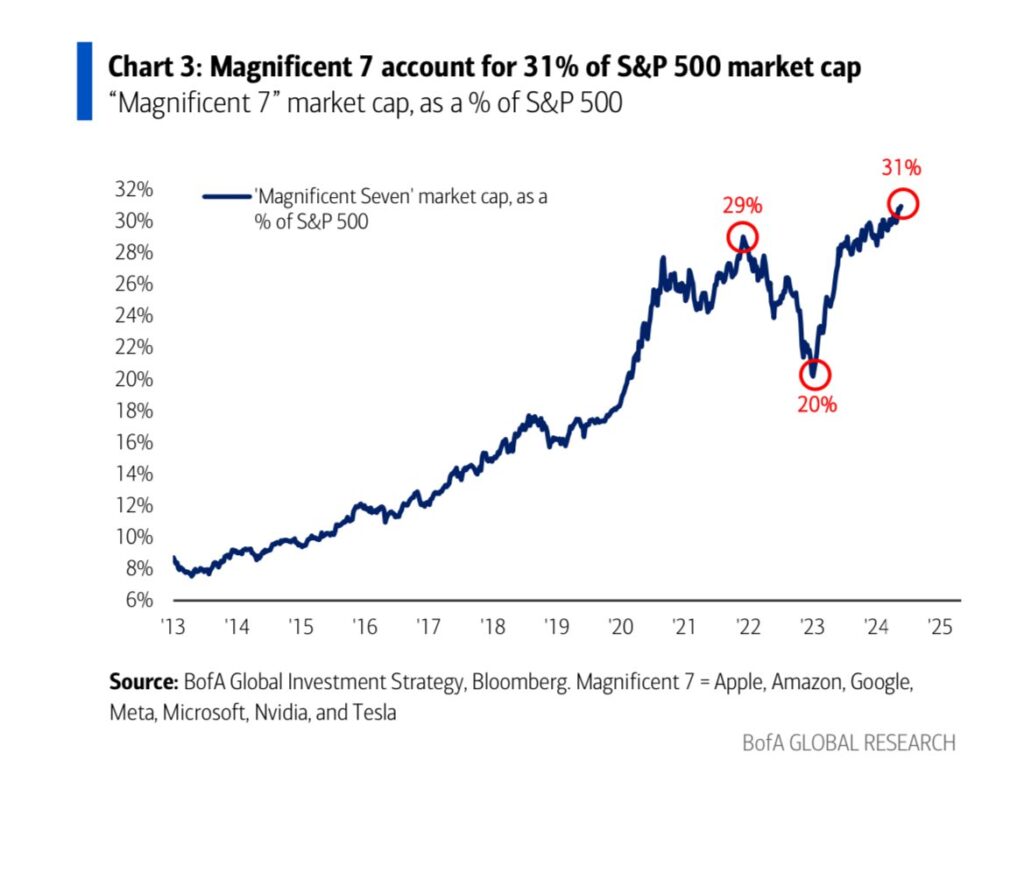

The first reason to be bearish continues to be the narrowness of the rally. The S&P is up more than 9% this year but more than 50% of that is due to just four stocks: Nvidia (NVDA), Facebook (META), Microsoft (MSFT) and Amazon (AMZN). Indeed, 39% is due to NVDA alone – and it is quite extended after last week’s huge post earnings pop. The Magnificent 7 now make up 31% of the S&P’s market cap!

The second reason to be bearish is valuation. The S&P now trades at 22x forward earnings according to Paul LaMonica in this weekend’s Barron’s The Trader Column [SUBSCRIPTION REQUIRED]. Indeed, most of this bull run since Oct22 has been fueled by multiple expansion not earnings growth as you can see in the chart above from Liz Ann Sonders.

