Rising Interest Rates Are A Massive Headwind

Last week’s relief rally was a face ripper. QQQ was +10.5% and ARKK +25.8% in four days (Tue-Fri). That likely caused a lot of shorts to cover and pulled a lot of longs back into the market relieving extremely oversold conditions. However, the stock market – and especially the NASDAQ – now faces some significant headwinds.

From a fundamental perspective, the most important headwind is rising interest rates. As I’ve discussed ad nauseum, growth stocks are particularly sensitive to rising interest rates because most of their intrinsic value is in future earnings. As interest rates rise, those future earnings are discounted at a higher risk free rate in discounted cash flow (DCF) models, reducing their present value. While the NASDAQ mostly ignored a 17 basis point jump in the 10 year treasury yield Monday – only dropping 0.40% – I suspect it will only be able to do so for so long.

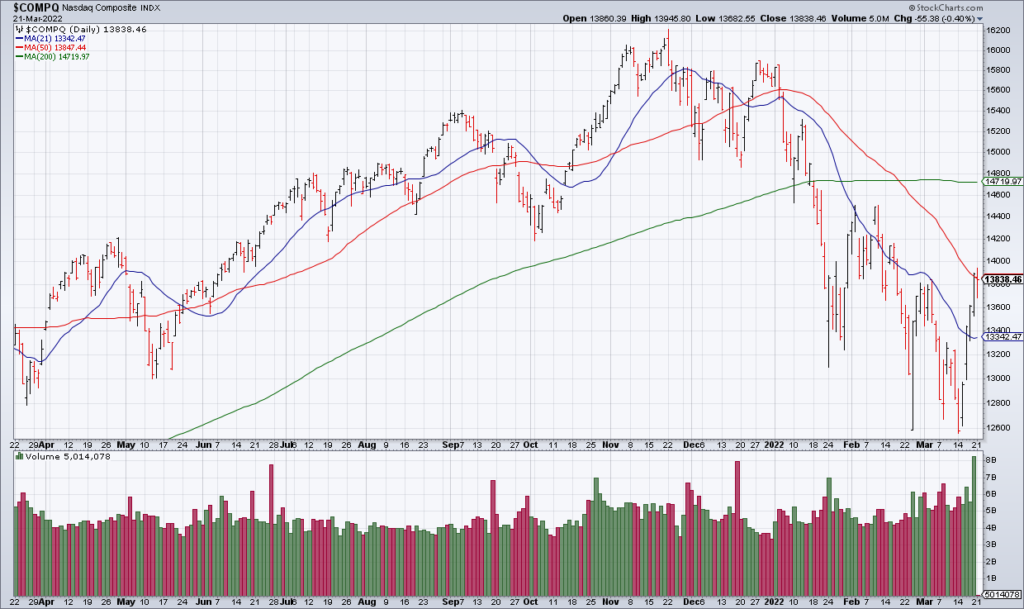

In addition – from a short term technical perspective – last week’s huge rally brought the NASDAQ up to its 50 DMA. The 50 and 200 DMAs are probably the most widely watched lines in technical analysis. With the NASDAQ’s 200 DMA flattening out and a downward sloping 50 DMA – which recently made a “Death Cross” – I’d assume many short term technical traders will take profits at these levels.