MJ: Mary Jane’s Last Dance, Microcap and Penny Stocks, Global Stocks +$50 Trillion Since Pandemic, UBER Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Tesla (TSLA), GameStop (GME), Bitcoin and now Marijuana Stocks (MJ). We’ve experienced a succession of mini-bubbles that I’ve never seen before. The current one is the rage for marijuana stocks which can be seen in the performance of the sector’s main ETF, MJ, which holds popular marijuana stocks like Tilray (TLRY – 20.44% of the ETF), Aphia (APHA – 14.40%), Canopy Growth Corporation (CGC – 7.07%) and GW Pharmaceuticals (GWPH – 6.13%).

Its creators cleverly chose the ticker MJ which stands for Mary Jane which is slang for marijuana. Well Mary Jane has been smoking this week up 42% Monday, Tuesday and Wednesday, including 15% Wednesday on almost 7x three month average volume. When the chart goes parabolic it’s usually time to sell so I’d expect a nasty shakeout sometime soon. Short term technician and trading wizard Scott Redler, who has played the move in marijuana stocks, thinks “it’s time for a pause”.

Marijuana stocks aren’t the only sector of the market investors are speculating in. In general, the smaller the stock, the riskier and investors have moved into microcaps and penny stocks. The iShares Microcap ETF (IWC) is +165% since March 19, 2020 and is now an insane 54.61% above its 200 DMA.

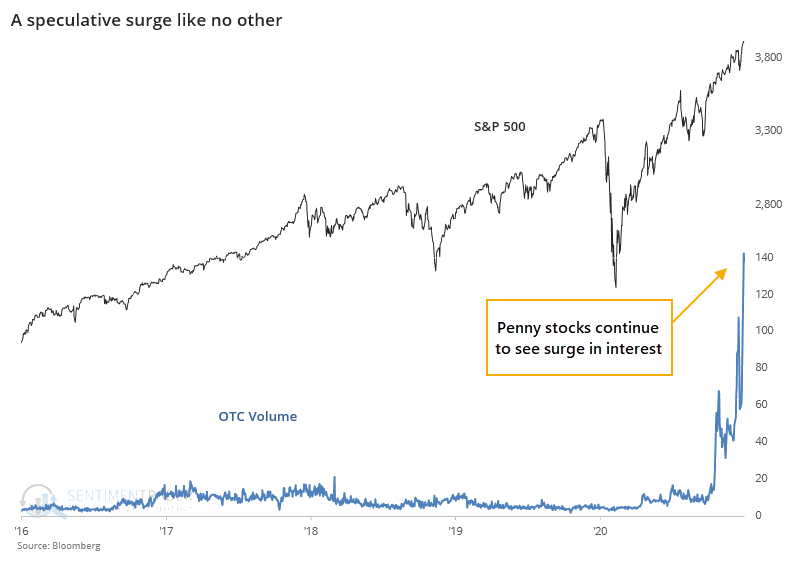

Not content to speculate in microcaps, investors have also moved into over the counter (OTC) or penny stocks who don’t meet the qualifications to be listed on the NYSE or NASDAQ. This is truly the wild west of the stock market where you have almost no idea what you are buying. OTC volume has skyrocketed in recent weeks (Chart Source: “Speculative volume skyrockets as smart money sells”, Sentimentrader, February 10).

This reminds me of a great scene from The Wolf of Wall Street.

While everyone’s focus has been on obscure sectors of the market, global stocks as a whole continue to rise. In fact, they are now +$50 trillion during the pandemic.

