S&P Resolves “Dueling Tails” To The Upside, The Point of Maximum Optimism II, The Economics of the $ Breakdown, CRM Earnings

Note: To sign up to be alerted when the morning email is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer choose to receive the emails.

Yesterday, the S&P (3,662) and NASDAQ closed at all-time highs. Significantly, the S&P broke out to the upside of the range (3,646) established by the “Dueling Tails”, so beautifully charted by David Zarling, on Monday November 9 and Tuesday November 10 in the wake of the Pfizer COVID vaccine announcement. Technically, this resolution to the upside suggests even more upside ahead – if it holds.

Investing involves not just predicting the future but comparing it to what is already priced in. If everyone already expects everything to be great, and it turns out that way, there is no particular reason for asset prices to change.

And at the moment, it seems that everyone expects everything to be really fantastic – James Mackintosh, “Market Expects Everything Will Be Awesome”, WSJ, Tuesday 12/1

The two best things I read yesterday were James Mackintosh’s piece in the WSJ in the morning and Greg Rieben’s blog post (“Investors Are Becoming Fearless”, 12/1) on sentiment (via The Chart Report) in the afternoon. In his blog post, Rieben posts two important charts showing how frothy sentiment has become.

The first chart shows $71 billion of flows into global equity funds in the previous two weeks – the highest since at least 2008. Interpretation: Investors are piling into the market. The second shows the 10 Day Put/Call Ratio reaching 0.413. The last two times it went below 0.5 – early June and late August – were followed by sharp corrections This shows investors scrambling to gain leverage in the market via calls and ignoring downside protection via puts (see Rieben’s blog post for the charts as I was unable to copy them here).

Next, I want to talk about the economics of the dollar breakdown. The dollar index has broken down below support at 92, paving the way for a trip to the 2018 lows at 88.

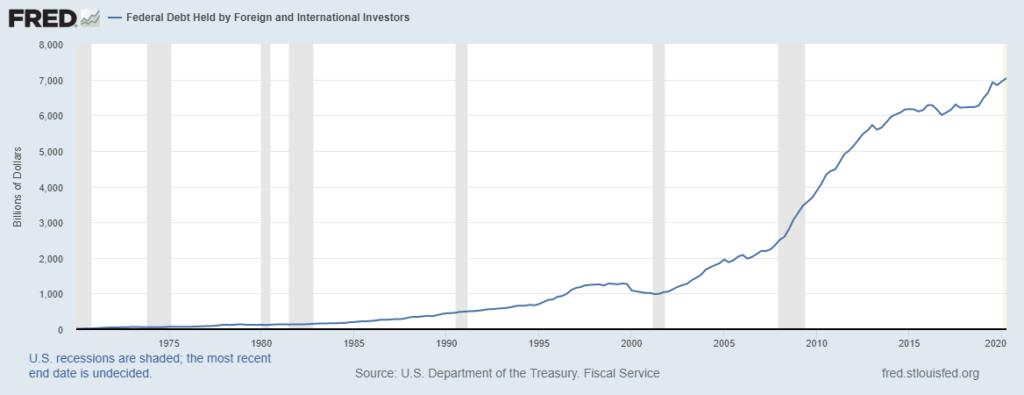

The most important consequence of the dollar breakdown is its effect on holders of $ denominated assets, especially treasuries. Foreigners held $7 trillion in treasuries at the end of the 2Q20. If the decline in the $ versus their home currencies begins to overwhelm the return they are getting from their investment, they may very well start selling. Treasury selling means lower prices which means higher interest rates. And higher interest rates are one thing our debt laden economy cannot handle.

A second negative consequence of the dollar breakdown is an increase in import prices. Given how much of our production we have outsourced, this increase in import prices is inflationary for the real economy as consumers and businesses are required to spend more dollars on the things they import.

The one benefit of a weak dollar is that helps companies based here that export most of their production because it makes their goods cheaper for foreign investors. On balance, however, the dollar breakdown is very negative economically and for the stock market.

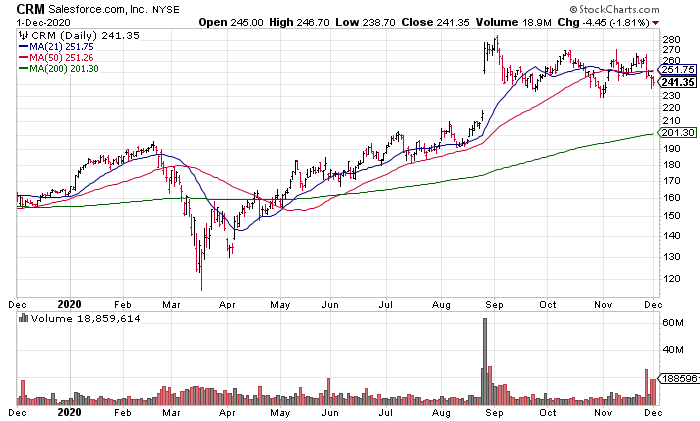

Lastly, I want to mention Salesforce (CRM) earnings from yesterday afternoon. Revenue growth decelerated to 20% in the quarter ended October 31, 2020 and they guided their fiscal year 4th quarter revenue to +17% – more deceleration. I believe this is why shares are down ~4% early in the premarket.