QE and the K-Shaped Recovery, Copper at 9 Year Highs, Interpreting Rising Interest Rates, WMT Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

In the past, I’ve written about how Quantitative Easing (QE) doesn’t result in real economic growth, increases in productivity do. This morning I want to discuss the regressive nature of QE. That is, how QE benefits the rich and hurts the poor and middle class.

First, as you can see from the tweet and accompanying chart from Holger Zschaepitz, QE is alive and well with the Fed adding $115 billion to its balance sheet in the week ending Wednesday February 17.

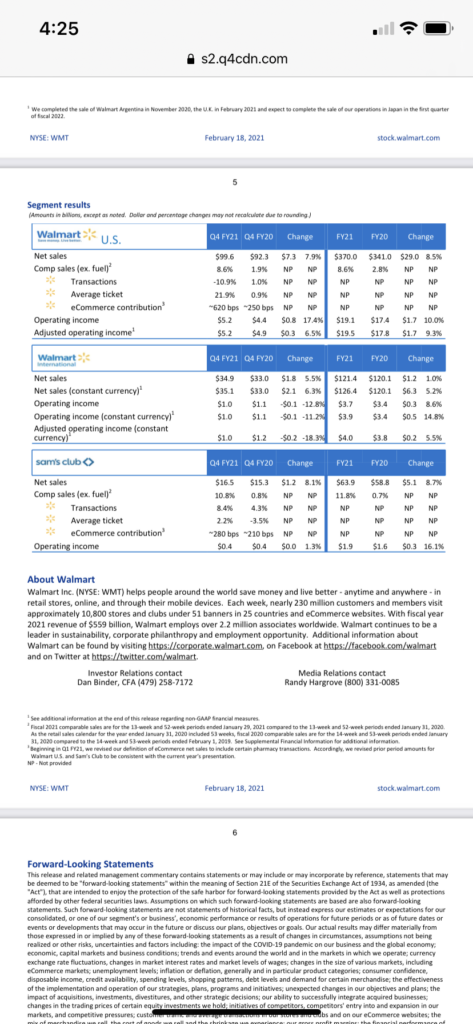

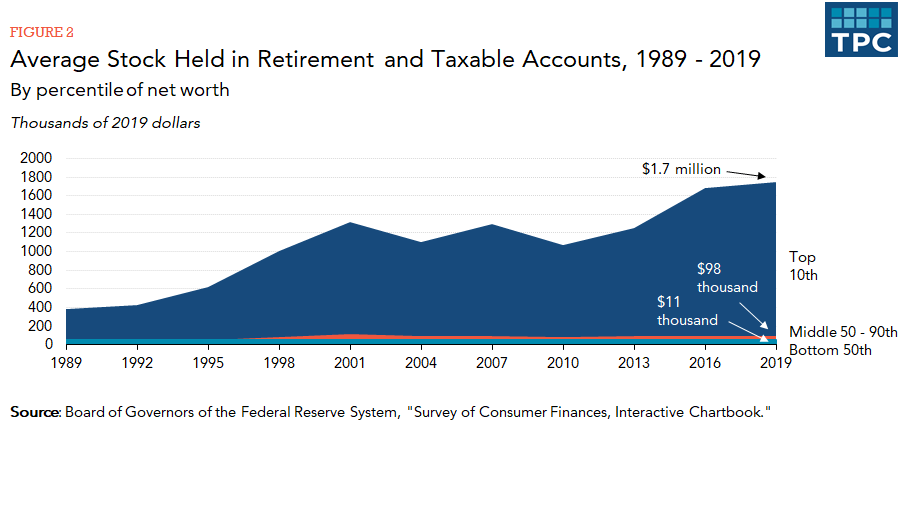

The problem with QE, in addition to causing bubbles and not real economic growth, is that by inflating financial markets it benefits the rich who own stocks, not the middle and lower class who do not. As you can see in the chart below from the Tax Policy Center, the average amount of stock held in retirement and taxable accounts by the Top 10% by net worth is $1.7 million while that held by the 50% to 90% is $98,000 and that by the Bottom 50% $11,000. By pumping up financial markets, including the stock market, QE benefits the Top 10% with only trickle down effects for the middle and lower classes.

Obviously, this is unfair and so it’s ironic that Liberals – who are so concerned with the material well being of the lower class – are the biggest supporters of QE. This is the case because they believe in government regulation and management of the economy as well as because they are ignorant about how QE works. For example, economist Stephanie Kelton, author of The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy, is the face of the far left’s economics today. The Left embraces her economics without realizing that it’s bad economics resulting in bubbles not real economic growth and is highly regressive as well.

Economics in general and Monetary Theory in particular is intimidating to most people and so they don’t invest time in understanding it despite the fact that it is the most important issue in the world today. The actions of global central banks have caused the biggest bubble in financial history. When it pops, it will wreak havoc across the real economy the likes of which has never been seen before. Further, if they continue down this path, they risk the destruction of the fiat currencies that currently function as our money and Civilizational Breakdown.

While highly unlikely, it is imperative that Americans educate themselves about Monetary Theory before it is too late. The place to start is with the great Austrian Economist Ludwig von Mises’s masterpiece Human Action.

QE is spilling over into the real economy now as commodity prices and interest rates are on the rise. For example, copper is at 9 year highs. Copper is often called the metal with the Phd in Economics because demand for it is a function of economic strength but in this case it’s giving a false signal as it’s being driven by QE not economic growth.

Similarly, interest rates are on the rise which is being interpreted as a sign of economic growth on the horizon when really it’s probably a reflection of investors’ belief in coming inflation.

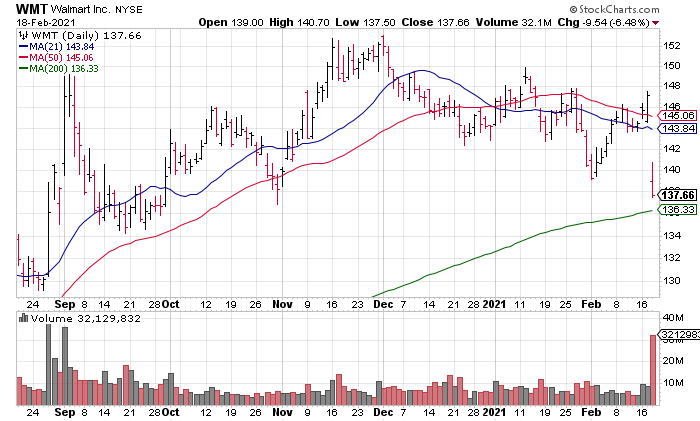

Lastly, I want to discuss Walmart (WMT, market cap $389 billion) earnings. WMT reported a solid quarter with US Comps excluding fuel +8.6% though Adjusted Operating Income was -3.5% and Adjusted Diluted EPS up less than 1%. For whatever reason, Wall Street didn’t like it and dumped the stock yesterday to the tune of -6.48% on about 4x average three month volume. Though by no means cheap at 25x trailing Adjusted Diluted EPS, I decided to pick up some shares which closed about $1 above their 200 DMA.