Stunning Reversal

The much anticipated September CPI Report came out this morning before the market opened hotter than expected. The CPI increased 8.2% year over year and 0.4% month over month – above expectations. The Futures were up big before the report and then fell like a brick when it came out. The NASDAQ was down more than 3% early in the morning. And then the market staged a stunning reversal with the NASDAQ finishing the day up 2.23% – almost 6% higher than its morning lows. We haven’t seen price action like this since the day the market topped on November 22, 2021.

This kind of action is often seen at market turning points and I’m sure many will wonder if the bottom is in. In addition to the massive reversal the NASDAQ reclaimed the June lows. And all of this – I must emphasize – on a worse than expected September CPI Report. When the market rallies on bad news it frequently suggests that it’s all priced in.

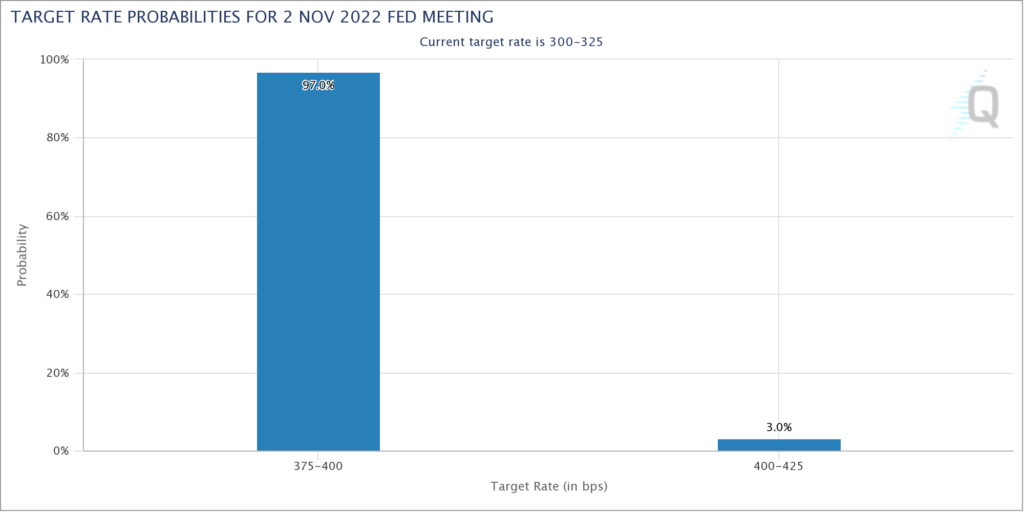

And yet I must admit that I’m completely baffled. The September CPI Report essentially guarantees that the Fed will hike another 75 points on November 2. They continue to tighten despite prices in the real world rolling over and signs of significant economic weakness. From a fundamental standpoint it’s hard for me to imagine – therefore – that this is anything more than a short or intermediate term low.

The commentary and interpretations of today’s action is sure to be fascinating. Technicians will focus on the stunning reversal – on bad news no less. Macro oriented analysts will scratch their heads for the reason stated in the previous paragraph.