Please Shoot Me On The Midnight Train To Georgia: Adventures In The Bubble

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

I just woke up to the NASDAQ Futures being -2% as Democrat control of the Senate becomes a real possibility with one of the two Georgia Senate seat runoffs being called for Democrats and the other too close to call. A Democratic sweep would mean Democratic control of the Presidency, House and Senate and hence the ability to push through their agenda, including higher capital gains and corporate income taxes as well as more clean energy mandates and regulations of business in general. Apparently, investors think stocks on the NASDAQ have the most to lose.

The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubble of financial history, right along with the South Sea Bubble, 1929, and 2000 – Jeremy Grantham, “Waiting For The Last Dance”, GMO, January 5, 2021

Yesterday, legendary investor Jeremy Grantham doubled down on his bubble call saying that he didn’t see the bubble lasting beyond late Spring or early Summer, “coinciding with the broad rollout of the COVID vaccine”. According to Grantham, there are many aspects of the current market that suggest to him that it is an epic bubble but “the single most dependable feature of the late stages of the great bubbles has been really crazy investor behavior, especially on the part of individuals”. This is the moment, Grantham also wrote, when professional investors show their true mettle and careers will be made and broken.

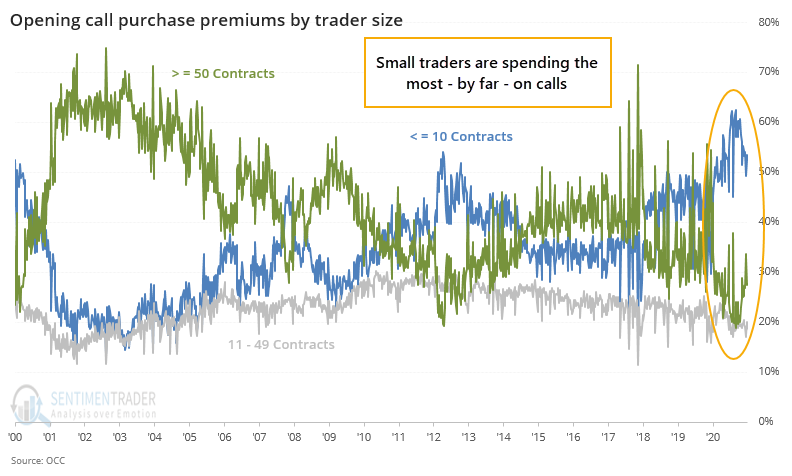

And, yes, individual investors are acting absolutely insane. According to Sentimentrader, even more so than in 2000, individual investors are buying calls like mad. To end last week, 54% of call premium, the amount of money spent to buy calls, was being spent by investors buying less than 10 contracts i.e. individual investors compared to 28% for those buying more than 50 contracts i.e. professional investors. While not as extreme as late August/early September, this exceeds what we saw in 2000 when individual investors were tripping over themselves to buy calls on the latest Dot Com name and bragging at cocktail parties about how much money they were making (TSLA, anyone?)(“No letup in leverage”, Sentimentrader, January 5, 2021).

Speaking of TSLA, Morgan Stanley’s Adam Jonas raised hit Price Target (PT) yesterday afternoon from $540 to $810 sending TSLA shares up almost 2% to ~$750 in the after hours. At $750, TSLA would have a market cap of ~$830 billion or $1.66 million per car sold in 2020 (“Tesla 4Q 2020 Vehicle Production and Deliveries”, Press Release, January 2, 2021).

Meanwhile, JP Morgan said on Monday that Bitcoin could hit $146k as it “crowds out” gold as the preferred hedge against declines in fiat currencies (“JP Morgan Says Bitcoin Could Surge to $146,000 in Long Term”, Bloomberg, Jan 4, 2021).

The Russell 2000 was recently more than 30% above its 200 DMA – the most in the last 20 years. Since the only other two times in the relevant period the index was more than 25% above its 200 DMA were 2003 and 2009, Krupinski and The Chart Report’s Patrick Dunuwila take this as another piece of evidence that we are actually at the beginning of a new bull market (Chart Source: Gregory Krupinski Twitter, January 4, 2021, 5:04pm).

Further reason not to worry is The Irrelevant Investor Michael Batnick’s “refutation” of Grantham. Ignoring all other valuation metrics to focus on Free Cash Flow Yield, Batnick suggests that stocks are “not cheap, but really not close to expensive”. Batnick concludes: “I will go on record that I don’t think this is anywhere near like 1999 or 1929. Are there pockets of excess? Absolutely, I’m not blind. But a 70% decline in the major averages? Sorry, I don’t see it” (“One Of The Great Bubbles Of Financial History”, Michael Batnick, The Irrelevant Investor, January 5, 2021).

I’m sorry you don’t see it either, Michael, because it is so obvious and therefore reveals your caliber as an investor. I applaud your moxie for taking on Grantham but really it’s foolhardiness. This reminds me of all the self proclaimed “Kobe Stoppers” during the great basketball player’s career. That never really worked out too well for them. Mediocrities shouldn’t try to take on legends.

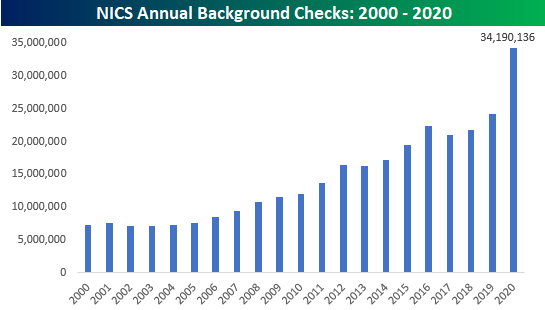

The one positive development I see is that the odds of getting shot during this madness are rising rapidly as Americans bought guns at a rate never seen before in 2020 (Chart Source: “Stocking Up The Gun Safes”, BeSpoke, January 4, 2021).

This has been a boon for the gun manufacturers Smith & Wesson (SWBI) and Sturm, Ruger (RGR) who saw their sales rise 119% and 53% in their most recent quarters, respectively.

If you can keep your head when all about you

Are losing theirs and blaming it on you,

If you can trust yourself when all men doubt you,

But make allowance for their doubting too;

If you can wait and not be tired by waiting,

Or being lied about, don’t deal in lies,

Or being hated, don’t give way to hating.

And yet don’t look too good, nor talk too wise.

– “If”, Rudyard Kipling

Keep your heads folks – and keep them on a swivel too!