Nothing Doing Wednesday, December’s Strong Seasonality Likely Pulled Forward, The Point of Maximum Optimism III

Note: To sign up to be alerted when the morning email is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

There was nothing much doing in the stock market yesterday (Wednesday). Price didn’t move much and volume was notably light. Here were the performances for the major indexes: S&P +0.18% NASDAQ -0.05% Russell +0.11%. Volume on the SPY, QQQ and IWM were 58%, 50% and 77% their 3-month averages.

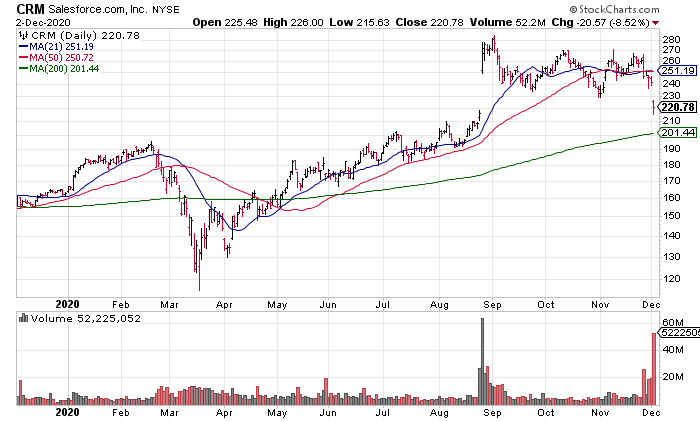

The only action I found systemically important was in Saleforce (CRM), which reported earnings Tuesday afternoon, which was -8.52% on 7x average volume. Its 200 DMA now appears to be in play for the first time since early May.

The Futures suggest today is shaping up to be more of the same: S&P Futures -0.17% NASDAQ Futures +0.12% Russell Futures -0.24% (as of 1:33am PST).

The country’s largest grocer, Kroger (KR), reports earnings later this morning and Ulta Beauty (ULTA) reports this afternoon.

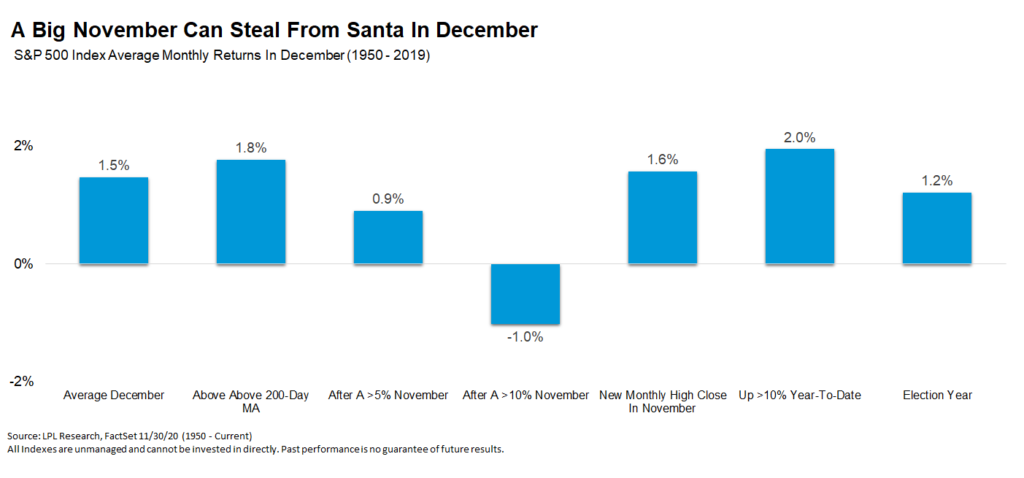

After the historic move in November we wouldn’t be surprised to see below average returns in December – LPL, “Big Gains In November Steal From Santa”, 12/2

As I wrote Sunday morning, December has been the the 2nd best month historically since 1964 (“Strong Seasonality / Earnings Week of 11/30, Analyzing November”, 11/29). However, LPL Financial had a great chart in yesterday’s blog showing that when November > 10%, the S&P’s average return in December is actually -1% since 1950. As I wrote Sunday, it’s very likely that December’s strong seasonality was pulled forward by a historic November.

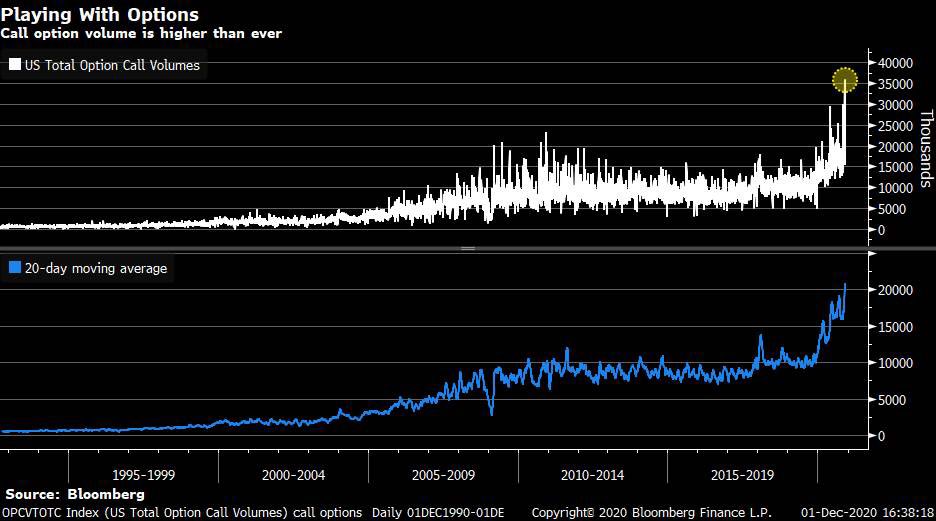

Sentiment continues to run extremely bullish. Call buying is exploding with an average of more than 20 million contracts traded over the last 20 days. 35 million contracts were traded on the day before Thanksgiving (Chart Source: Liz Ann Sonders Tweet, 12/2, 4:17am PST).

The other side of the coin is that put prices are collapsing, as shown by the VIX, as investors no longer feel the need for downside protection (Source: Tarek I. Saab Tweet, 12/2, 12:10am PST)

Another tell of extreme bullishness was Goldman’s upgrade of Tesla (TSLA) yesterday afternoon to Buy with a $780 Price Target. According to CNBC, Goldman said that TSLA can sell 15 million cars by 2040 – they sold 431,000 the last 12 months. At $780, TSLA would be worth more than $850 billion while its Non-GAAP EPS Excluding Sales of Regulatory Credits is 90 cents over the last 12 months.