QQQ: Failed Breakout Watch, PG & NFLX Earnings: A Tale of Two Kinds of Stocks

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

On Saturday I wrote about technical divergences in the NASDAQ and yesterday I wrote about Small and Micro Caps failing to confirm the new highs in the S&P last week. Another bearish technical development is a potential failed breakout in the leading NASDAQ-100 (ETF: QQQ). The QQQ broke out from its previous closing high of $336.45 (February 12) on Friday April 9th but has fallen back down to that level in the previous two sessions, closing yesterday at $336.41. A failed breakout shows that supply exceeds demand above that price level and the security is therefore not ready for those levels. Because the QQQ is the most important ETF in the market this bears close watching.

The two most important stocks that reported earnings yesterday were Procter & Gamble (PG) and Netflix (NFLX). These two stocks nicely encapsulate two different kinds of stocks. PG represents quality and defense while NFLX embodies momentum and glamour. The latter has led since the March 2020 lows but, as I pointed out yesterday, defensive stocks are breaking out now. The response to yesterday’s earnings reports has strengthened my conviction that now is the time for quality and defense.

For their 3QFY21 ended March 31, 2021, PG reported Organic Revenue +4% and Core EPS +8%. They also maintained their FY21 Guidance of an 8%-10% increase in Core EPS from FY20’s $5.12. PG stock was +0.83% yesterday after its earnings report while the S&P was -0.68%. While hardly cheap at 25x current fiscal year earnings guidance, PG is the epitome of quality and has been acting well the last month as you can see in the chart above.

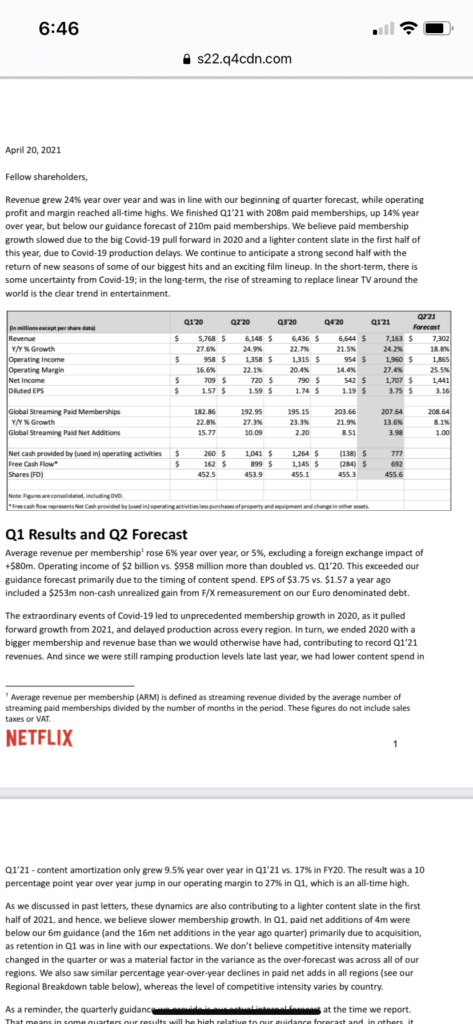

NFLX reported 1Q21 earnings after the close yesterday. Being a momentum and glamour stock, investors haven’t worried much about earnings or free cash flow but have focused almost exclusively on subscriber growth assuming that the former will materialize in the future as long as the latter remain strong. Unfortunately, NFLX provided tepid guidance for only 1 million new subscribers for 2Q21 and the stock is getting clobbered as a result, down ~8% in the premarket (as of 2:30am PST). It looks set to test its 200 DMA today which has not been in play for most of the move off the March 2020 lows but has started to catch up with price as the stock has stagnated over the last nine months.