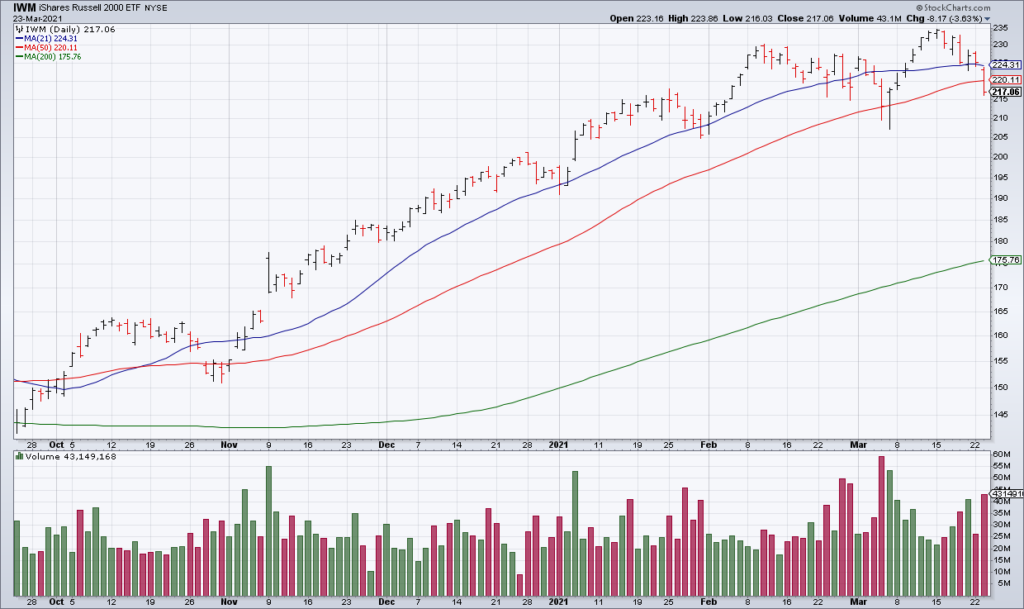

Russell Closes Below 50 DMA, Bad Breadth, Interest Rates Still Look Higher, The Crowd Believes

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

For the first time in 96 sessions, according to Sentimentrader, the Russell 2000 closed below its 50 DMA. This is important because the Russell has been leading this market higher, outperforming other benchmarks, since the beginning of November 2020. As Sam McCallum rightly asks: If the Russell stops leading what’s left to take its place?

For most of this bull market, the leader has been Tech but it is far from having repaired the technical damage sustained in the correction starting in mid-February. For example, take a look at the charts of the QQQ, which I use as a proxy for what I call Mega Cap Tech, and ARKK, which I use as a proxy for what I call Speculative Tech.

Hence McCallum’s question and the interpretation I’ve been giving here: Reopen Value, for which I use the IWM (the Russell 2000 ETF) as a proxy, is the last pillar of this bull market. If it is topping, the bull has nothing left to stand on.

On the surface, yesterday wasn’t too bad with the S&P -0.76%, the NASDAQ -1.12% and the Russell -3.58%. However, because the Russell was so weak breadth was quite bad with NYSE + NASDAQ Advancers to Decliners of 1294 to 6183. In other words, for every stock that rose yesterday, five fell. Only a small number of mega cap names held the market together.

Long term interest rates have come in a bit the last three sessions with the 10 Year Treasury Yield down about 10 basis points and the Long Term Treasury ETF (TLT) up 2.67% over that period. That helped the market, especially Tech, Friday and Monday though it failed to do so yesterday. Nevertheless this is most likely just a respite, a countertrend move, as the fundamentals (see “Inflation Is Here”, Top Gun Financial, Wednesday March 17) and technicals for higher interest rates remain in place.

Despite the market’s struggles since mid-February, the crowd is of the almost unanimous belief that this is just a correction within a bull market. My view that the bull market topped in mid-February and the recent bounce is the first bear market rally is an extreme minority viewpoint. For instance, take a look at the three tweets above. Let’s take them each in turn.

Ryan Detrick, LPL’s Chief Market Strategist, has no qualms about calling this the second year of a new bull market that started on March 23, 2020. In his note going into more detail on his views about the second year of the bull market, Detrick looks back at bull markets subsequent to bear markets greater than 30% since WWII. He finds that the second year of these bull markets are up 16.9% on average, though there is typically a large pullback averaging 10.2%. So nothing to worry about: just an expected pullback during the second year of a bull market that is still very much intact:

Pullbacks tend to happen during the second year of a new bull market, with an average year two pullback of 10.2%. Considering the current bull market reflected the best start to a bull market ever, this could open the door for an above-average pullback during year two.

This bull market is off to an amazing start, but it is important to remember it is still young. While a pickup in volatility would be normal at this stage of a strong bull market, we think suitable investors may want to consider buying the dip. Vaccine distribution, fiscal and monetary stimulus, and a robust economic recovery all have our confidence high.

Stefan Scheplick isn’t worried about the Russell 2000 slicing through its 50 DMA since its done it five times previously in the last year and recovered each time. The implication is that it will this time as well.

Lastly, Eddy Elfenbein’s tweet. Elfenbein tweeted a chart of the S&P without 2020 – as if last year never even happened. One interpretation is 2020 was just a freak interlude in an ongoing bull market like the 1987 stock market crash.

That the crowd is still bullish is a good thing for more elite traders and investors because it gives us more time to position our portfolios for what I believe to be the new bear market while they are busy buying the dip which keeps a bid under the market allowing us to make these adjustments at good prices.