PANW, DE & AZO Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

As a generalist macro investor I focus on mega caps or stocks in the S&P 100. I look for high quality, reasonably valued stocks that express my macro views. This morning I feel like digging into a few stocks that recently reported earnings to see if any might be prospects for my portfolio as well as for the light they might shed on the market as a whole.

Let’s start with cybersecurity company Palo Alto Networks (PANW, Market Cap $37 Billion) which reported earnings last Thursday afternoon. PANW reported 24% revenue growth to $1,074 million and Non-GAAP diluted EPS growth of 18% to $1.38 for the quarter ended April 30, 2021. PANW also guided Non-GAAP diluted EPS for their fiscal year ending at the end of July to $5.97-$5.99. PANW shares closed Monday at $364.52 for a 61x P/E multiple on the midrange of that guidance. At 61x current year earnings with ~20% growth I see little edge in owning PANW here.

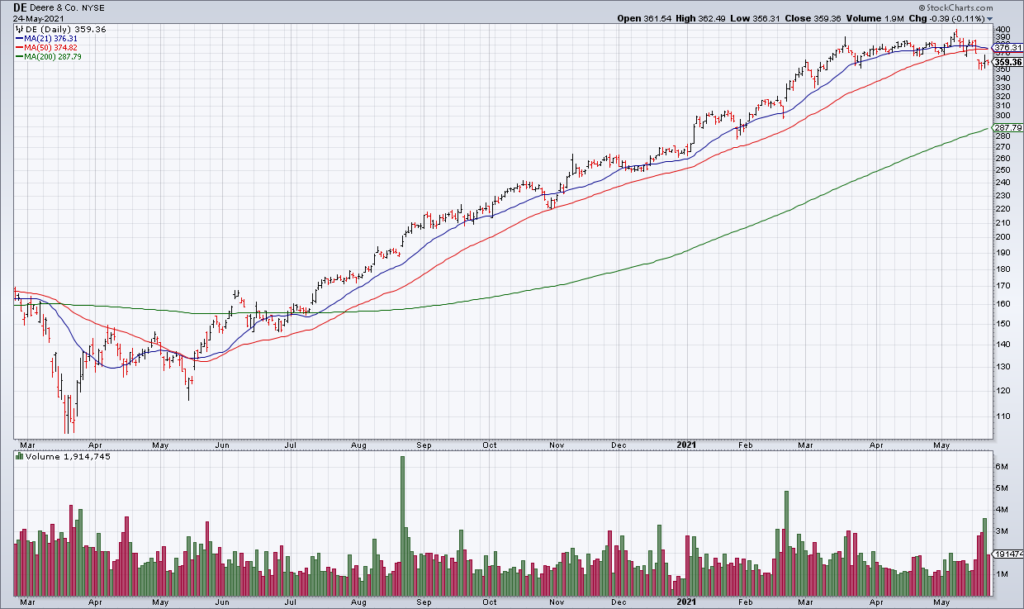

Next let’s take a look at agricultural machinery company John Deere (DE, Market Cap $113 Billion) which reported earnings last Friday morning. DE reported revenue growth of 30% to $12,058 million and diluted EPS growth of 169% to $5.68 for the quarter ended May 2, 2021. DE also guided net income to between $5.3 billion and $5.7 billion for their fiscal year ending at the end of October. Using the end of quarter average diluted share count of 315.2 million that works out to $17.45 per share. DE closed Monday at $359.36 for a 21x multiple on current year earnings. Given my belief that we are in the early stages of a commodity super cycle driven by inflation, DE is interesting.

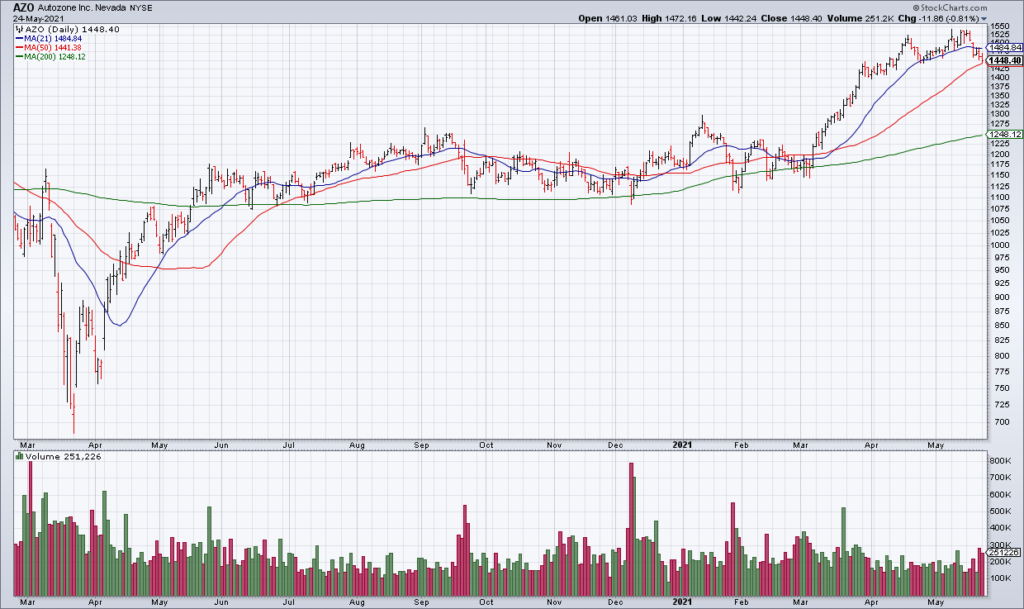

Last let’s take a look at auto parts retailer Autozone (AZO, Market Cap $34 Billion) which reported earnings earlier this morning. Comps were +28.9% and diluted EPS +84% to $26.48 for the quarter ended May 8, 2021. AZO doesn’t provide forward guidance so we’ll have to look at a trailing twelve month (TTM) earnings of $90.95 to get a P/E ratio. AZO closed Monday at $1448.40 for a trailing P/E ratio of 16x. AZO would be compelling if I didn’t believe consumer spending will be undermined by inflation going forward.

To summarize, in PANW I see an expensive tech stock, in DE a compelling way to play the commodity super cycle and in AZO a great company firing on all cylinders whose business I believe will be hurt by rising inflation.