That 70s Show: Inflation Is Set To Roar

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

I get it that the Fed doesn’t want to recognize inflation, but there is inflation – Dover Corp CEO Richard Tobin April 20

We’re working very hard to avoid or minimize allowing supply-chain issues to lead to production shortfalls. We’re not saying that we’ll definitely have a problem. We want to flag that it’s a risk that we’re managing – Caterpillar CEO Jim Umpleby April 29

The industry is facing the most challenged driver market that I’ve seen in my 37-year career at JB Hunt – JB Hunt COO Nicholas Hobbs

We’re confident in our ability to manage through transitory raw material availability and cost inflation issues. The pace at which capacity comes back online and supply becomes more robust remains uncertain – Sherwin Williams CEO John Morikis

All quoted in “From Apple To Domino’s Pizza, US Companies Scramble To Meet Surge In Demand: Supply-Chain Snarles and Labor Shortages Crimp Some Businesses Looking To Ride Rebound In US Economy; ‘Caught Flat Footed'”, The Wall Street Journal, May 3, B1 [SUBSCRIPTION REQUIRED]

‘The economy is a long way from our goals, and it is likely to take some time for substantial further progress to be achieved,’ Fed Chairman Jerome Powell said in introductory remarks for his press conference following the central bank’s policy-setting meeting Wedensday [4/28].

Mr. Powell on Wednesday was steadfast on the Fed’s willingness to look through any inflation related supply-chain problems that might emerge over the next several months. ‘We think of bottlenecks as things that, in their nature, will be resolved as workers and businesses adapt,’ he said. ‘And we think of them as not calling for a change in monetary policy, since they’re temporary and expected to resolve themselves’ – Justin Lahart, “The Economy Isn’t Too Hot for the Fed”, April 30 [SUBCRIPTION REQUIRED]

There is a very interesting dynamic playing out in the economy right now that is almost certain to result in significant inflation. That dynamic consists in the reality of inflation as described by corporate executives, some examples of which you can read above, combined with the Fed’s refusal to admit that it’s anything more than “transitory”. This means that they will not act until it is too late and inflation is out of control. Not enough attention is being paid to this dynamic. Investors are focused on the booming economy as it reopens but not on the inflation that will almost certainly undermine it.

How to play it? Take a close look at the chart in Andrew Thrasher’s tweet above of commodity price performance over the last 12 months. What you see is that prices for economic inputs like lumber (+355%), oil (+212%) and copper (+93%) in addition to food commodities are raging. Many more examples could be cited.

But then look at the bottom of Thrasher’s chart at the worst performing commodity. Incredibly, gold, the most pure inflation play, is only +3% over the last 12 months. Gold performed incredibly in the 1970s inflation and it will again this time around as well. However, for whatever reason, investors have no interest in the precious metals for the time being. That presents an incredible opportunity to pick up the best asset to play inflation with at discounted prices. This is the kind of no brainer you dream about.

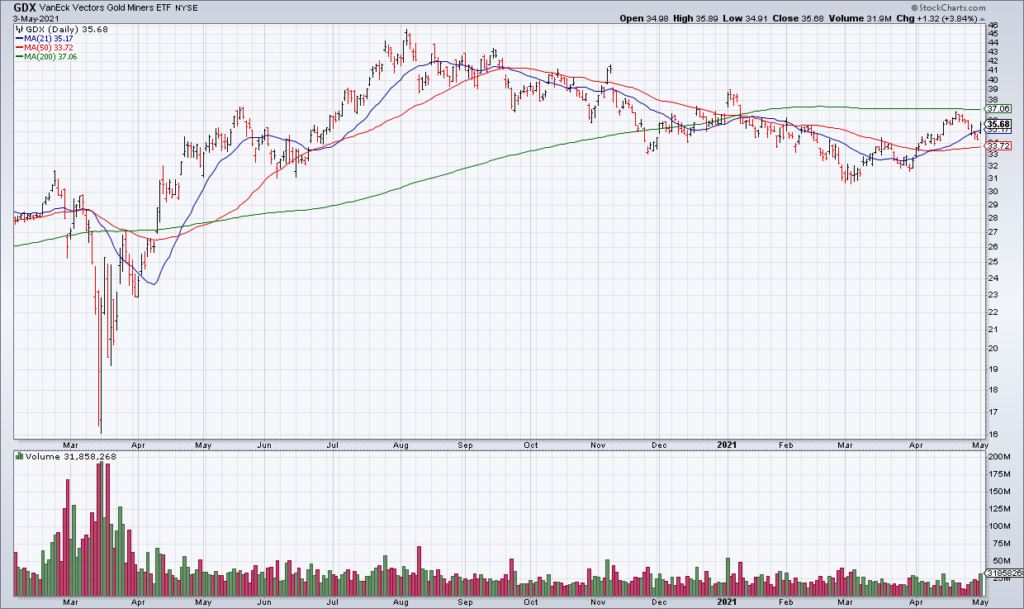

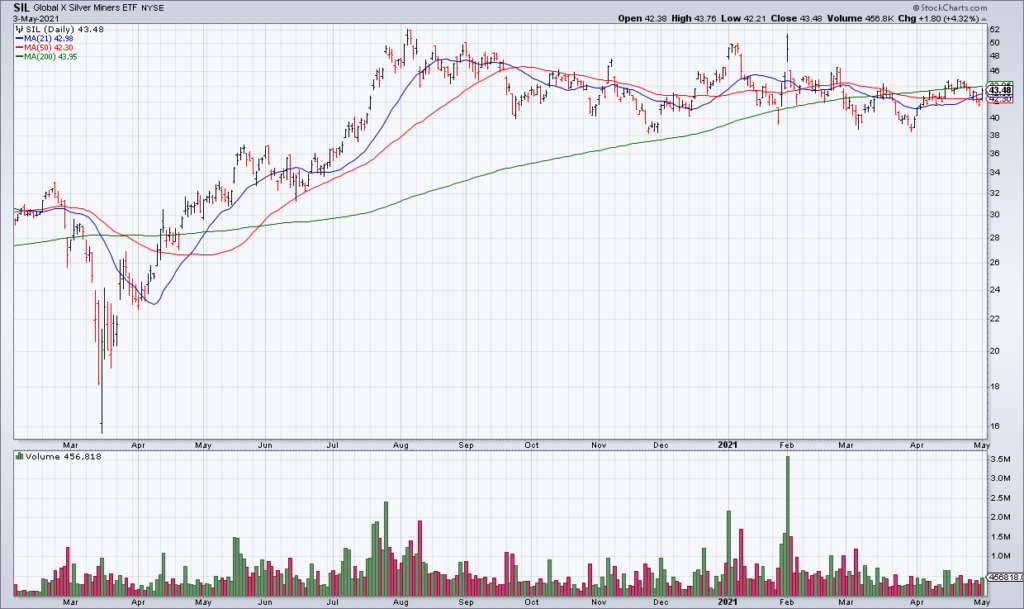

The precious metals and their miners did catch a bid Monday with GDX +3.84%, GDXJ +4.40%, SIL +4.32% and SILJ +5.85% causing Top Gun’s portfolio to have its best day ever – eclipsing our previous best from only a few weeks ago. This is just a taste of things to come IMO.