Technical Damage Mounting, Sentiment: Just A Correction, Value > Growth II, AVGO Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

The stock market got hit again yesterday as the yield on the 10 Year Treasury rose another 8 basis points to 1.55%. The S&P was -1.34%, the NASDAQ -2.11% and the Russell -2.76%. The stock market was essentially flat for the first 2 1/2 hours yesterday until selling off hard from 9am to 11am PST before bouncing a bit in the last two hours.

The technical damage to the stock market is mounting. The S&P closed 50 points below its 50 DMA.

The NASDAQ closed well below 13,000 at 12,723 and is now -1.28% YTD.

The most important ETF in the market, the bull market leader for the last 12 years, the QQQ is back to its September 2, 2020 highs. In other words, it has made no progress over the last 6 months.

The leading ETF for the last year, Cathie Wood’s Ark Innovation ETF (ARKK), got hit another 5.34% on 3x average volume and is now down almost 25% from its peak over the last 13 sessions.

This looks to me like more than a correction; it looks to me like a topping process as leader after leader tops which is the way bull markets top (see Lowry’s white paper “The Nature of Bull Market Tops” available for free on their website).

However, the crowd views this as just a correction. I read a number of tweets yesterday about how little the S&P is off its highs, calling it “healthy”, making fun of #stockmarketcrash trending on Twitter and comparing it to the September 2020 correction. Here are a few:

It always takes the crowd longer to understand what’s really going on. Nevertheless, this sentiment means that they will be looking to buy the dip at some point so you can expect a powerful bounce in the near future. That will be the time to get your portfolio in order and even short as it will not be a correction within a bull market but the first bounce within a new bear market.

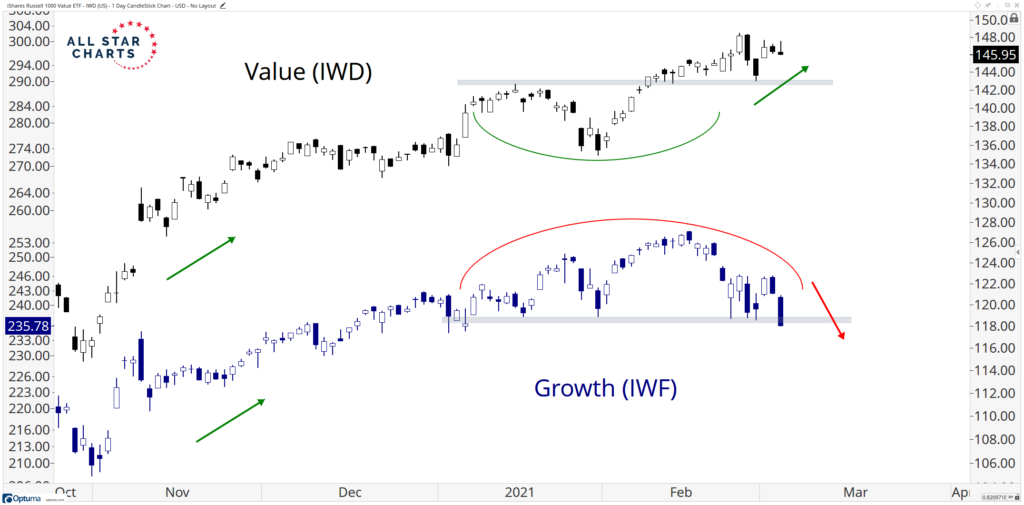

Steve Strazza of All Star Charts wrote an excellent blog post yesterday illustrating the rotation from Growth to Value with some outstanding technical analysis (“Will FAANGs Pop The Bubble In Passive?”, Thursday March 4). The post is filled with terrific charts and analysis and I highly recommend reading it in full. For now, this chart of the Russell 1000 Value ETF (IWD) versus the Russell 1000 Growth ETF (IWF) showing the former breaking out while the latter breaks down will suffice.

While Strazza doesn’t seem to be concerned about the implications for the overall market, he should be. That’s because Value is too small a proportion of the major indexes to propel them higher. If Growth is truly rolling over – and I believe it is – so is the bull market.

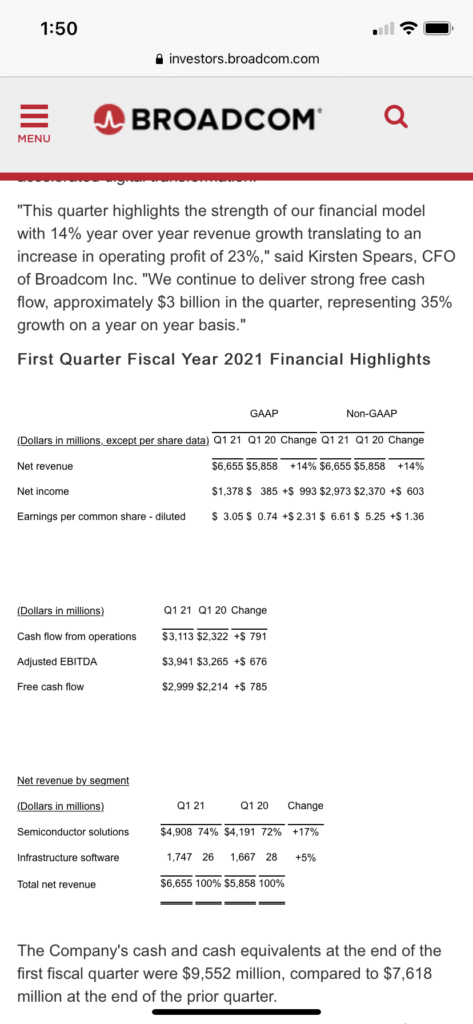

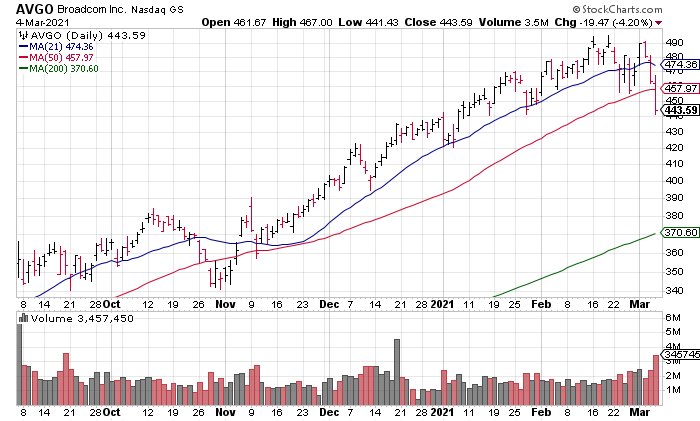

Lastly, a word about Broadcomm (AVGO, Market Cap $196 Billion) earnings from yesterday afternoon. Broadcomm is an important stock in its own right and makes up about 5% of the important VanEck Semiconductor ETF (SMH). The quarter looked fine to me with Revenue +14% and Non-GAAP Diluted EPS +26%. Current quarter Revenue Guidance was +13%. However, the stock is currently -2% in the premarket. A look at the chart suggests that another bad day will represent a nasty reversal from near ATHs at Monday’s close to complete breakdown.