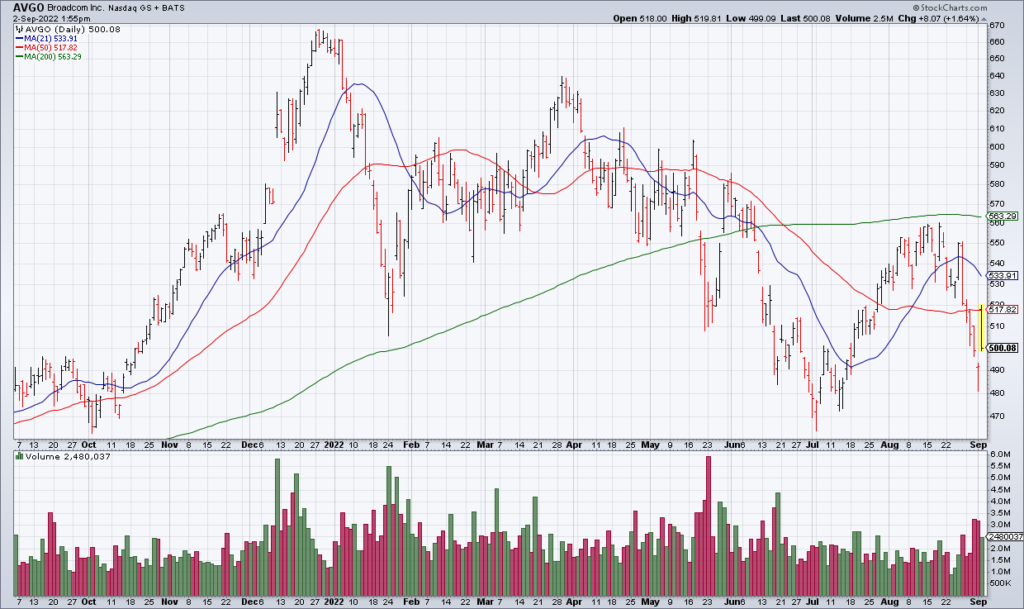

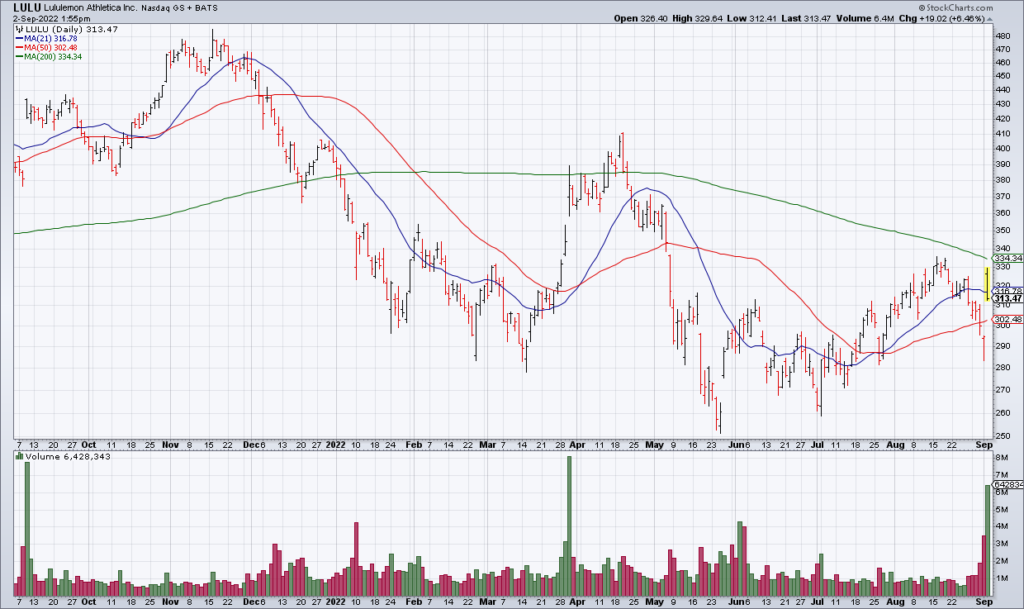

No Growth Problems at AVGO LULU

In recent blogs I have been arguing that the tightening the Fed has already done is starting to choke off growth. But it’s important to be open minded and not ignore data points that go counter to your thesis. Earnings from Broadcom (AVGO) and Lululemon (LULU) Thursday afternoon fit into that category.

2Q22 revenue at AVGO was +25% and strong margins resulted in 40% increase in EPS. Further they guided 3Q22 revenue growth to 20% with similarly solid margins. Clearly the weakness enveloping the chip space is not affecting AVGO.

The same kind of analysis applies for LULU. Comps were +23% and EPS +33%. 3Q22 guidance was similarly solid. Both stocks are up on a day in which the NASDAQ is down more than 1%.

How to account for these strong earnings reports? I can’t be certain what they mean but perhaps AVGO and LULU are just superior companies that are able to manage the macro headwinds better than others. The weight of the evidence still suggests to me that growth is rolling over and a recession is in the cards for 2023.