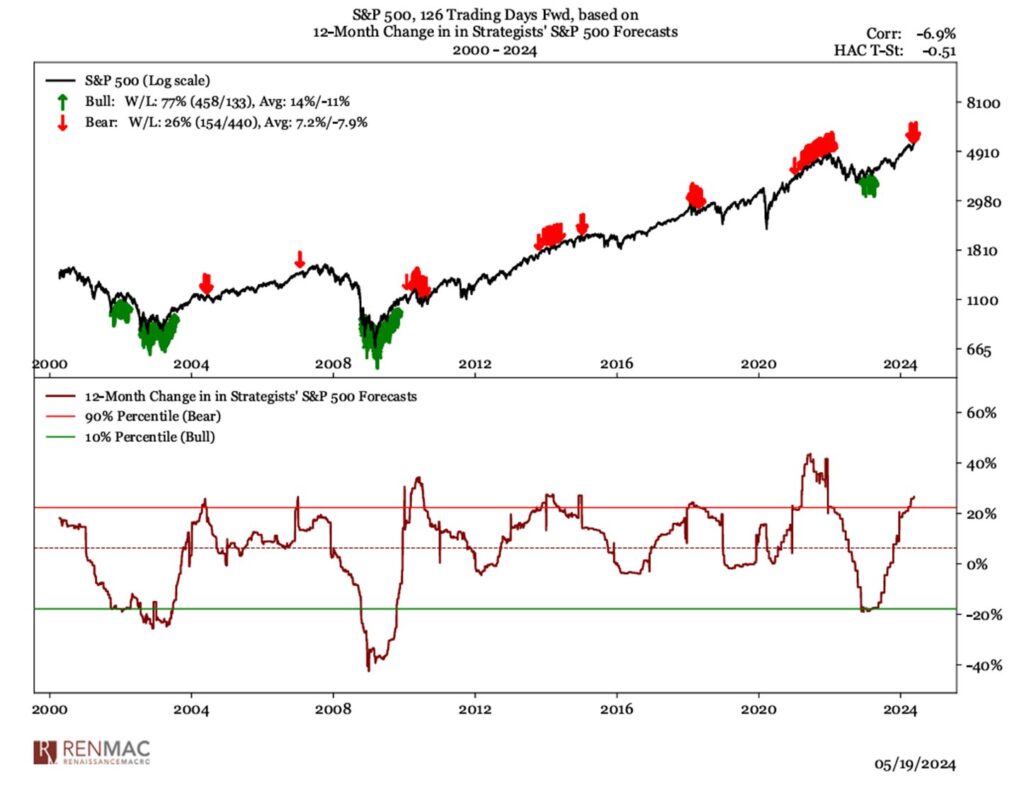

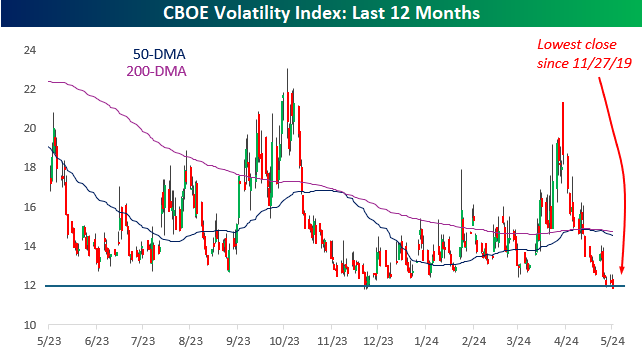

The third reason to be bearish is extremely bullish sentiment. As you can see in the first chart above from Renaissance Macro, strategists bullishness has just crossed above the 90th percentile based on 12-month changes in S&P 500 forecasts. Indeed, one of the last remaining bears – Mike Wilson – capitulated last week, raising his S&P price target by 20% to 5,400. A soft landing is now fully priced in and there is no fear in the market as can be seen in the VIX.

The fourth reason to be bearish is that Fed continues to be “higher for longer”. Most Fed forecasters now see only one or two rate cuts this year.

The fifth reason to be bearish is the increasingly dangerous geopolitical environment. The war in Ukraine shows no sign of ending after more than two years and the new war in the Middle East carries a decent likelihood of escalation. As Walter Russel Mead pointed out in the WSJ last Tuesday, Biden’s “diplomacy of retreat” is emboldening the world’s bad actors. Iran, Russia and China are all using the current environment to pursue their goal of undermining the US-based international order – and we are letting it happen (“America Hits The Global Snooze Button” [SUBSCRIPTION REQUIRED]).

The sixth and final reason to be bearish is the upcoming 2024 Presidential Election in November which is likely to be one of the nastiest in American history. There is a decent probability that whichever side loses will not be quick to concede which could result in some tense moments – or worse.