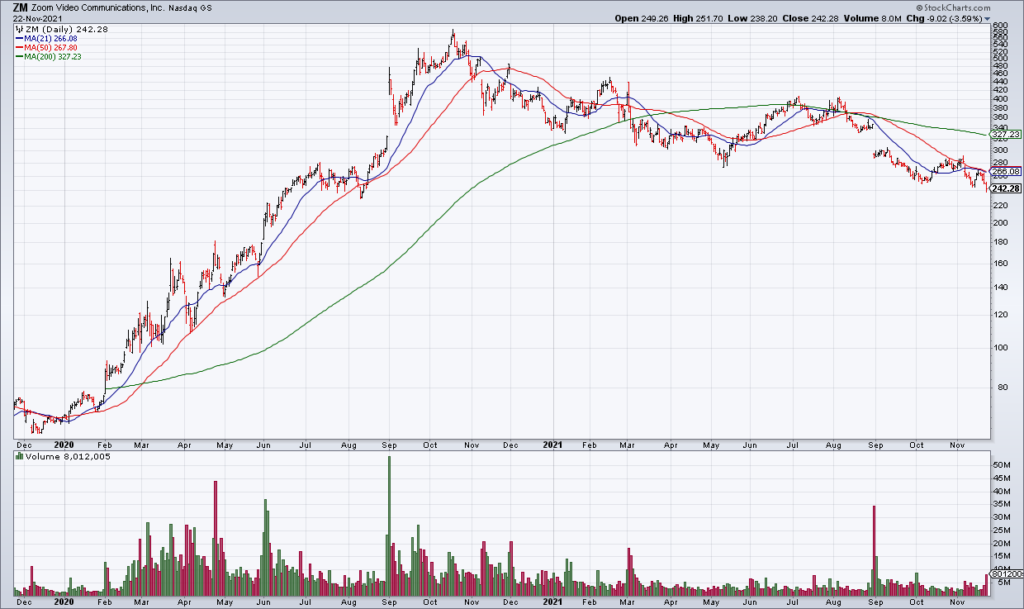

Pandemic Darling ZM Down > 50% From Highs

While my focus is the intraday reversal in the QQQ and a potential market top, a secondary story Monday was earnings from pandemic darling Zoom (ZM). The report looked fine to me with revenue of $1.051 billion and EPS of $1.11, up 35% and 12% year over year, respectively. 4Q guidance was for revenue between $1.051-$1.053 billion and EPS between $1.05-$1.06.

However, as we have seen throughout 3Q earnings season, now is not the time for expensive tech. At 50x its 2021 EPS guidance and its business trailing off after the boon of the pandemic, ZM is still on the outs. Already down more than 50% from its 2020 highs, ZM closed the after hours down another 6.31%.

Anything can happen but I wouldn’t want to be long tech darlings Autodesk (ADSK), Nutanix (NTNX) or Pure Storage (PSTG) all of which report earnings Tuesday after the close.