Minervini on Tops and Selling, The Indexes Are Topping, Adding SPG & XOP to the Year End Trade

Note: To sign up to be alerted when the morning email is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe”.

I normally don’t write morning emails over the weekend but I have enough to say this morning that it makes sense.

The last section of yesterday’s Day 3 of Mark Minervini’s Master Trader Program was on tops and selling. According to Minervini, while buying is somewhat mechanical, selling is more of an art. You look for a number of things in the price action such as climactic buying which signals exhaustion rather than breakout at the end of a move. He ran us through a number of charts of climactic buying and tops followed by Stage 3 topping processes and then Stage 4 sell offs and it reminded me of the current action in the major indexes (see Mark Minervini, Trade Like A Stock Market Wizard (2013), Chapter 5 “Trading With The Trend” for the 4 technical/price stages a stock goes through).

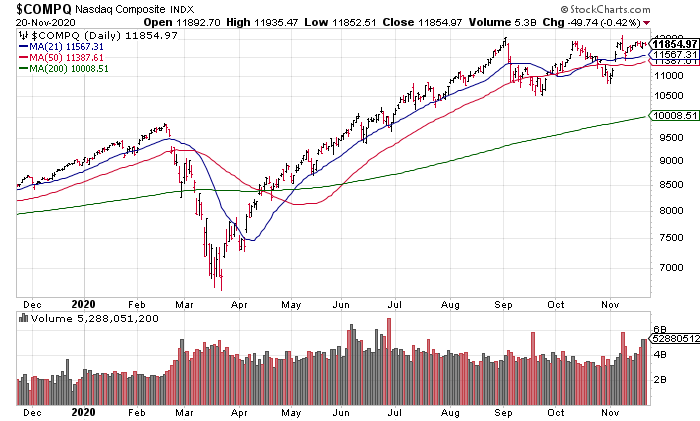

Starting with the NASDAQ, it seems pretty clear that 12,000 is at least very strong resistance. We first pierced it on September 2 and, while bumping up against it since then, have not been able to convincingly break through it in the 2 1/2 months since. With the rotation trade out of tech into value ahead of an expected 2021 reopening based on the COVID vaccines, I don’t see how the NASDAQ pushes through 12,000.

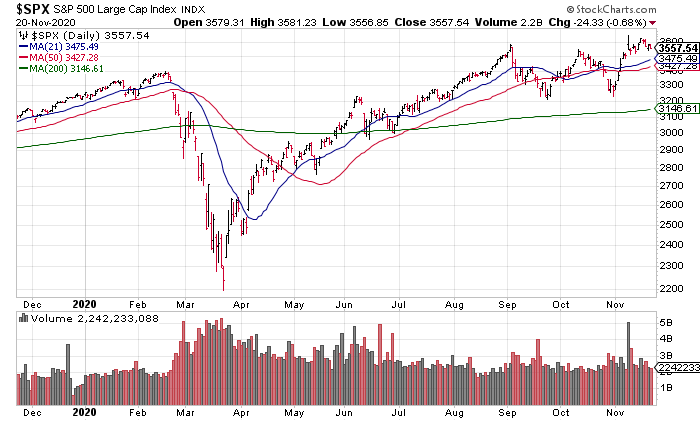

The S&P is less tech heavy, more balanced, than the NASDAQ and so it’s topping process looks a little different. The September 2 high was marginally breached on November 9 on the Pfizer COVID vaccine news but 3,600 still looks like very stiff resistance. Again, we’ve mostly gone sideways since September 2.

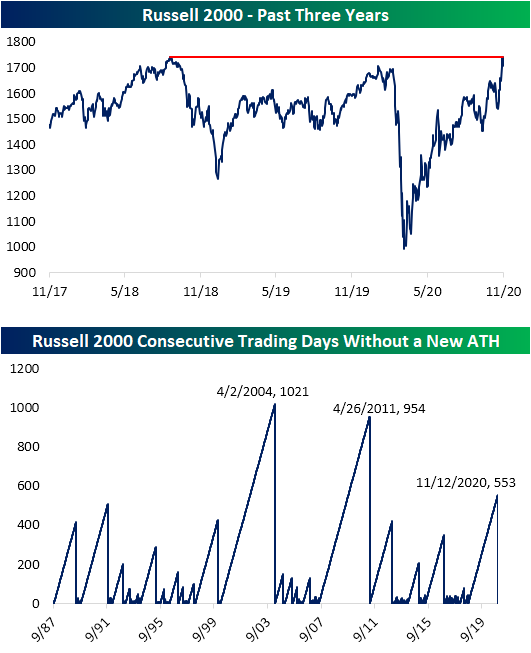

The Russell is trickier. We broke out to news highs on the Moderna COVID vaccine news last Monday (November 16) with a little follow through on Tuesday November 17 and while making the case for a top here is tougher technically, based on the other indexes, the age of this bull market, valuation and other considerations, I believe 1,800 will be a tough level to sustainably crack, though a marginal new high above it before year end wouldn’t surprise me.

This has two implications for me. First, it means that I’m going to need at least a 3% correction in the Russell to put on my year end trade as I believe 1,800 is stiff resistance and only a marginal new high is possible. A retest of the breakout from the 2018 highs at 1740 would provide sufficient room for a nice 3-4% year end bounce to finish around 1800.

Second, it means that I don’t want to hold this trade past the first trading day of January 2021, as I believe 2021 will mark the onset of a very nasty bear market. More on this another time or you can peruse my website in which I cover my reasons for why this bull market is on its last legs in many previous Client Notes.

I read a terrific article by Liz Moyer in Barron’s yesterday on Simon Property Group (SPG) as a great way to play the reopen trade (SUBSCRIPTION REQUIRED:https://www.barrons.com/articles/the-mall-isnt-dead-why-its-time-to-go-shopping-for-simon-property-stock-51605887581?mod=past_editions). As investors anticipate a 2021 reopening, they should rotate out of online commerce stocks like Shopify and Amazon, which have had enormous run ups, into brick and mortar retailers. As the owner of 16 of the top 30 malls in the US, SPG is a perfect vehicle for playing the rotation trade.

I also think playing it via the SPDR Oil Producers and Exploration ETF (XOP), which I just traded for a 35% gain in 2 1/2 weeks (https://stocktwits.com/TopGunFP/message/257587327), makes a lot of sense.

Lastly, I will put on smaller positions in the Russell 2000 via IWM and Japan via EWJ.

But I need that ~3% correction, as previously discussed, to make this trade make sense to me.

It’s not about being an optimist or a pessimist but a realist. What that means in financial markets is understanding the distinction between price (perception) and fundamentals (reality) and the catalysts that may cause the two to converge #Variant Perception #Price vs #Value – TopGunFP, Twitter, Friday November 20, 4:12pm (https://twitter.com/TopGunFP/status/1329940600284536833?s=20)

To sum up, there are a lot of moving pieces but let’s focus first on what’s in front of us: the last 6 weeks of the year. We’re looking for a correction to put on the year end trade for a nice cap off to 2020. However, we will not overstay our welcome as the market is topping and I expect 2021 to be the start of a nasty bear market. Therefore, we will close out this trade on the first trading day of 2021.

We’re essentially trading perception embodied in price rather than reality embodied in the fundamentals in making this year end trade. We’re betting that the crowd doesn’t wake up to the reality of the popping stock market bubble and ensuing bear market until next year.