Price: Chopping Around, Internals: Bad Breadth, No Volume

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

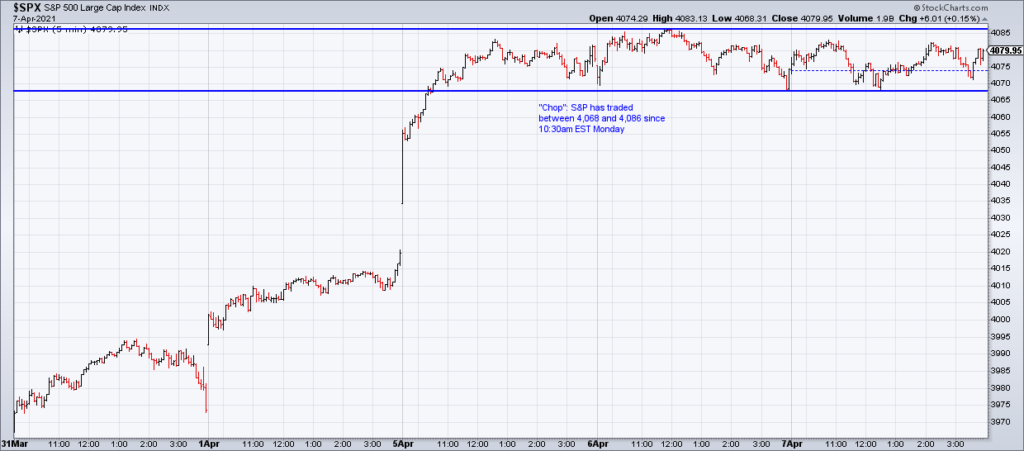

Since Monday morning’s gap up, the S&P has gone nowhere. In fact, we’ve been trading within a narrow 50 basis point range between 4,068 and 4,086. Tom Hearden characterized Tuesday as a “snoozefest” and yesterday was more of the same with the S&P +0.15%, NASDAQ -0.07% and Russell -1.60%.

Big Tech continues to lead the market with the S&P Tech Sector ETF (XLK) +0.53%. Because it is the biggest sector in the S&P at ~27%, strength here can cover weakness in a lot of other areas. And the biggest of the big were even stronger than the sector as a whole with Apple (AAPL) +1.34%, Amazon (AMZN) +1.72%, Microsoft (MSFT) +0.82%, Google (GOOGL) +1.35% and Facebook (FB) +2.23%.

If we dig into market internals, we see bad breadth once again and no volume. NYSE + NASDAQ Advancers to Decliners Wednesday were 2,693 (35% of all securities traded) to 4,762 (62%). In addition, Wednesday was the lowest volume day of the year for stocks according to @Not_Jim_Cramer.