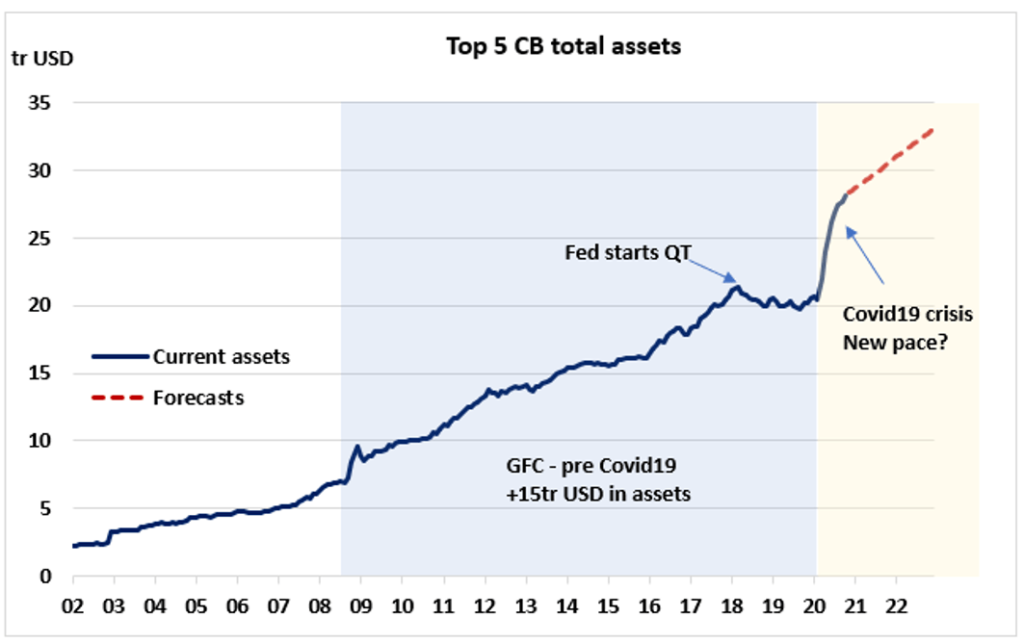

There are two basic explanations for this. The first one, favored by The Kiddie Technicians among others, is that we are the beginning of a mega bull market. Stocks are acting so strong because they are discounting enormous growth going forward. I wish that were true but the real reason global stocks are levitating is massive liquidity injections by global central banks. We’re not on the verge of a mega bull market. We’re on a manic crack high created by historically unprecedented easy money (Chart Source: Rothko Research).

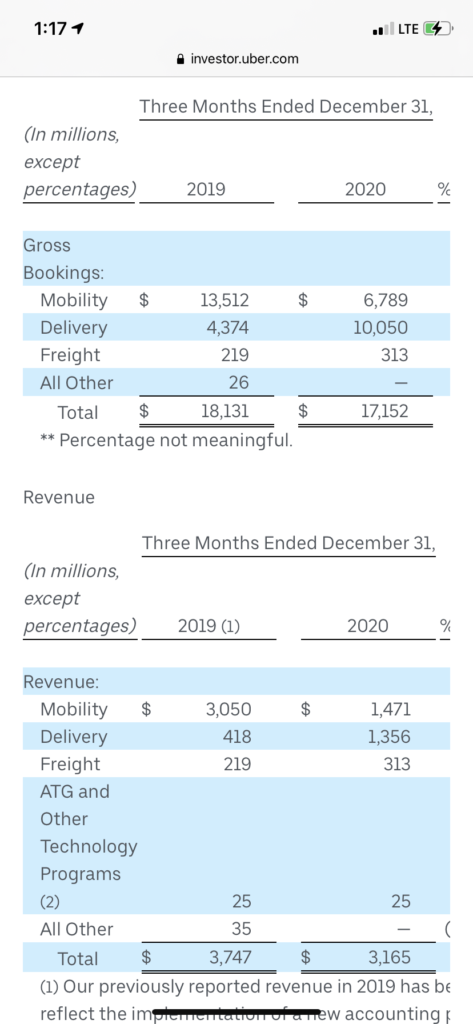

Before concluding, let’s analyze Uber (UBER – $108 billion market cap) earnings before we too lose contact with reality. UBER is interesting at the moment because it has two main businesses, ride hailing and food delivery, that are being oppositely effected by the pandemic. Ride hailing is being badly hit, as we saw yesterday with Lyft (LYFT). UBER 4Q20 Mobility (Ride Hailing) Bookings were -50% and Revenue -52%. Delivery (Food Delivery), on the other hand, saw 4Q20 bookings +130% and Revenue +224% as people stay at home and order delivery. Overall, UBER is still a massive money losing operation with a $968 million 4Q20 Net Loss. The stock is currently down about 4.5% in the premarket.