Santa Comes Early

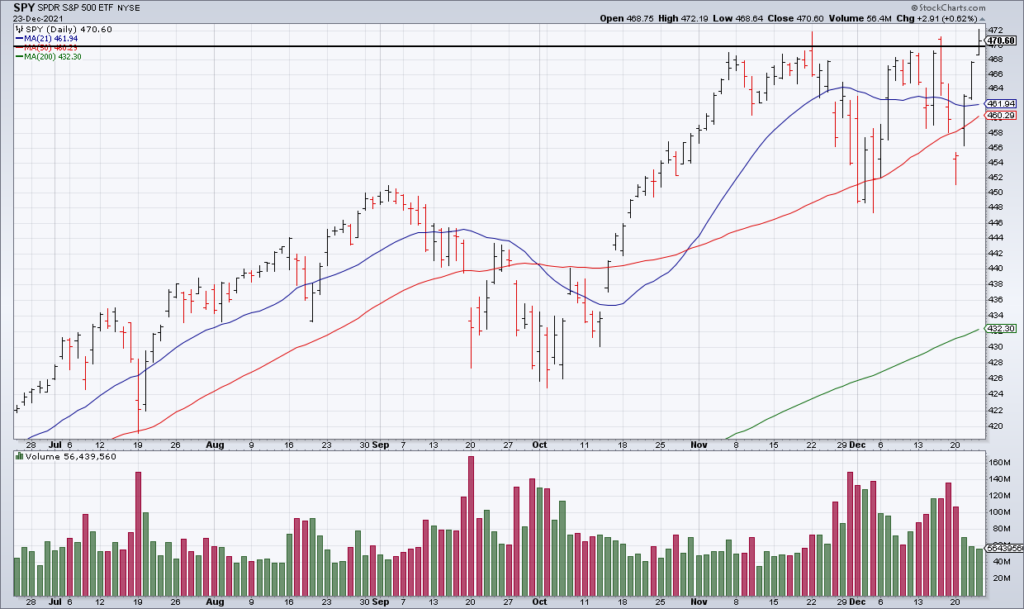

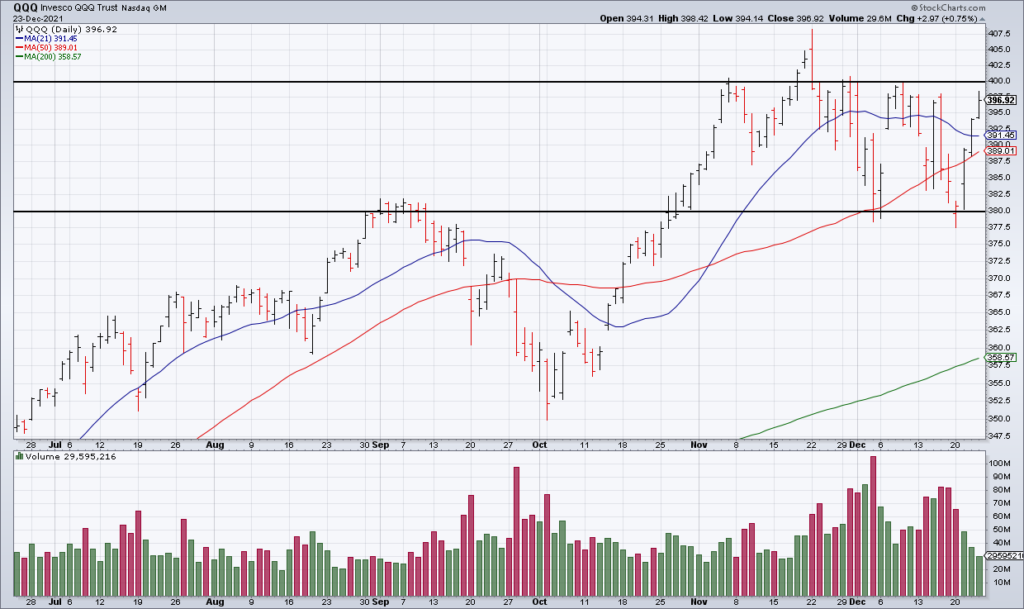

Stocks had a furious rally the last three days of the holiday shortened week. On Thursday, the S&P was +0.62% to 4,726 (a new all time high), the NASDAQ was +0.85% and the Russell +0.89%. I don’t want to be a grinch but volume was very light as you can see if you look at the last three sessions in the above charts of four of the most important ETFs. In addition, there was no news of any systemic importance; nothing fundamental changed. As a result, it is my belief that – in this day of extremely fast information transmission via social media – the traditional Santa Claus Rally has been front run and pulled forward. Anything is possible but it’s hard for me to imagine that the market can tack on much in the way of further gains next week. However, this is a contrarian view as most are expecting just that.

If I am correct then this could be a harbinger for 2022 because as Ryan Detrick titled his chart in the above tweet: “If Santa Should Fail To Call, Bears May Come To Broad & Wall”. Santa has failed to materialize only 6 times since the early 1990s. Two of these instances were 1999 and 2007 – ahead of the nasty market crashes of 2000 and 2008. This indicator is by no means the be all and end all but it’s worth paying attention to what happens these next 7 trading sessions. If I’m correct, expect a lump of coal from Santa this year and the start of a nasty bear market in 2022.