Persistent Inflation Means Gold Will Continue To Shine

Is there a more hated asset than gold? Keynes called it a “barbarous relic”. Warren Buffett is famously not a fan of gold. And yet gold is working now precisely as it should as a hedge against inflation and excessive fiat money creation. Historically, money was tied to gold until Nixon broke the last link by closing the gold window in August 1971. Since then, fiat currencies have floated free of any tie to anything real. Gold bugs have long warned that one day a price would be paid for this. With gold rapidly approaching $3000/oz. perhaps that time is now.

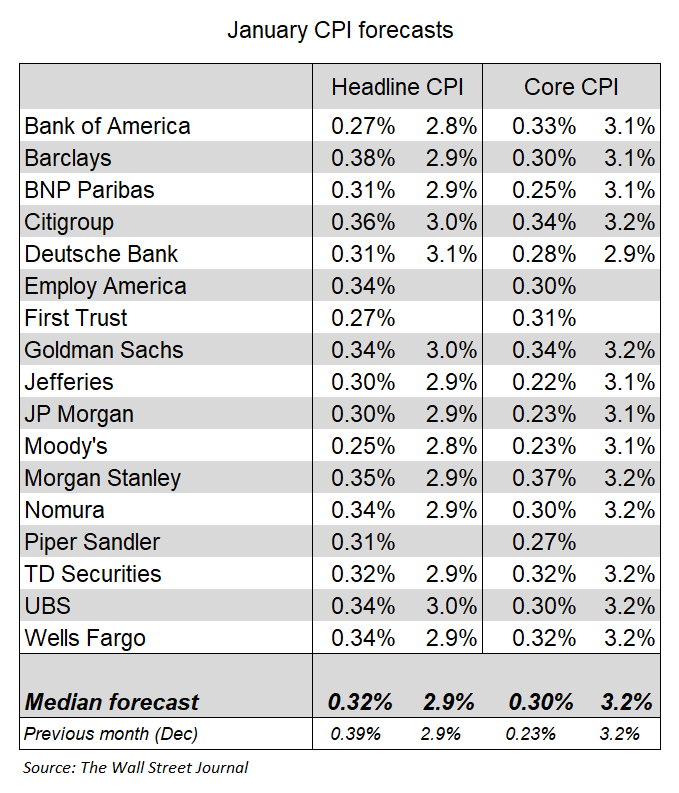

Wednesday morning the BLS reported inflation numbers much higher than expectations. Forecasters called for January Headline and Core CPI to rise 0.32% and 0.30% month over month. In fact, Headline and Core CPI came in at 0.47% and 0.45%, respectively, according to the WSJ’s Nick Timiraos on X. The Fed declared victory against inflation last year but the fight may be a long way from won.

Also out Wednesday morning were 4Q24 Earnings from leading gold producer Barrick (GOLD). Not surprisingly the surge in gold prices turbocharged Barrick’s results. Revenue was up 13% in 2024 and Adjusted EBITDA 30% on the back of an increase in their Realized Gold Price of 23% to $2,397/oz. from $1,948. GOLD shares are trading up more than 5% at the open to about $18.

Expect more of the same when Kinross Gold (KGC) reports 4Q24 Earnings after the close today (Wednesday).