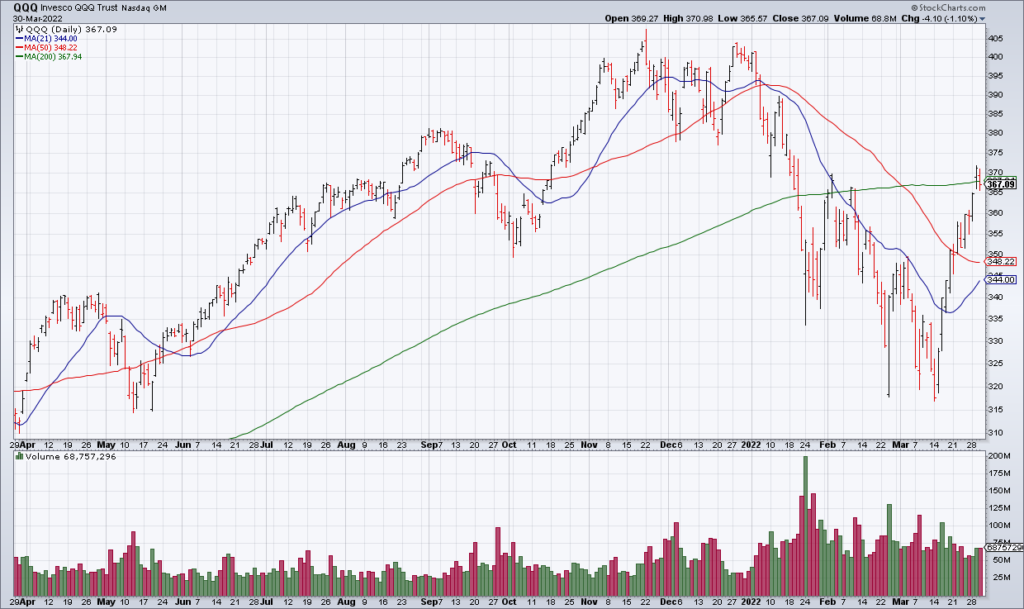

QQQ Testing 200 DMA, Keep An Eye On The $

The 200 DMA is the most fundamental line in technical analysis. By definition, securities and indexes that are above upward sloping 200 DMAs are considered to be in uptrends. Conversely, securities and indexes that are below downward sloping 200 DMAs are considered to be in downtrends.

On that score, it’s important to point out that the QQQ – the most important security in the market – is currently testing its upward sloping 200 DMA. It closed marginally above it on Tuesday and marginally below it on Wednesday. For me, the 200 DMA is the line in the sand for my QQQ short.

However, I did not cover Tuesday. Why? Because the close was only “marginally” above the 200 DMA in my opinion. I suspected that it may well reverse Wednesday – and that is precisely what happened. NASDAQ-100 Futures are up marginally right now so we may have another test of it today.

Getting back to why I didn’t cover Tuesday. For me to cover, I need to see the QQQ start to “get away” from its 200 DMA, not “marginally” close above it. How can these terms be operationalized? Unfortunately they can’t. While I think everyone has a sense of their connotation they do not have a precise denotation. As I’ve said many times, trading is an art not a science. I can’t operationalize these terms numerically. They require judgment and feel. While that is unsatisfying to many, that is the nature of the game.

As a hypothetical, were the QQQ to reclaim its 200 DMA at the close today and continue to move higher Friday into the close, that would likely be enough to get me to at least reduce my short position. While the rally does not make sense to me on a fundamental basis, the stock market does not have to make sense. You still have to respect price.

The performance of QQQ his highly dependent on the performance of Apple (AAPL) – the most important stock in the market with a 12.43% weighting in QQQ. Prior to a slight correction on Wednesday, AAPL had been up 11 consecutive days! Because of AAPL’s size, it has an enormous influence on the performance of the major indexes, especially the QQQ. So definitely keep an eye on AAPL.

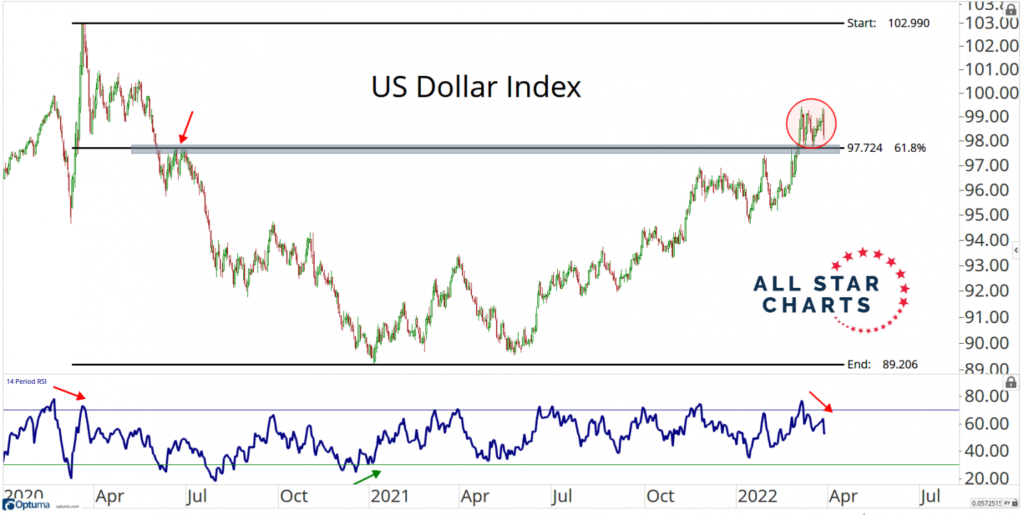

The technician Ian Culley had a tweet about the dollar Wednesday that caught my attention. While the dollar has been trending up for about a year now – and risk assets down – Culley pointed out a divergence between DXY and the dollar’s Advance – Decline line with 29 other currencies. This suggests – though by no means guarantees – that the dollar may be topping out. What does it mean?

In a blog yesterday (“The Most Bullish Catalyst”, JC Parets, March 30), the technician JC Parets argued that a dollar reversal would be bullish for risk assets. His reasoning is sound. As you can see in the chart above, JC points out that dollar weakness correlated with strength in risk assets in 2020 and dollar strength in 2021 and 2022 has correlated with weakness in risk assets. JC infers that the same correlation would hold now and a dollar reversal would be bullish risk assets going forward.

However, it strikes me as premature to call for a dollar reversal. The dollar continued to be strong up until two days ago. It’s weakening may simply be a dip in a continuing uptrend, much as I view the recent rally in stocks as counter to the long term trend. In fact, the rally in stocks might be causing the dollar to weaken as investors embrace a risk on attitude. For now, this is just something to keep an eye on. What it means for me personally is that I will be keeping a closer eye on the dollar via The Dollar ETF (UUP).

I remain bullish precious metals, commodity and defensive/value stocks and bearish growth stocks. However, in this blog I’ve outlined a couple of things to keep an eye on that would challenge this thesis. If QQQ starts to get away from its 200 DMA and a weak dollar provides a tailwind for growth stocks, I would have to reevaluate and adjust.