S&P 4,000, KMX Earnings and the Reopen Trade, Economic Reopening, Surging Inflation and How To Play It

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

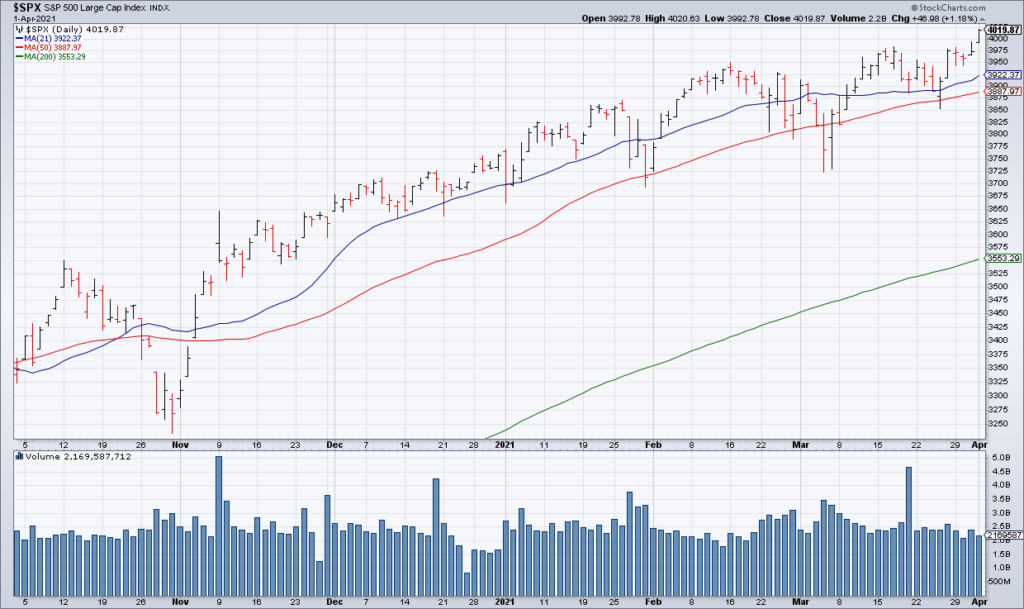

I still can’t quite believe it: S&P 4,000. I remember when I was just getting started in this business and the Great Recession bottomed at 666 intraday on the S&P on March 9, 2009. That’s an annualized return of greater than 16% over the last twelve fat years.

It wouldn’t surprise me if this round number acts as a top for the S&P just as 5,000 did for the NASDAQ in 2000, when it was only able to close above that level twice (Thursday March 9, 2000 and Friday March 10, 2000). Then again, it wouldn’t surprise me if it didn’t. The market can do anything.

Leading the way higher yesterday for the second day in a row was the NASDAQ (+1.76%) and Tech (S&P Tech XLK +2.01%). The Russell (+1.50%) followed close behind and the S&P (+1.18%) had an excellent day as well. As JC Parets of All Star Charts, along with many technicians, is fond of saying “New All Time Highs Is Not Bearish” and the action the last two days was anything but.

Even though the NASDAQ has not made new All Time Highs, it has broken out of its wedge defined by the trendline from the February Highs and the trendline from the March lows. Technically, the action here looks bullish to me as well.

Tech valuations are, of course, in a bubble. Take Microsoft (MSFT) as an example. The stock closed about 1% from its All Time Closing High yesterday but is valued at 35x Enterprise Value / 2020 Diluted EPS. MSFT is a great company but that multiple is probably around 35% too high.

Tech valuations are not alone in being in bubble territory. Stocks in the so called Reopen Trade, those that will benefit the most from the reopening of the economy due to the containment of the coronavirus via vaccine, also sport bubble valuations. We were reminded of that yesterday when S&P Consumer Discretionary used car retailer Carmax (KMX, Market Cap $20 Billion) reported earnings.

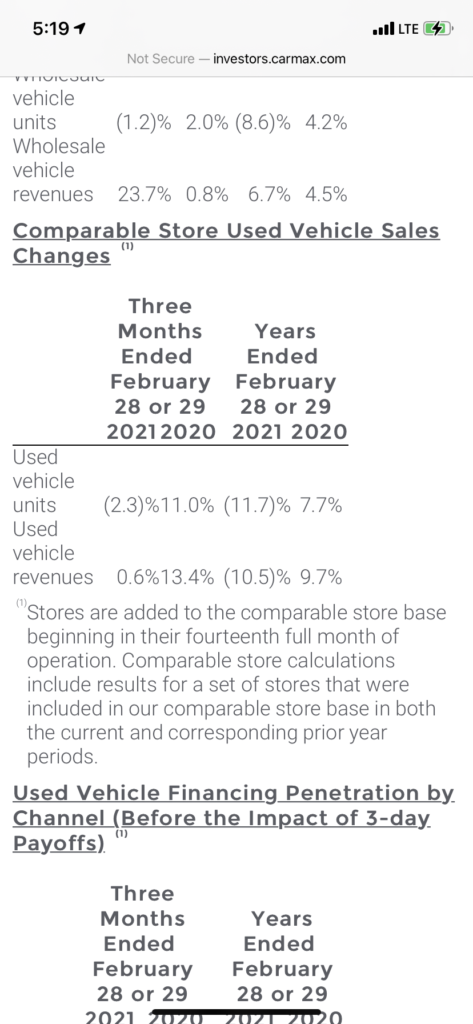

KMX reported an underwhelming quarter with Used Vehicle Revenue Comps +0.6% and Diluted EPS -2.3% to $1.27 from $1.30 a year ago. This was not good enough for a stock that was +44% YTD through Tuesday. KMX got hit 7% on 3.5x average volume.

Even after yesterday’s drubbing, KMX still trades at 23x peak diluted EPS of $5.33 for the pre-COVID year ended 2/29/20. This is typical of the Reopen names. Investors are rightfully excited about what economic reopening means for these companies’ businesses but they have already more than fully priced in a significant pickup in economic activity. Therefore, from a valuation perspective, the Reopen Trade, along with Tech, is sufficiently expensive to top. Perhaps KMX was the canary in the coal mine that nobody paid attention to yesterday. Perhaps not.

What investors seem to fail to understand is that while economic reopening will help the economy it will also add fuel to already percolating inflation. As consumers start spending more, the increased demand will lead to a significant further increase in prices from what we are already seeing (from all the monetary and fiscal stimulus and the beginning of economic reopening).

Luckily, the vehicles to play inflation, the precious metals and their miners, have been left for dead by investors. Just Tuesday the leading gold miners ETF (GDX) barely closed above $31 support at $31.83. It has since rallied almost $2 but still represents a great entry for a vehicle I expect to return multiples of its current price in the years to come.

The other precious metals vehicles to play inflation are GLD, SLV, GDXJ, SIL and SILJ.