Stocks Reverse Higher On Fed

The expectation heading into Wednesday’s Fed Decision is that the Fed will double the pace of its taper to $30 billion/month. That much has probably been priced into markets after Tuesday’s session. Further, my guess is that Chairman Powell will try to soften the blow to financial markets by saying that the Fed is willing to “adjust” (i.e. stop) tapering if conditions down the line warrant another pivot. If so, I would expect the market to firm up in the wake of his press conference following the release of the statement – Top Gun Financial, Tuesday 12/14

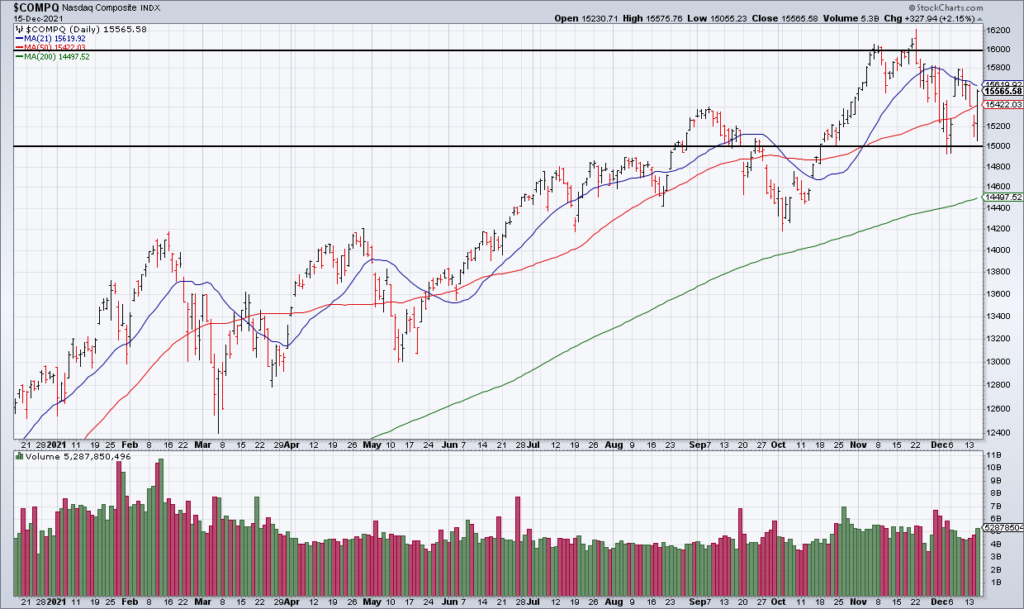

In Tuesday afternoon’s blog I laid out my expectations heading into the Fed. On Wednesday morning at 9:23am I suggested that the weakness we’d seen so far in the session created the conditions for a bounce if Chairman Powell struck the right balance in his press conference. Everything played out the way I thought it might and stocks rallied hard from the press conference at 2:30pm EST into the close with the S&P finishing the day +1.63%, the NASDAQ +2.15% and the Russell +1.65%. NYSE + NASDAQ Advancers to Decliners were 5,161 to 2,872 on strong volume of 10.1 billion shares.

The NASDAQ closed at 15,566 – right in the middle of the range highlighted in the above chart between 15,000 and 16,000. With the Fed Decision the last important data point of 2021, I believe this range will contain the NASDAQ into the end of the year. I can’t rule out marginal new highs above $400 for mega cap tech (QQQ) due to positive seasonality, but it would only be marginal new highs IMO. Despite all the excitement Wednesday about the post-Fed move, I continue to believe that 2022 will be the first year of a massive bear market.